Can you explain both the Lori company problem and example 1

Can you explain both : the Lori company problem and example 1

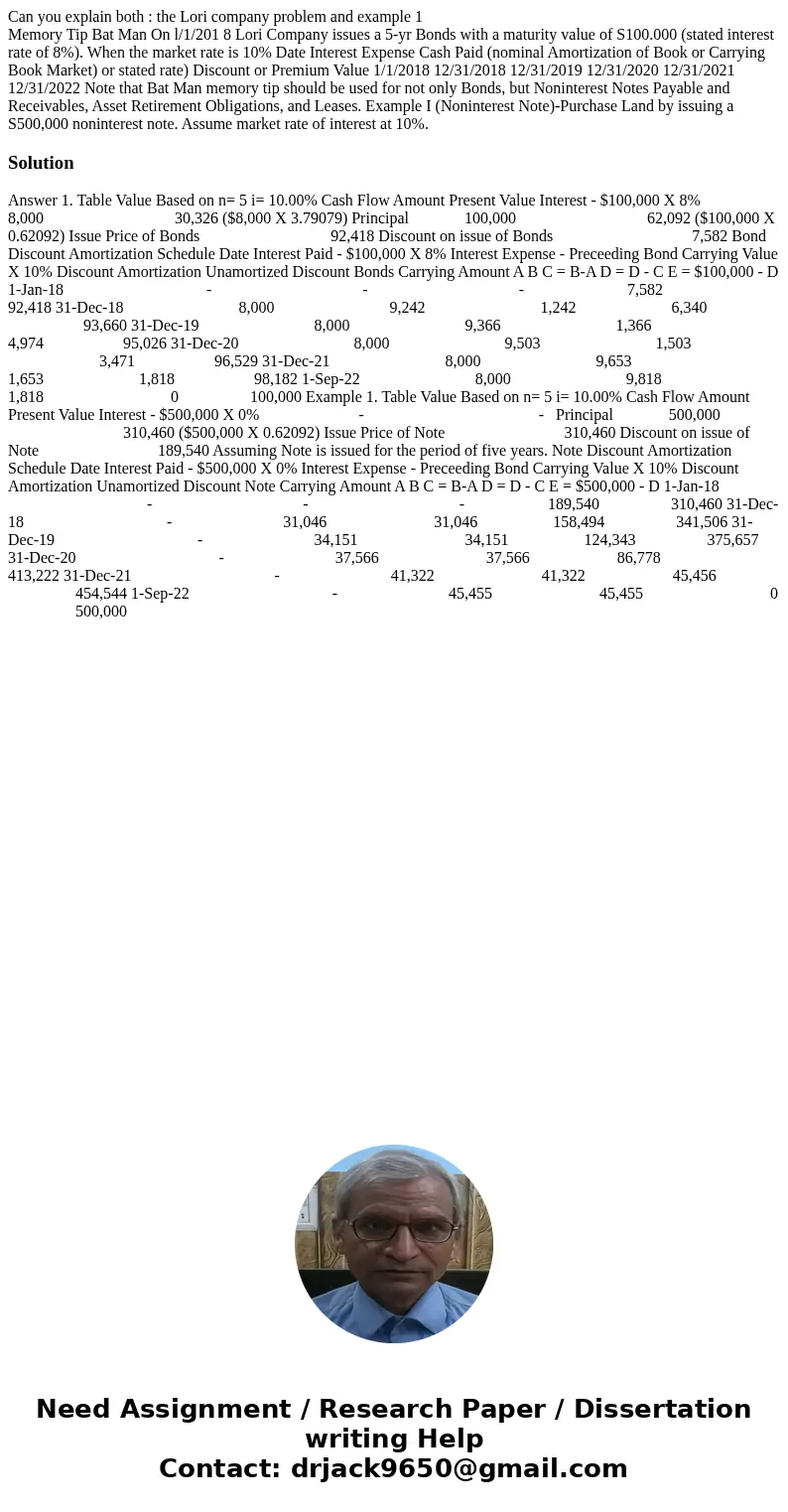

Memory Tip Bat Man On l/1/201 8 Lori Company issues a 5-yr Bonds with a maturity value of S100.000 (stated interest rate of 8%). When the market rate is 10% Date Interest Expense Cash Paid (nominal Amortization of Book or Carrying Book Market) or stated rate) Discount or Premium Value 1/1/2018 12/31/2018 12/31/2019 12/31/2020 12/31/2021 12/31/2022 Note that Bat Man memory tip should be used for not only Bonds, but Noninterest Notes Payable and Receivables, Asset Retirement Obligations, and Leases. Example I (Noninterest Note)-Purchase Land by issuing a S500,000 noninterest note. Assume market rate of interest at 10%. Solution

Answer 1. Table Value Based on n= 5 i= 10.00% Cash Flow Amount Present Value Interest - $100,000 X 8% 8,000 30,326 ($8,000 X 3.79079) Principal 100,000 62,092 ($100,000 X 0.62092) Issue Price of Bonds 92,418 Discount on issue of Bonds 7,582 Bond Discount Amortization Schedule Date Interest Paid - $100,000 X 8% Interest Expense - Preceeding Bond Carrying Value X 10% Discount Amortization Unamortized Discount Bonds Carrying Amount A B C = B-A D = D - C E = $100,000 - D 1-Jan-18 - - - 7,582 92,418 31-Dec-18 8,000 9,242 1,242 6,340 93,660 31-Dec-19 8,000 9,366 1,366 4,974 95,026 31-Dec-20 8,000 9,503 1,503 3,471 96,529 31-Dec-21 8,000 9,653 1,653 1,818 98,182 1-Sep-22 8,000 9,818 1,818 0 100,000 Example 1. Table Value Based on n= 5 i= 10.00% Cash Flow Amount Present Value Interest - $500,000 X 0% - - Principal 500,000 310,460 ($500,000 X 0.62092) Issue Price of Note 310,460 Discount on issue of Note 189,540 Assuming Note is issued for the period of five years. Note Discount Amortization Schedule Date Interest Paid - $500,000 X 0% Interest Expense - Preceeding Bond Carrying Value X 10% Discount Amortization Unamortized Discount Note Carrying Amount A B C = B-A D = D - C E = $500,000 - D 1-Jan-18 - - - 189,540 310,460 31-Dec-18 - 31,046 31,046 158,494 341,506 31-Dec-19 - 34,151 34,151 124,343 375,657 31-Dec-20 - 37,566 37,566 86,778 413,222 31-Dec-21 - 41,322 41,322 45,456 454,544 1-Sep-22 - 45,455 45,455 0 500,000

Homework Sourse

Homework Sourse