A couple hints 1 use exact time for example for January 313

A couple hints:

1. use \"exact time\" -- for example, for January, 31/365, not 1/12 (what\'s called \"approximate time\").

Exact time is required for credit card finance.

2. Use \"next day\" assumption, whereby transactions are posted the next day.

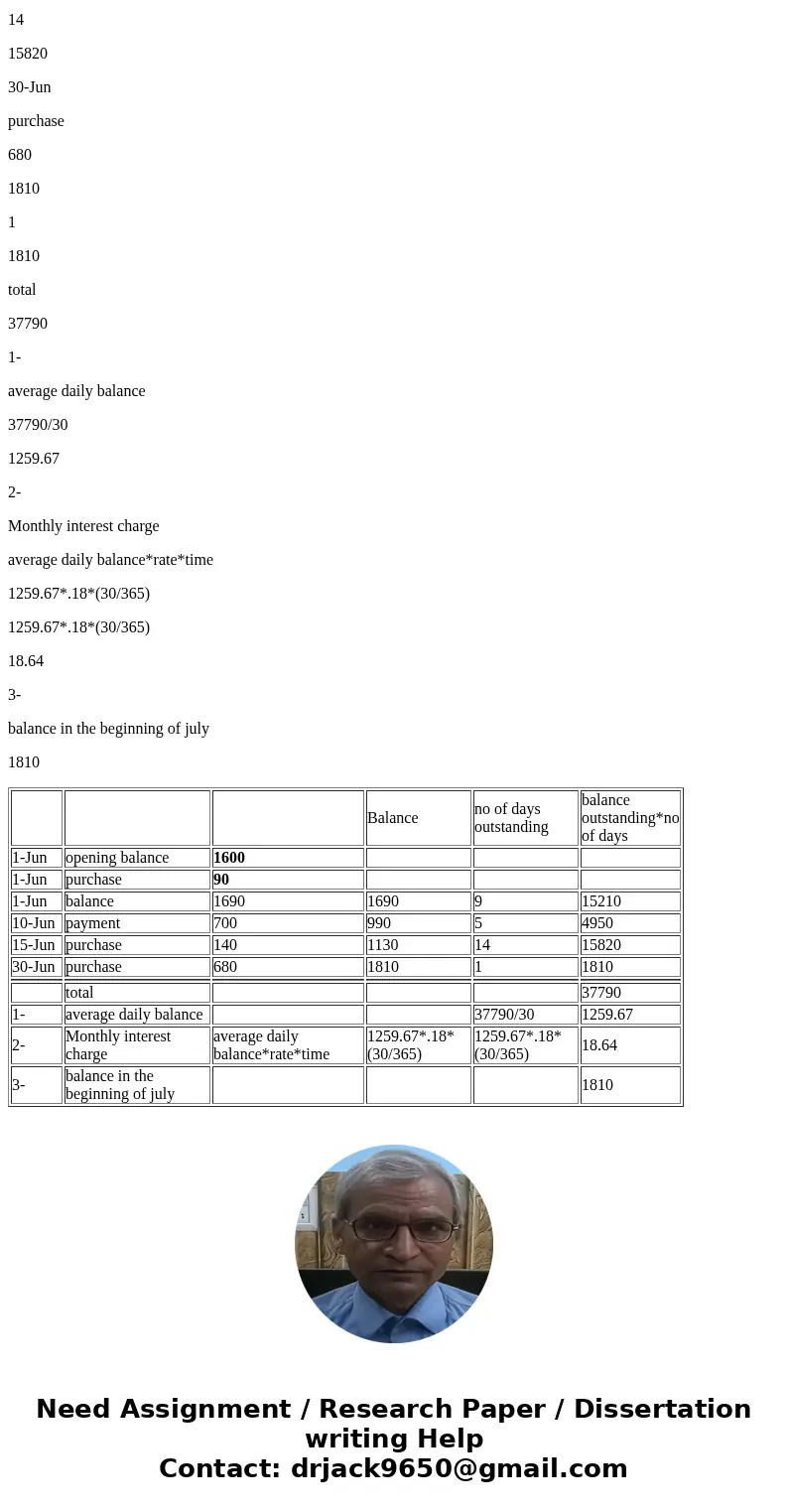

Your credit card statement for the month of June is to the left. Previous balance (May 31): $1,600. APR = 18%. Assume ADB including new purchases. Find: 1,_average daily balance, 2 monthly interest charge, and 3. balance at beginning of July. Date: Transaction Amount 6/10 6/15 6/30 Purchase $90 Payment 700 Purchase 140 Purchase 680Solution

Balance

no of days outstanding

balance outstanding*no of days

1-Jun

opening balance

1600

1-Jun

purchase

90

1-Jun

balance

1690

1690

9

15210

10-Jun

payment

700

990

5

4950

15-Jun

purchase

140

1130

14

15820

30-Jun

purchase

680

1810

1

1810

total

37790

1-

average daily balance

37790/30

1259.67

2-

Monthly interest charge

average daily balance*rate*time

1259.67*.18*(30/365)

1259.67*.18*(30/365)

18.64

3-

balance in the beginning of july

1810

| Balance | no of days outstanding | balance outstanding*no of days | |||

| 1-Jun | opening balance | 1600 | |||

| 1-Jun | purchase | 90 | |||

| 1-Jun | balance | 1690 | 1690 | 9 | 15210 |

| 10-Jun | payment | 700 | 990 | 5 | 4950 |

| 15-Jun | purchase | 140 | 1130 | 14 | 15820 |

| 30-Jun | purchase | 680 | 1810 | 1 | 1810 |

| total | 37790 | ||||

| 1- | average daily balance | 37790/30 | 1259.67 | ||

| 2- | Monthly interest charge | average daily balance*rate*time | 1259.67*.18*(30/365) | 1259.67*.18*(30/365) | 18.64 |

| 3- | balance in the beginning of july | 1810 |

Homework Sourse

Homework Sourse