On January 1 2017 Tamarisk Inc sold 15 bonds having a maturi

On January 1, 2017, Tamarisk Inc. sold 15% bonds having a maturity value of $890,000 for $920,555, which provides the bondholders with a 14% yield. The bonds are dated January 1, 2017 and mature on January 1, 2022, with interest payable on January 1 of each year. The company follows IFRS and uses the effective interest method.

Prepare the journal entry at the date of issue.

Prepare a schedule of interest expense and bond amortization for 2017 through 2020.

Prepare the journal entries to record the interest payment and the amortization for 2017

Solution

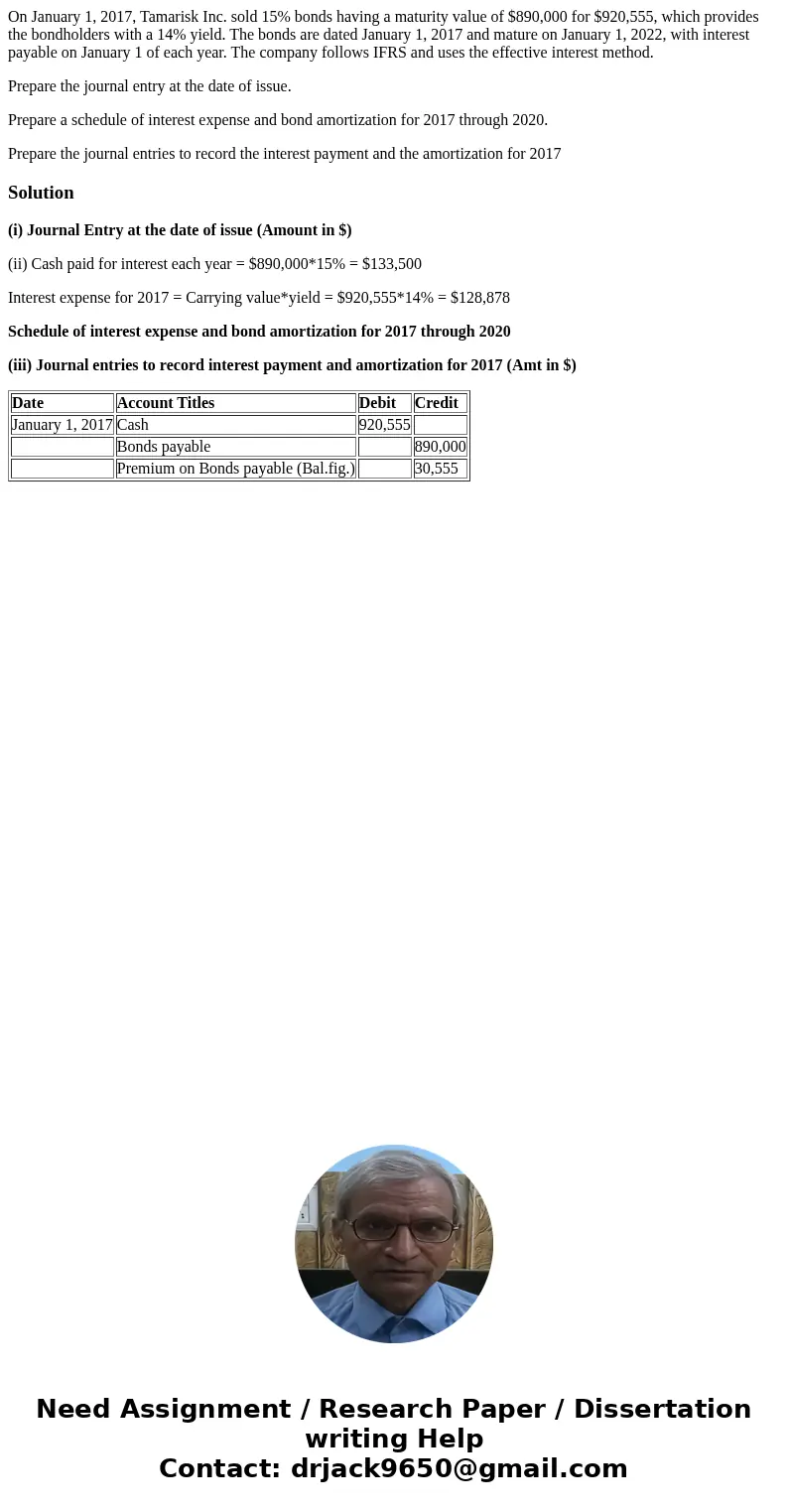

(i) Journal Entry at the date of issue (Amount in $)

(ii) Cash paid for interest each year = $890,000*15% = $133,500

Interest expense for 2017 = Carrying value*yield = $920,555*14% = $128,878

Schedule of interest expense and bond amortization for 2017 through 2020

(iii) Journal entries to record interest payment and amortization for 2017 (Amt in $)

| Date | Account Titles | Debit | Credit |

| January 1, 2017 | Cash | 920,555 | |

| Bonds payable | 890,000 | ||

| Premium on Bonds payable (Bal.fig.) | 30,555 |

Homework Sourse

Homework Sourse