73 Supernormal Growth You are interested in buying stock in

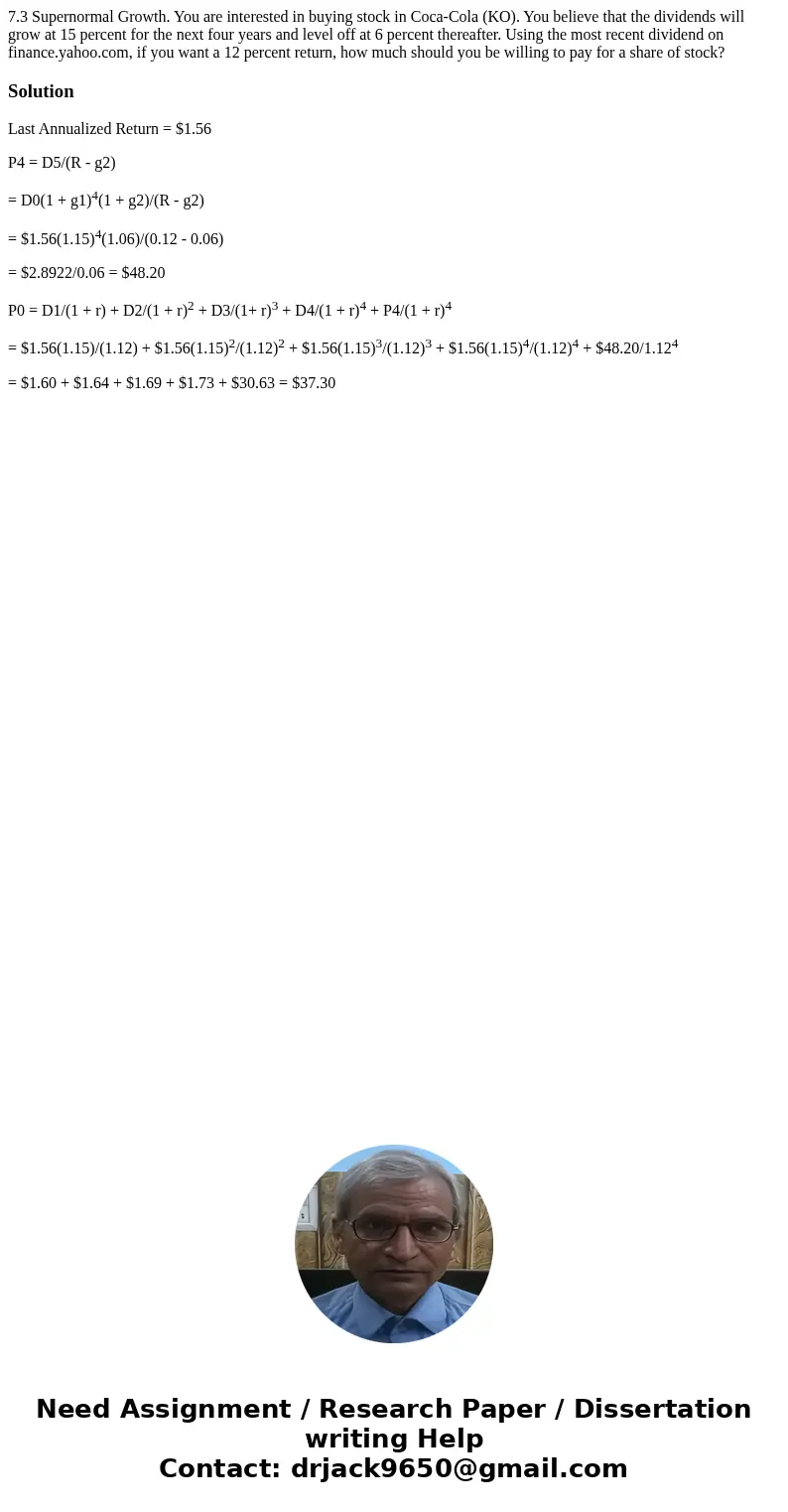

7.3 Supernormal Growth. You are interested in buying stock in Coca-Cola (KO). You believe that the dividends will grow at 15 percent for the next four years and level off at 6 percent thereafter. Using the most recent dividend on finance.yahoo.com, if you want a 12 percent return, how much should you be willing to pay for a share of stock?

Solution

Last Annualized Return = $1.56

P4 = D5/(R - g2)

= D0(1 + g1)4(1 + g2)/(R - g2)

= $1.56(1.15)4(1.06)/(0.12 - 0.06)

= $2.8922/0.06 = $48.20

P0 = D1/(1 + r) + D2/(1 + r)2 + D3/(1+ r)3 + D4/(1 + r)4 + P4/(1 + r)4

= $1.56(1.15)/(1.12) + $1.56(1.15)2/(1.12)2 + $1.56(1.15)3/(1.12)3 + $1.56(1.15)4/(1.12)4 + $48.20/1.124

= $1.60 + $1.64 + $1.69 + $1.73 + $30.63 = $37.30

Homework Sourse

Homework Sourse