ICE Ch 143pdf ACCTG 334 Chapter 14 InClass Exercise Early R

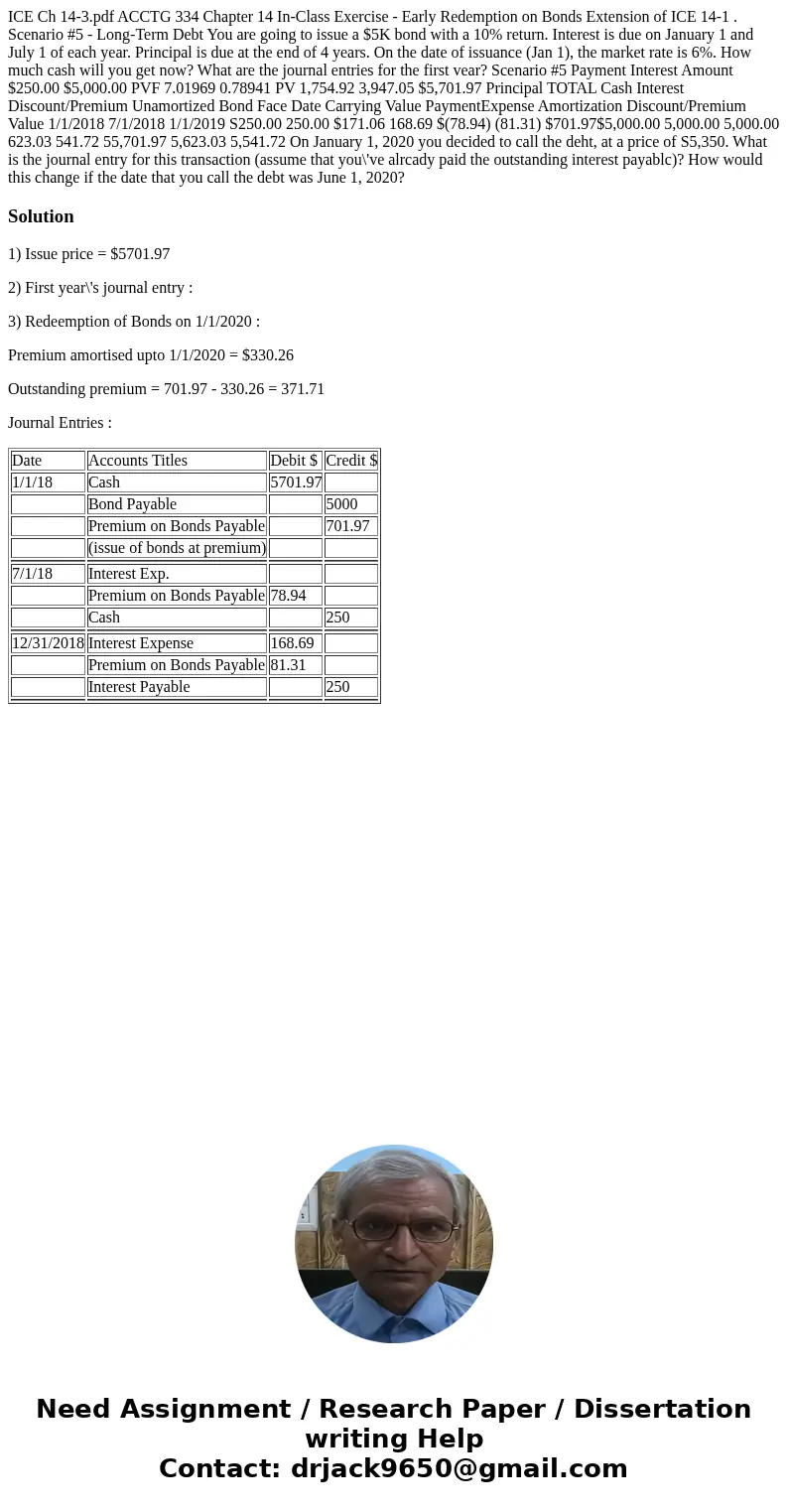

ICE Ch 14-3.pdf ACCTG 334 Chapter 14 In-Class Exercise - Early Redemption on Bonds Extension of ICE 14-1 . Scenario #5 - Long-Term Debt You are going to issue a $5K bond with a 10% return. Interest is due on January 1 and July 1 of each year. Principal is due at the end of 4 years. On the date of issuance (Jan 1), the market rate is 6%. How much cash will you get now? What are the journal entries for the first vear? Scenario #5 Payment Interest Amount $250.00 $5,000.00 PVF 7.01969 0.78941 PV 1,754.92 3,947.05 $5,701.97 Principal TOTAL Cash Interest Discount/Premium Unamortized Bond Face Date Carrying Value PaymentExpense Amortization Discount/Premium Value 1/1/2018 7/1/2018 1/1/2019 S250.00 250.00 $171.06 168.69 $(78.94) (81.31) $701.97$5,000.00 5,000.00 5,000.00 623.03 541.72 55,701.97 5,623.03 5,541.72 On January 1, 2020 you decided to call the deht, at a price of S5,350. What is the journal entry for this transaction (assume that you\'ve alrcady paid the outstanding interest payablc)? How would this change if the date that you call the debt was June 1, 2020?

Solution

1) Issue price = $5701.97

2) First year\'s journal entry :

3) Redeemption of Bonds on 1/1/2020 :

Premium amortised upto 1/1/2020 = $330.26

Outstanding premium = 701.97 - 330.26 = 371.71

Journal Entries :

| Date | Accounts Titles | Debit $ | Credit $ |

| 1/1/18 | Cash | 5701.97 | |

| Bond Payable | 5000 | ||

| Premium on Bonds Payable | 701.97 | ||

| (issue of bonds at premium) | |||

| 7/1/18 | Interest Exp. | ||

| Premium on Bonds Payable | 78.94 | ||

| Cash | 250 | ||

| 12/31/2018 | Interest Expense | 168.69 | |

| Premium on Bonds Payable | 81.31 | ||

| Interest Payable | 250 | ||

Homework Sourse

Homework Sourse