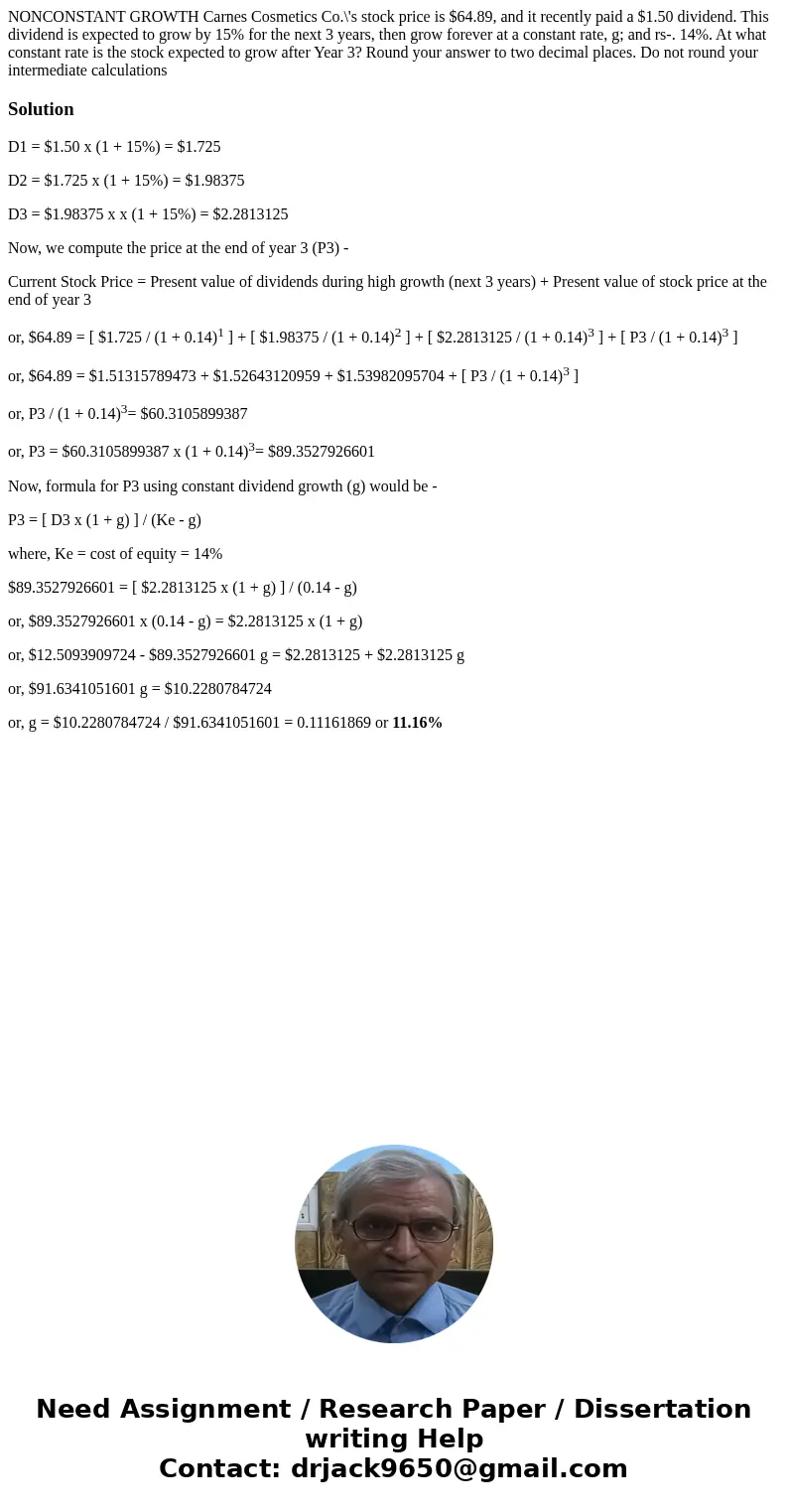

NONCONSTANT GROWTH Carnes Cosmetics Cos stock price is 6489

Solution

D1 = $1.50 x (1 + 15%) = $1.725

D2 = $1.725 x (1 + 15%) = $1.98375

D3 = $1.98375 x x (1 + 15%) = $2.2813125

Now, we compute the price at the end of year 3 (P3) -

Current Stock Price = Present value of dividends during high growth (next 3 years) + Present value of stock price at the end of year 3

or, $64.89 = [ $1.725 / (1 + 0.14)1 ] + [ $1.98375 / (1 + 0.14)2 ] + [ $2.2813125 / (1 + 0.14)3 ] + [ P3 / (1 + 0.14)3 ]

or, $64.89 = $1.51315789473 + $1.52643120959 + $1.53982095704 + [ P3 / (1 + 0.14)3 ]

or, P3 / (1 + 0.14)3= $60.3105899387

or, P3 = $60.3105899387 x (1 + 0.14)3= $89.3527926601

Now, formula for P3 using constant dividend growth (g) would be -

P3 = [ D3 x (1 + g) ] / (Ke - g)

where, Ke = cost of equity = 14%

$89.3527926601 = [ $2.2813125 x (1 + g) ] / (0.14 - g)

or, $89.3527926601 x (0.14 - g) = $2.2813125 x (1 + g)

or, $12.5093909724 - $89.3527926601 g = $2.2813125 + $2.2813125 g

or, $91.6341051601 g = $10.2280784724

or, g = $10.2280784724 / $91.6341051601 = 0.11161869 or 11.16%

Homework Sourse

Homework Sourse