2 Record entries for any items on the bank reconciliation st

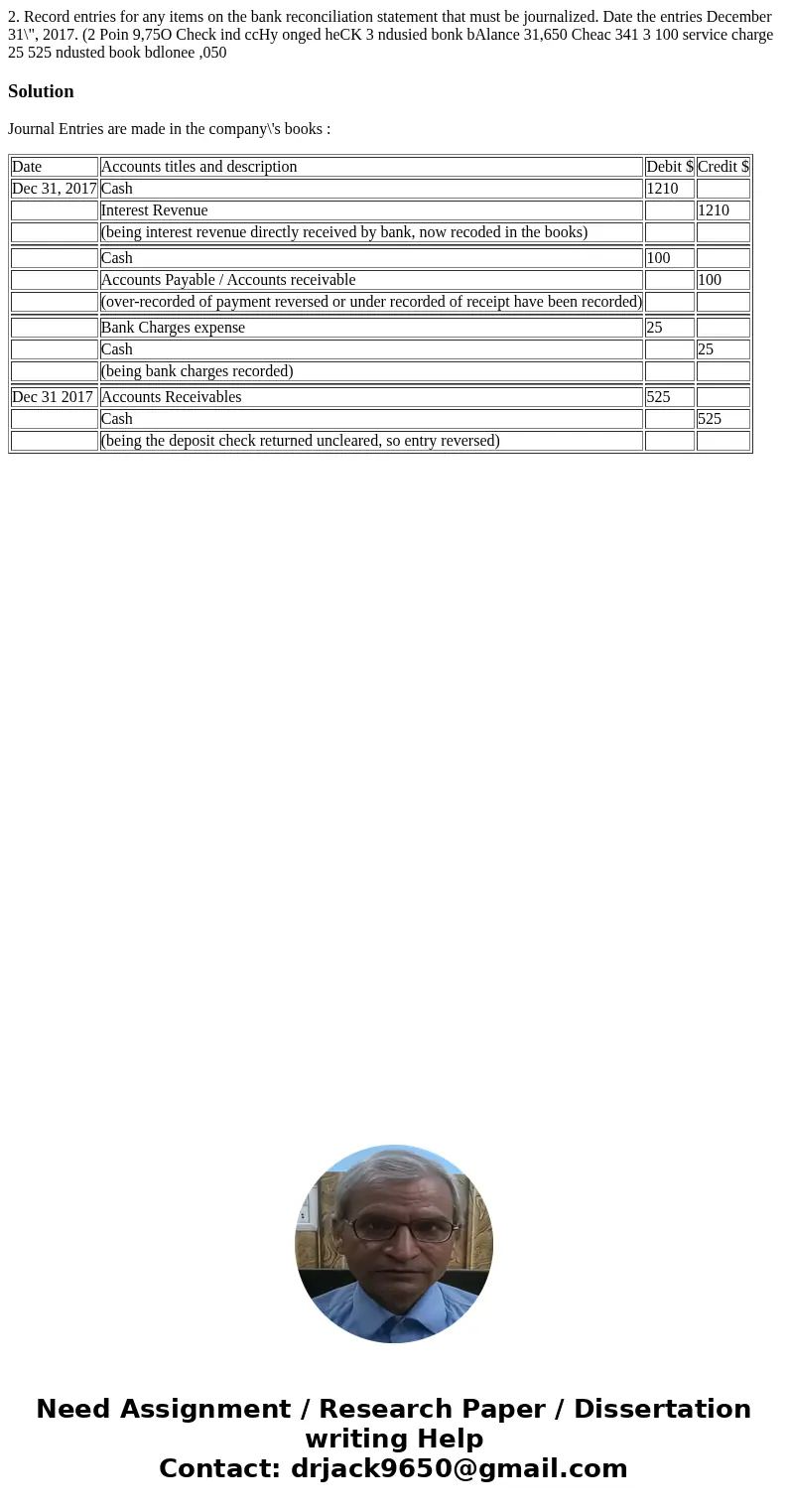

2. Record entries for any items on the bank reconciliation statement that must be journalized. Date the entries December 31\", 2017. (2 Poin 9,75O Check ind ccHy onged heCK 3 ndusied bonk bAlance 31,650 Cheac 341 3 100 service charge 25 525 ndusted book bdlonee ,050

Solution

Journal Entries are made in the company\'s books :

| Date | Accounts titles and description | Debit $ | Credit $ |

| Dec 31, 2017 | Cash | 1210 | |

| Interest Revenue | 1210 | ||

| (being interest revenue directly received by bank, now recoded in the books) | |||

| Cash | 100 | ||

| Accounts Payable / Accounts receivable | 100 | ||

| (over-recorded of payment reversed or under recorded of receipt have been recorded) | |||

| Bank Charges expense | 25 | ||

| Cash | 25 | ||

| (being bank charges recorded) | |||

| Dec 31 2017 | Accounts Receivables | 525 | |

| Cash | 525 | ||

| (being the deposit check returned uncleared, so entry reversed) |

Homework Sourse

Homework Sourse