count Title Debit Credit 27340 15330 9270 35900 Cash Account

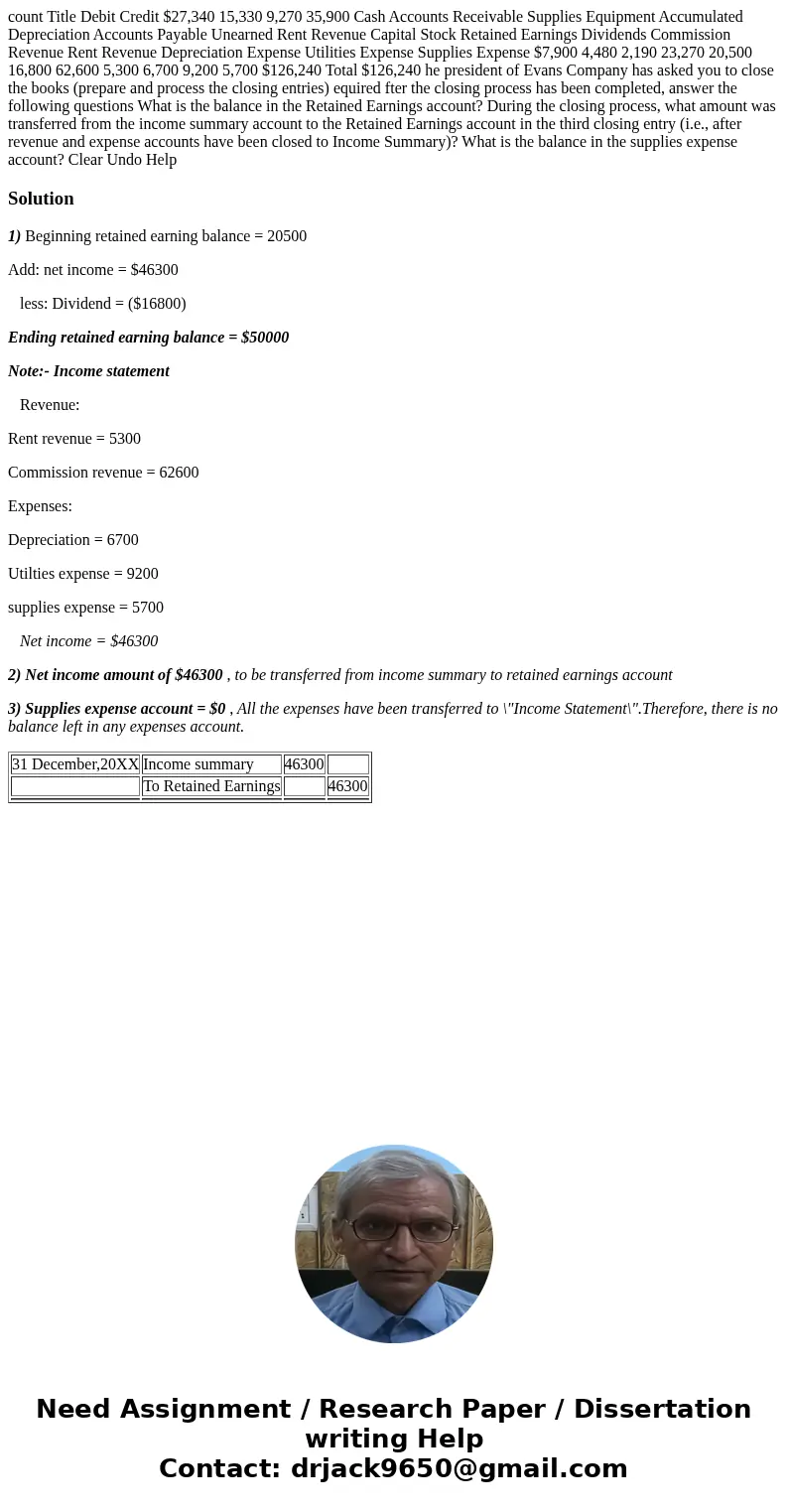

count Title Debit Credit $27,340 15,330 9,270 35,900 Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Unearned Rent Revenue Capital Stock Retained Earnings Dividends Commission Revenue Rent Revenue Depreciation Expense Utilities Expense Supplies Expense $7,900 4,480 2,190 23,270 20,500 16,800 62,600 5,300 6,700 9,200 5,700 $126,240 Total $126,240 he president of Evans Company has asked you to close the books (prepare and process the closing entries) equired fter the closing process has been completed, answer the following questions What is the balance in the Retained Earnings account? During the closing process, what amount was transferred from the income summary account to the Retained Earnings account in the third closing entry (i.e., after revenue and expense accounts have been closed to Income Summary)? What is the balance in the supplies expense account? Clear Undo Help

Solution

1) Beginning retained earning balance = 20500

Add: net income = $46300

less: Dividend = ($16800)

Ending retained earning balance = $50000

Note:- Income statement

Revenue:

Rent revenue = 5300

Commission revenue = 62600

Expenses:

Depreciation = 6700

Utilties expense = 9200

supplies expense = 5700

Net income = $46300

2) Net income amount of $46300 , to be transferred from income summary to retained earnings account

3) Supplies expense account = $0 , All the expenses have been transferred to \"Income Statement\".Therefore, there is no balance left in any expenses account.

| 31 December,20XX | Income summary | 46300 | |

| To Retained Earnings | 46300 | ||

Homework Sourse

Homework Sourse