Mad Hatter Enterprises purchased new equipment for 365000 FO

Mad Hatter Enterprises purchased new equipment for $365,000, FOB shipping point. Other costs connected with the purchase were as follows State sales tax Freight costs Insurance while in transit Insurance after equipment placed in service Installation costs Testing, including $300 of spoilage 29,200 5,600 800 1.200 2,000 700 Required: Prepare in good form the jourmal entries aecessary to record the aboves assume all expenses were paid in Cash

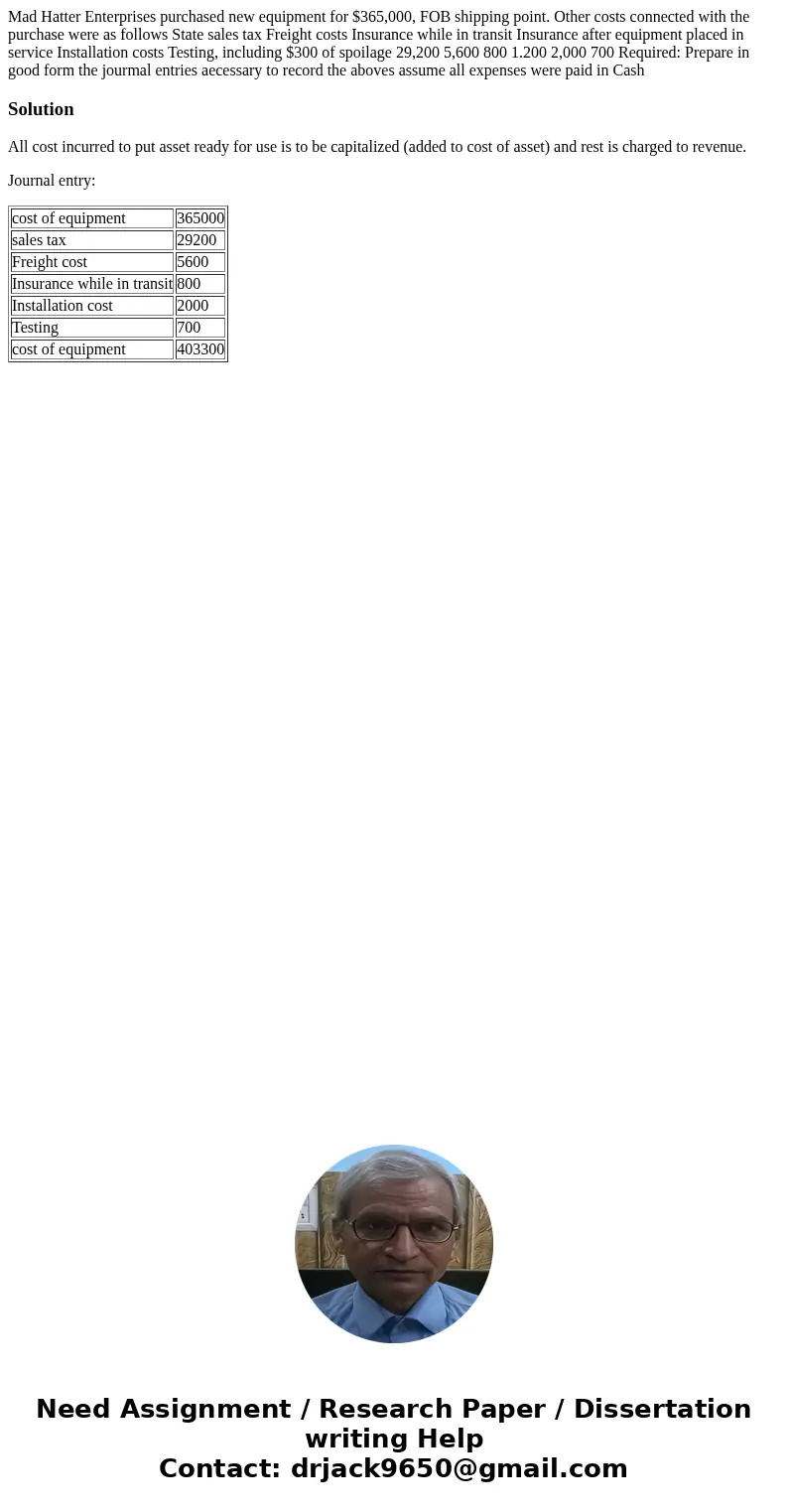

Solution

All cost incurred to put asset ready for use is to be capitalized (added to cost of asset) and rest is charged to revenue.

Journal entry:

| cost of equipment | 365000 |

| sales tax | 29200 |

| Freight cost | 5600 |

| Insurance while in transit | 800 |

| Installation cost | 2000 |

| Testing | 700 |

| cost of equipment | 403300 |

Homework Sourse

Homework Sourse