Accounting in acquisition and disposition of property plant

Accounting in acquisition and disposition of property, plant and Equipment

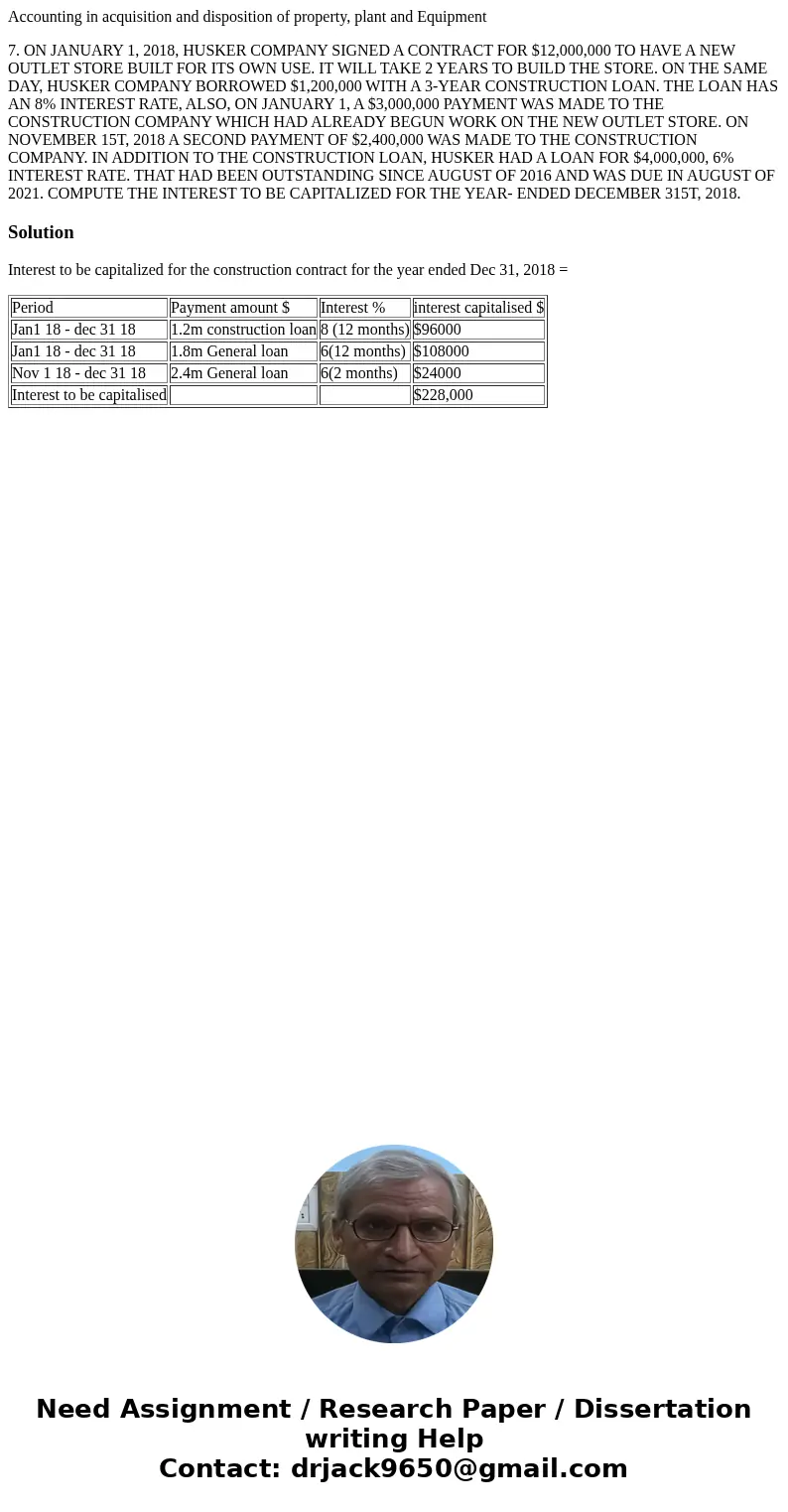

7. ON JANUARY 1, 2018, HUSKER COMPANY SIGNED A CONTRACT FOR $12,000,000 TO HAVE A NEW OUTLET STORE BUILT FOR ITS OWN USE. IT WILL TAKE 2 YEARS TO BUILD THE STORE. ON THE SAME DAY, HUSKER COMPANY BORROWED $1,200,000 WITH A 3-YEAR CONSTRUCTION LOAN. THE LOAN HAS AN 8% INTEREST RATE, ALSO, ON JANUARY 1, A $3,000,000 PAYMENT WAS MADE TO THE CONSTRUCTION COMPANY WHICH HAD ALREADY BEGUN WORK ON THE NEW OUTLET STORE. ON NOVEMBER 15T, 2018 A SECOND PAYMENT OF $2,400,000 WAS MADE TO THE CONSTRUCTION COMPANY. IN ADDITION TO THE CONSTRUCTION LOAN, HUSKER HAD A LOAN FOR $4,000,000, 6% INTEREST RATE. THAT HAD BEEN OUTSTANDING SINCE AUGUST OF 2016 AND WAS DUE IN AUGUST OF 2021. COMPUTE THE INTEREST TO BE CAPITALIZED FOR THE YEAR- ENDED DECEMBER 315T, 2018.Solution

Interest to be capitalized for the construction contract for the year ended Dec 31, 2018 =

| Period | Payment amount $ | Interest % | interest capitalised $ |

| Jan1 18 - dec 31 18 | 1.2m construction loan | 8 (12 months) | $96000 |

| Jan1 18 - dec 31 18 | 1.8m General loan | 6(12 months) | $108000 |

| Nov 1 18 - dec 31 18 | 2.4m General loan | 6(2 months) | $24000 |

| Interest to be capitalised | $228,000 |

Homework Sourse

Homework Sourse