Pharrell Inc has sales of 593000 costs of 265000 depreciatio

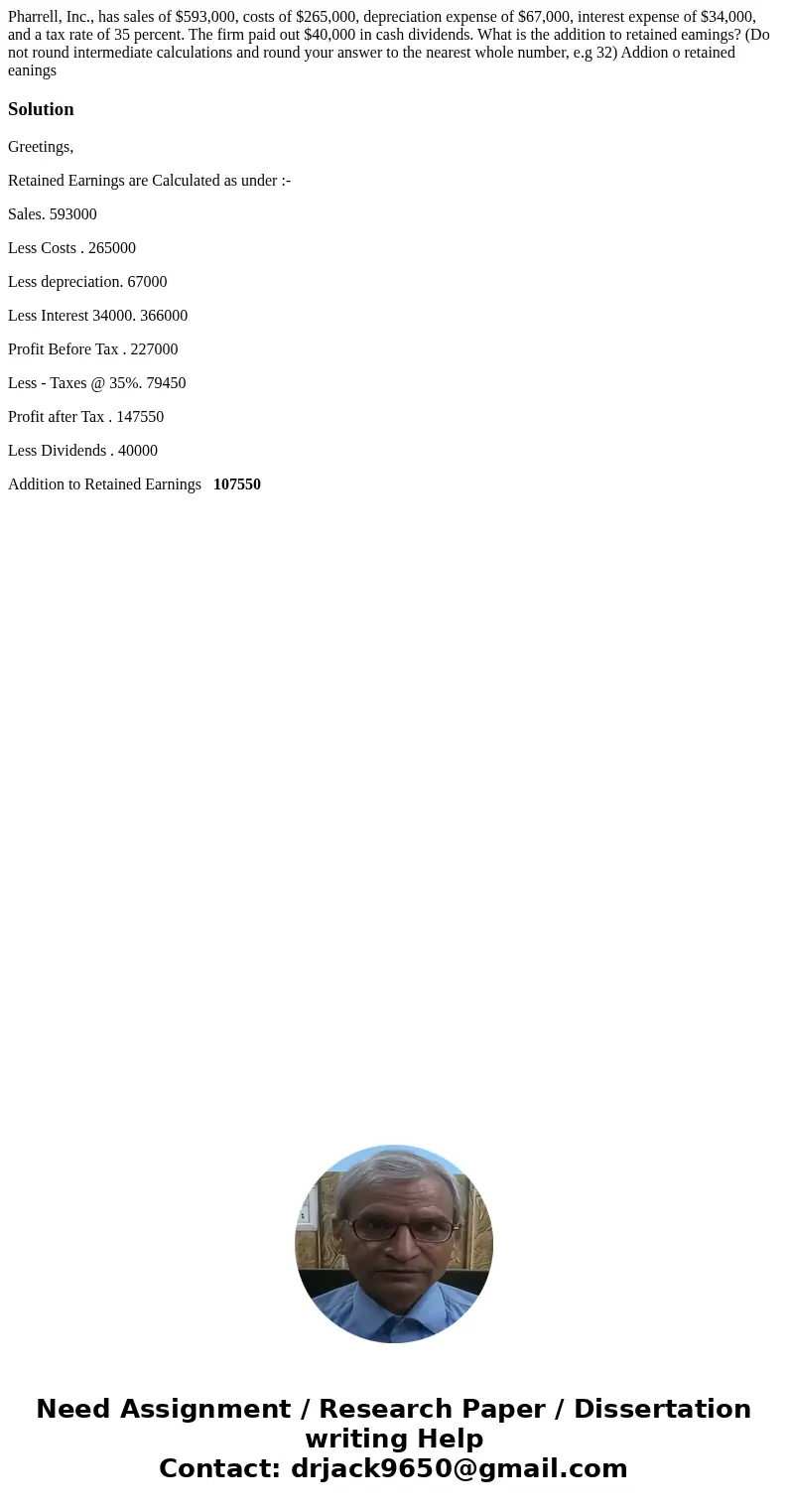

Pharrell, Inc., has sales of $593,000, costs of $265,000, depreciation expense of $67,000, interest expense of $34,000, and a tax rate of 35 percent. The firm paid out $40,000 in cash dividends. What is the addition to retained eamings? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g 32) Addion o retained eanings

Solution

Greetings,

Retained Earnings are Calculated as under :-

Sales. 593000

Less Costs . 265000

Less depreciation. 67000

Less Interest 34000. 366000

Profit Before Tax . 227000

Less - Taxes @ 35%. 79450

Profit after Tax . 147550

Less Dividends . 40000

Addition to Retained Earnings 107550

Homework Sourse

Homework Sourse