Fischer Inc has 8 percent coupon bonds on the market that ha

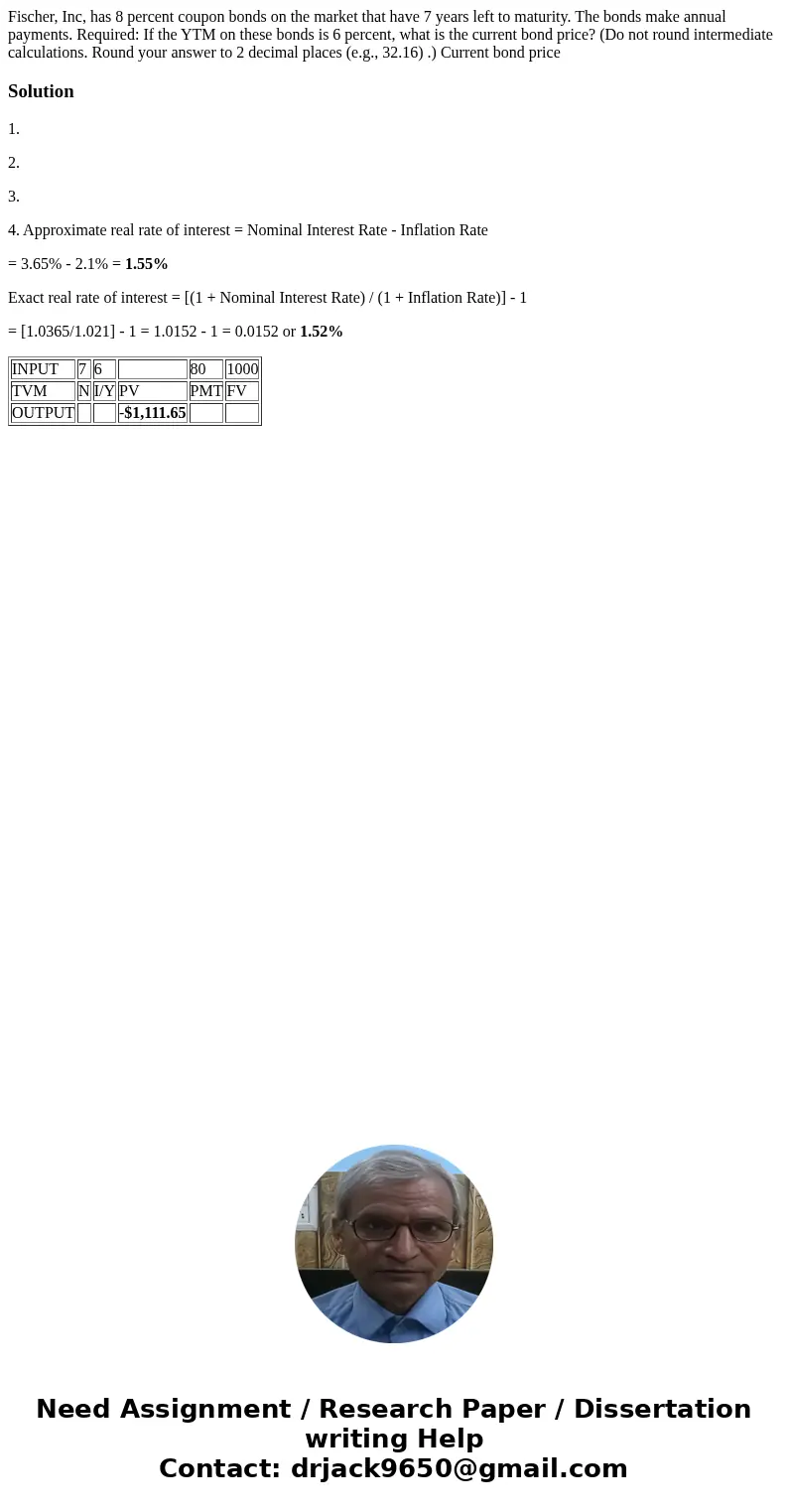

Fischer, Inc, has 8 percent coupon bonds on the market that have 7 years left to maturity. The bonds make annual payments. Required: If the YTM on these bonds is 6 percent, what is the current bond price? (Do not round intermediate calculations. Round your answer to 2 decimal places (e.g., 32.16) .) Current bond price

Solution

1.

2.

3.

4. Approximate real rate of interest = Nominal Interest Rate - Inflation Rate

= 3.65% - 2.1% = 1.55%

Exact real rate of interest = [(1 + Nominal Interest Rate) / (1 + Inflation Rate)] - 1

= [1.0365/1.021] - 1 = 1.0152 - 1 = 0.0152 or 1.52%

| INPUT | 7 | 6 | 80 | 1000 | |

| TVM | N | I/Y | PV | PMT | FV |

| OUTPUT | -$1,111.65 |

Homework Sourse

Homework Sourse