Please make sure you walk through exactly how you answer the

****Please make sure you walk through exactly how you answer the question with steps and formulas so i learn how to do it, thank you*****

A financial institution has entered into a 10-year currency swap with company Y. Under the terms of the swap, the financial institution receives interest at 3% per annum in Swiss francs and pays interest at 8% per annum in U.S. dollars. Interest payments are exchanged once a year. The principal amounts are 7 million dollars and 10 million francs. Suppose that company Y declares bankruptcy at the end of year 6, when the exchange rate is $0.80 per franc. What is the cost to the financial institution? Assume that, at the end of year 6, the interest rate is 3% per annum in Swiss francs and 8% per annum in U.S. dollars for all maturities. All interest rates are quoted with annual compounding.

Solution

When interest rates are compounded annually

F = S ( 1+r / 1+rf )

where F is the T-year forward rate, S is the spot rate, r is the domestic risk-free rate, and rf is the foreign risk-free rate. As r = 0.08 and rf = 0.03 , the spot and forward exchange rates at the end of year 6 are

Spot: 0.8000

1 year forward ( 7th Year ) 0.8388

2 year forward:( 8th Year ) 0.8796

3 year forward: ( 9th Year ) 0.9223

4 year forward: ( 10th Year ) 0.9670

The value of the swap at the time of the default can be calculated on the assumption that forward rates are realized.

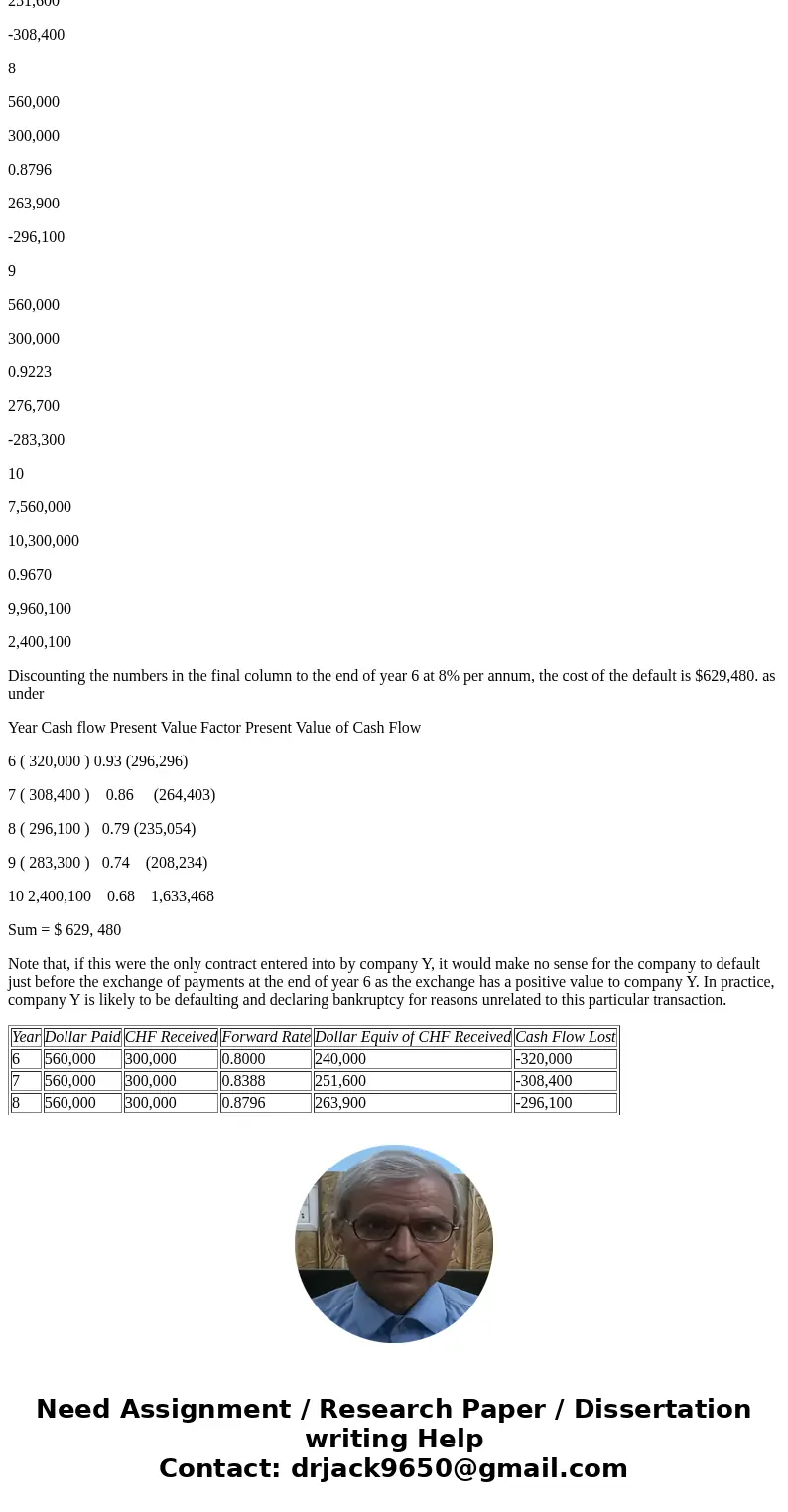

The cash flows lost as a result of the default are therefore as follows:

