Mufala Inc will issue 10000000 of 6 10year bonds The market

Mufala, Inc., will issue $10,000,000 of 6% 10-year bonds. The market rate for bonds with similar risk and maturity is 8%. Interest will be paid by Mufala semiannually. What is the issue price of the bonds? (Refer to the appropriate table in the Present and Future Value Tables section of your tex

Issue price of the bonds__________ ?

hello please help me to answer this problem I previously submitted this question and the answer was giving incorrect $8,656,546

Solution

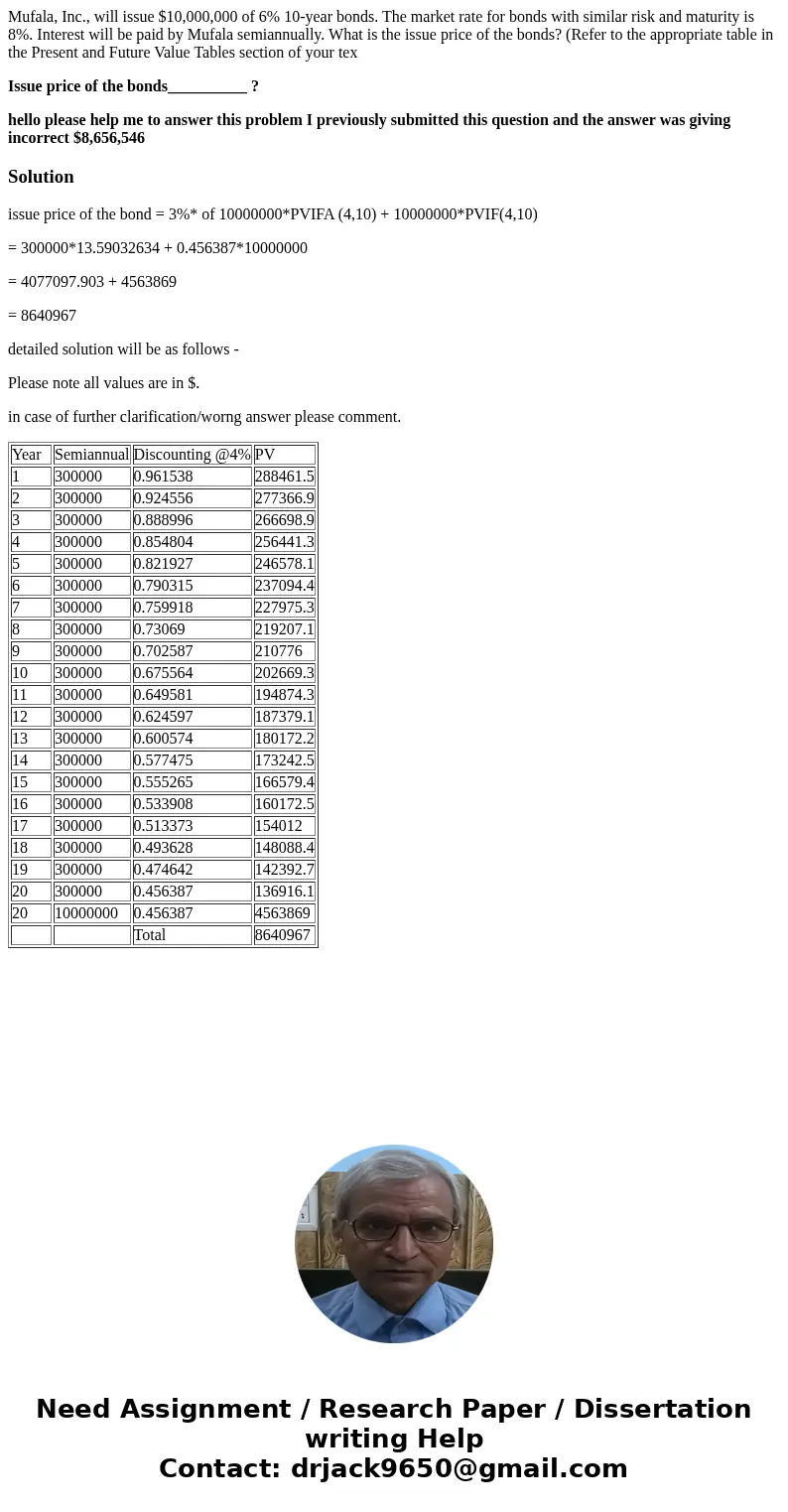

issue price of the bond = 3%* of 10000000*PVIFA (4,10) + 10000000*PVIF(4,10)

= 300000*13.59032634 + 0.456387*10000000

= 4077097.903 + 4563869

= 8640967

detailed solution will be as follows -

Please note all values are in $.

in case of further clarification/worng answer please comment.

| Year | Semiannual | Discounting @4% | PV |

| 1 | 300000 | 0.961538 | 288461.5 |

| 2 | 300000 | 0.924556 | 277366.9 |

| 3 | 300000 | 0.888996 | 266698.9 |

| 4 | 300000 | 0.854804 | 256441.3 |

| 5 | 300000 | 0.821927 | 246578.1 |

| 6 | 300000 | 0.790315 | 237094.4 |

| 7 | 300000 | 0.759918 | 227975.3 |

| 8 | 300000 | 0.73069 | 219207.1 |

| 9 | 300000 | 0.702587 | 210776 |

| 10 | 300000 | 0.675564 | 202669.3 |

| 11 | 300000 | 0.649581 | 194874.3 |

| 12 | 300000 | 0.624597 | 187379.1 |

| 13 | 300000 | 0.600574 | 180172.2 |

| 14 | 300000 | 0.577475 | 173242.5 |

| 15 | 300000 | 0.555265 | 166579.4 |

| 16 | 300000 | 0.533908 | 160172.5 |

| 17 | 300000 | 0.513373 | 154012 |

| 18 | 300000 | 0.493628 | 148088.4 |

| 19 | 300000 | 0.474642 | 142392.7 |

| 20 | 300000 | 0.456387 | 136916.1 |

| 20 | 10000000 | 0.456387 | 4563869 |

| Total | 8640967 |

Homework Sourse

Homework Sourse