3 Jackson Sanders works for Peterson Company all year and ea

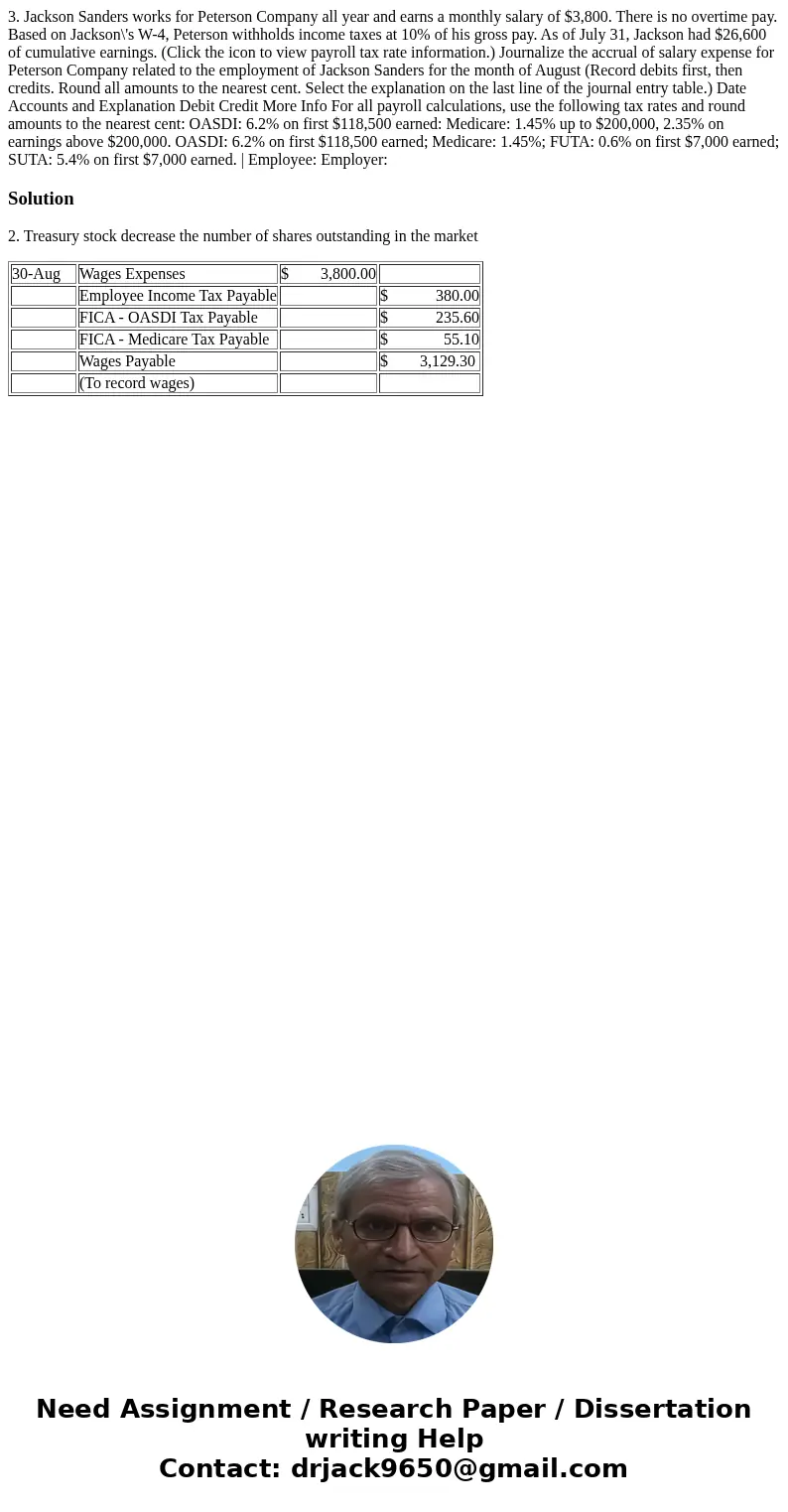

3. Jackson Sanders works for Peterson Company all year and earns a monthly salary of $3,800. There is no overtime pay. Based on Jackson\'s W-4, Peterson withholds income taxes at 10% of his gross pay. As of July 31, Jackson had $26,600 of cumulative earnings. (Click the icon to view payroll tax rate information.) Journalize the accrual of salary expense for Peterson Company related to the employment of Jackson Sanders for the month of August (Record debits first, then credits. Round all amounts to the nearest cent. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit More Info For all payroll calculations, use the following tax rates and round amounts to the nearest cent: OASDI: 6.2% on first $118,500 earned: Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $118,500 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. | Employee: Employer:

Solution

2. Treasury stock decrease the number of shares outstanding in the market

| 30-Aug | Wages Expenses | $ 3,800.00 | |

| Employee Income Tax Payable | $ 380.00 | ||

| FICA - OASDI Tax Payable | $ 235.60 | ||

| FICA - Medicare Tax Payable | $ 55.10 | ||

| Wages Payable | $ 3,129.30 | ||

| (To record wages) |

Homework Sourse

Homework Sourse