Should any overhead cost be added to Job W at yearend If so

Solution

Mason Company

Schedule of Cost of Goods Manufactured

Direct Materials:

Beginning raw materials inventory

$7000

Add: purchase of raw materials

118000

Raw materials available for use

125000

Less: ending raw materials inventory

15000

Raw materials used in production

110000

Direct Labor

70000

Manufacturing overhead

80000

Total manufacturing cost

260000

Add: beginning work in process in inventory

10000

270000

Less: Ending work in process inventory

5000

Cost of goods manufactured

265000

Prepare the cost of goods sold

Beginning finished goods inventory

$20000

Add : Cost of goods manufactured

265000

Goods available for sale

285000

Deduct : Ending finished goods inventory

35000

Cost of goods sold

250000

Income Statement

Sales

$524000

Cost of goods Sold

250000

Gross margin

274000

Selling & Administrative Expenses:

Selling Expenses

140000

Administrative Expenses

63000

203000

Net operating income

$71000

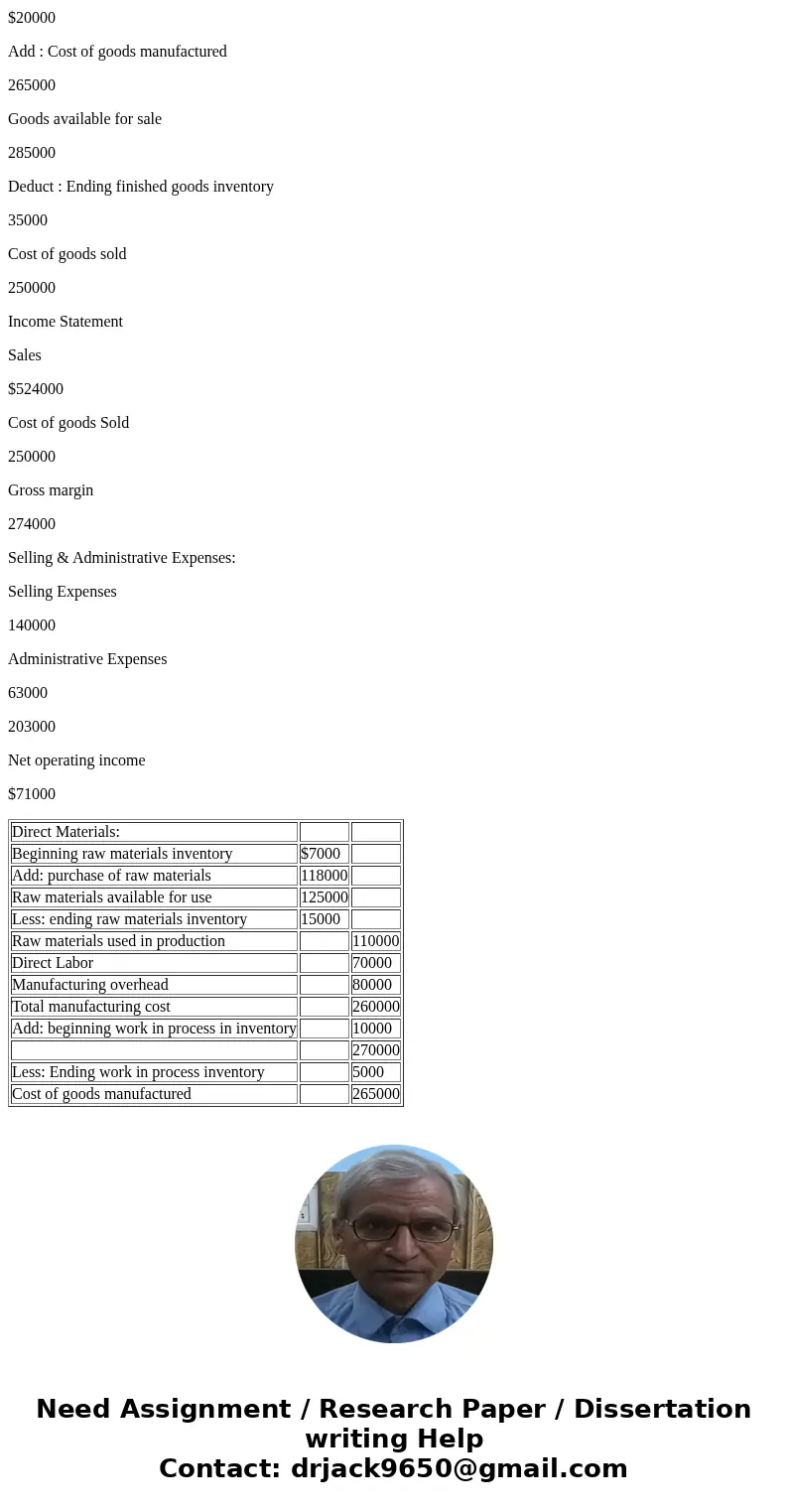

| Direct Materials: | ||

| Beginning raw materials inventory | $7000 | |

| Add: purchase of raw materials | 118000 | |

| Raw materials available for use | 125000 | |

| Less: ending raw materials inventory | 15000 | |

| Raw materials used in production | 110000 | |

| Direct Labor | 70000 | |

| Manufacturing overhead | 80000 | |

| Total manufacturing cost | 260000 | |

| Add: beginning work in process in inventory | 10000 | |

| 270000 | ||

| Less: Ending work in process inventory | 5000 | |

| Cost of goods manufactured | 265000 |

Homework Sourse

Homework Sourse