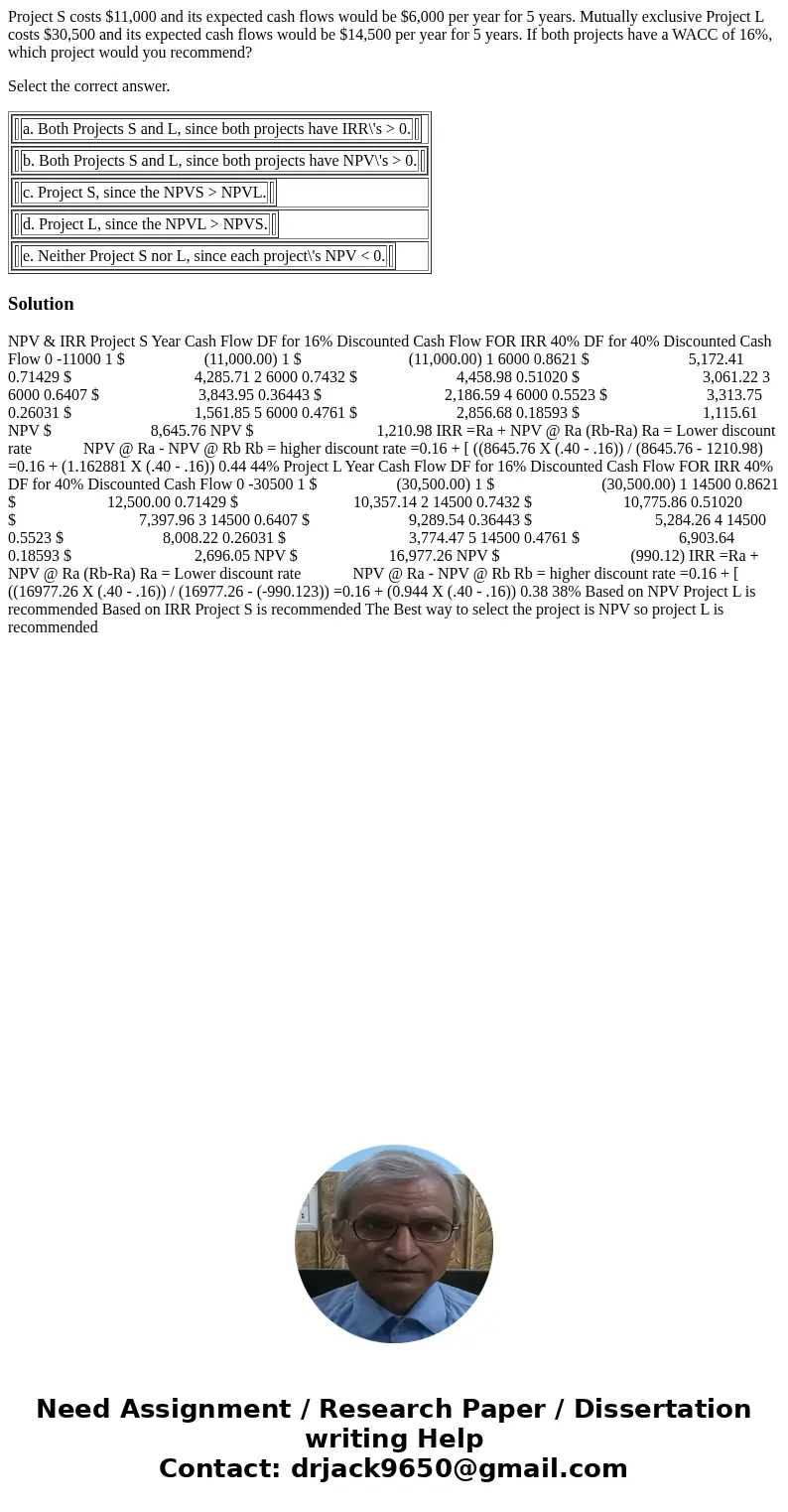

Project S costs $11,000 and its expected cash flows would be $6,000 per year for 5 years. Mutually exclusive Project L costs $30,500 and its expected cash flows would be $14,500 per year for 5 years. If both projects have a WACC of 16%, which project would you recommend?

Select the correct answer.

| a. Both Projects S and L, since both projects have IRR\'s > 0. | | |

| b. Both Projects S and L, since both projects have NPV\'s > 0. | | |

| c. Project S, since the NPVS > NPVL. | | |

| d. Project L, since the NPVL > NPVS. | | |

| e. Neither Project S nor L, since each project\'s NPV < 0. | | |

NPV & IRR Project S Year Cash Flow DF for 16% Discounted Cash Flow FOR IRR 40% DF for 40% Discounted Cash Flow 0 -11000 1 $ (11,000.00) 1 $ (11,000.00) 1 6000 0.8621 $ 5,172.41 0.71429 $ 4,285.71 2 6000 0.7432 $ 4,458.98 0.51020 $ 3,061.22 3 6000 0.6407 $ 3,843.95 0.36443 $ 2,186.59 4 6000 0.5523 $ 3,313.75 0.26031 $ 1,561.85 5 6000 0.4761 $ 2,856.68 0.18593 $ 1,115.61 NPV $ 8,645.76 NPV $ 1,210.98 IRR =Ra + NPV @ Ra (Rb-Ra) Ra = Lower discount rate NPV @ Ra - NPV @ Rb Rb = higher discount rate =0.16 + [ ((8645.76 X (.40 - .16)) / (8645.76 - 1210.98) =0.16 + (1.162881 X (.40 - .16)) 0.44 44% Project L Year Cash Flow DF for 16% Discounted Cash Flow FOR IRR 40% DF for 40% Discounted Cash Flow 0 -30500 1 $ (30,500.00) 1 $ (30,500.00) 1 14500 0.8621 $ 12,500.00 0.71429 $ 10,357.14 2 14500 0.7432 $ 10,775.86 0.51020 $ 7,397.96 3 14500 0.6407 $ 9,289.54 0.36443 $ 5,284.26 4 14500 0.5523 $ 8,008.22 0.26031 $ 3,774.47 5 14500 0.4761 $ 6,903.64 0.18593 $ 2,696.05 NPV $ 16,977.26 NPV $ (990.12) IRR =Ra + NPV @ Ra (Rb-Ra) Ra = Lower discount rate NPV @ Ra - NPV @ Rb Rb = higher discount rate =0.16 + [ ((16977.26 X (.40 - .16)) / (16977.26 - (-990.123)) =0.16 + (0.944 X (.40 - .16)) 0.38 38% Based on NPV Project L is recommended Based on IRR Project S is recommended The Best way to select the project is NPV so project L is recommended

Homework Sourse

Homework Sourse