Year

Dollar Paid

CHF Received

Forward Rate

Dollar Equiv of CHF Received

Cash Flow Lost

6

560,000

300,000

0.8000

240,000

-320,000

7

560,000

300,000

0.8388

251,600

-308,400

8

560,000

300,000

0.8796

263,900

-296,100

9

560,000

300,000

0.9223

276,700

-283,300

10

7,560,000

10,300,000

0.9670

9,960,100

2,400,100

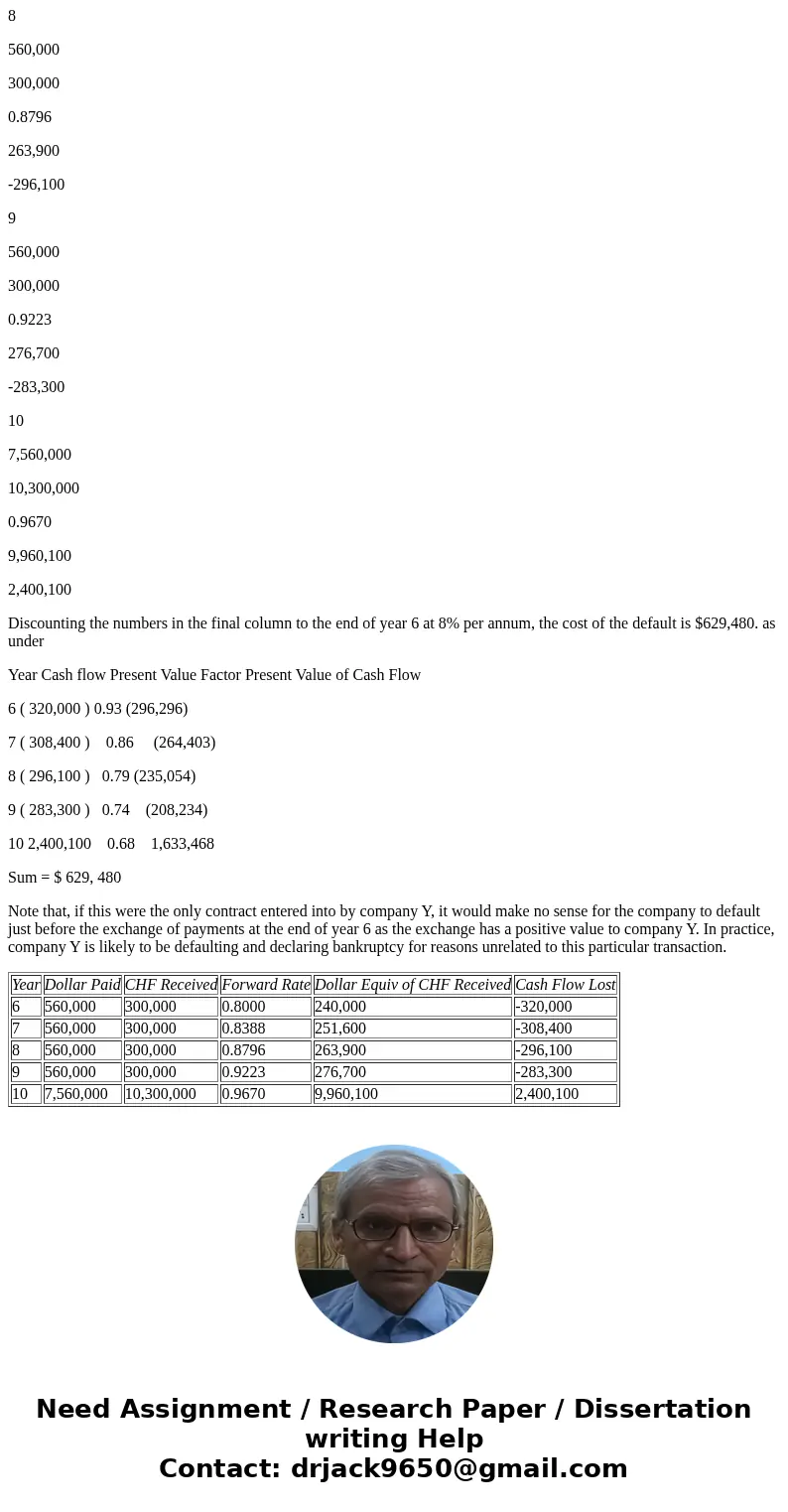

Discounting the numbers in the final column to the end of year 6 at 8% per annum, the cost of the default is $629,480. as under

Year Cash flow Present Value Factor Present Value of Cash Flow

6 ( 320,000 ) 0.93 (296,296)

7 ( 308,400 ) 0.86 (264,403)

8 ( 296,100 ) 0.79 (235,054)

9 ( 283,300 ) 0.74 (208,234)

10 2,400,100 0.68 1,633,468

Sum = $ 629, 480

Note that, if this were the only contract entered into by company Y, it would make no sense for the company to default just before the exchange of payments at the end of year 6 as the exchange has a positive value to company Y. In practice, company Y is likely to be defaulting and declaring bankruptcy for reasons unrelated to this particular transaction.

| Year | Dollar Paid | CHF Received | Forward Rate | Dollar Equiv of CHF Received | Cash Flow Lost |

| 6 | 560,000 | 300,000 | 0.8000 | 240,000 | -320,000 |

| 7 | 560,000 | 300,000 | 0.8388 | 251,600 | -308,400 |

| 8 | 560,000 | 300,000 | 0.8796 | 263,900 | -296,100 |

| 9 | 560,000 | 300,000 | 0.9223 | 276,700 | -283,300 |

| 10 | 7,560,000 | 10,300,000 | 0.9670 | 9,960,100 | 2,400,100 |

Homework Sourse

Homework Sourse