I need help figuring out which journal entries would be used

I need help figuring out which journal entries would be used for each listed on the first picture with the question. The pictures under it are journal entries I need to do. Last, is the where I would report it such as income statement, statement of comprehensive income, etc.

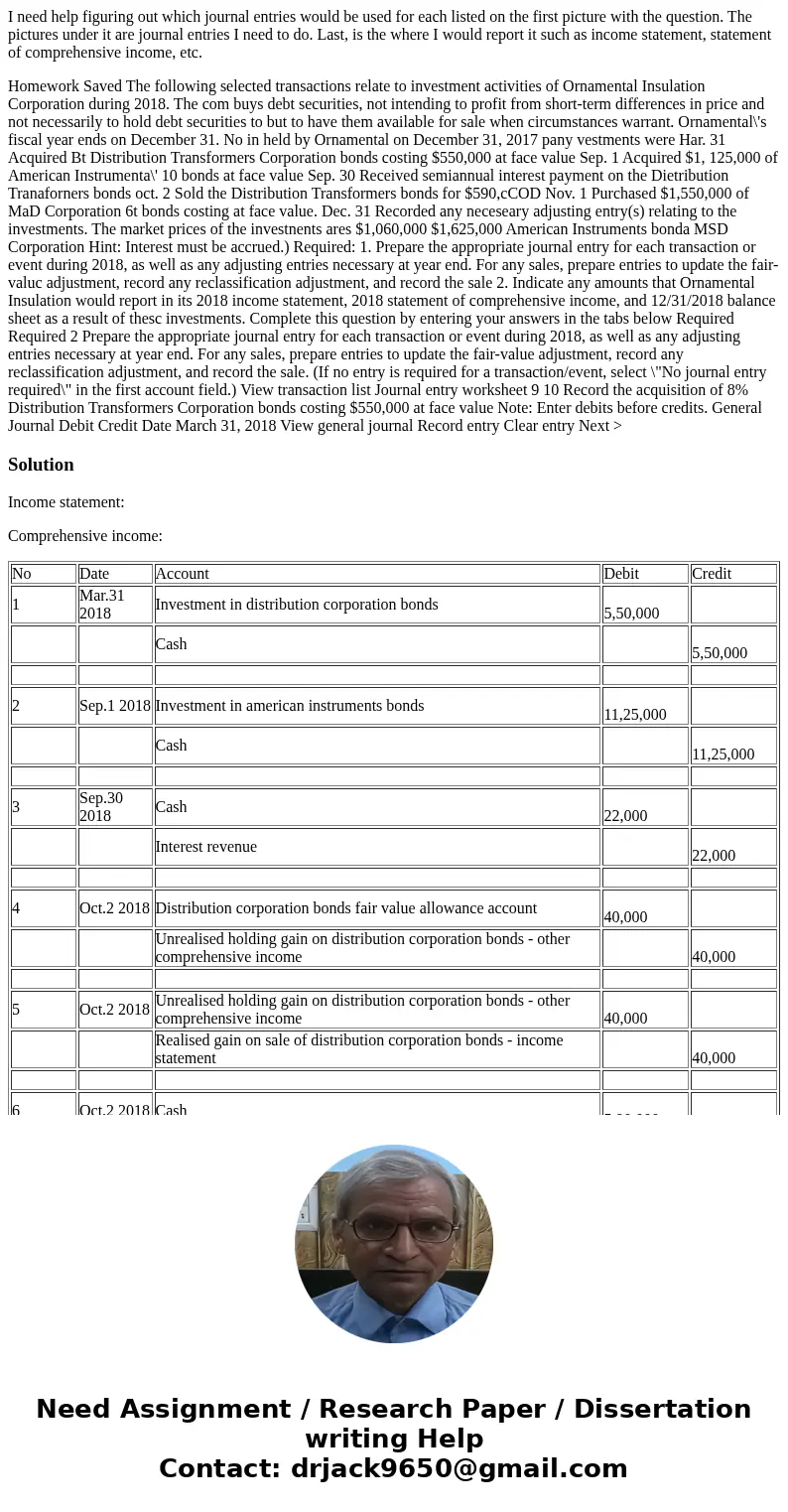

Homework Saved The following selected transactions relate to investment activities of Ornamental Insulation Corporation during 2018. The com buys debt securities, not intending to profit from short-term differences in price and not necessarily to hold debt securities to but to have them available for sale when circumstances warrant. Ornamental\'s fiscal year ends on December 31. No in held by Ornamental on December 31, 2017 pany vestments were Har. 31 Acquired Bt Distribution Transformers Corporation bonds costing $550,000 at face value Sep. 1 Acquired $1, 125,000 of American Instrumenta\' 10 bonds at face value Sep. 30 Received semiannual interest payment on the Dietribution Tranaforners bonds oct. 2 Sold the Distribution Transformers bonds for $590,cCOD Nov. 1 Purchased $1,550,000 of MaD Corporation 6t bonds costing at face value. Dec. 31 Recorded any neceseary adjusting entry(s) relating to the investments. The market prices of the investnents ares $1,060,000 $1,625,000 American Instruments bonda MSD Corporation Hint: Interest must be accrued.) Required: 1. Prepare the appropriate journal entry for each transaction or event during 2018, as well as any adjusting entries necessary at year end. For any sales, prepare entries to update the fair-valuc adjustment, record any reclassification adjustment, and record the sale 2. Indicate any amounts that Ornamental Insulation would report in its 2018 income statement, 2018 statement of comprehensive income, and 12/31/2018 balance sheet as a result of thesc investments. Complete this question by entering your answers in the tabs below Required Required 2 Prepare the appropriate journal entry for each transaction or event during 2018, as well as any adjusting entries necessary at year end. For any sales, prepare entries to update the fair-value adjustment, record any reclassification adjustment, and record the sale. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field.) View transaction list Journal entry worksheet 9 10 Record the acquisition of 8% Distribution Transformers Corporation bonds costing $550,000 at face value Note: Enter debits before credits. General Journal Debit Credit Date March 31, 2018 View general journal Record entry Clear entry Next >Solution

Income statement:

Comprehensive income:

| No | Date | Account | Debit | Credit |

| 1 | Mar.31 2018 | Investment in distribution corporation bonds | 5,50,000 | |

| Cash | 5,50,000 | |||

| 2 | Sep.1 2018 | Investment in american instruments bonds | 11,25,000 | |

| Cash | 11,25,000 | |||

| 3 | Sep.30 2018 | Cash | 22,000 | |

| Interest revenue | 22,000 | |||

| 4 | Oct.2 2018 | Distribution corporation bonds fair value allowance account | 40,000 | |

| Unrealised holding gain on distribution corporation bonds - other comprehensive income | 40,000 | |||

| 5 | Oct.2 2018 | Unrealised holding gain on distribution corporation bonds - other comprehensive income | 40,000 | |

| Realised gain on sale of distribution corporation bonds - income statement | 40,000 | |||

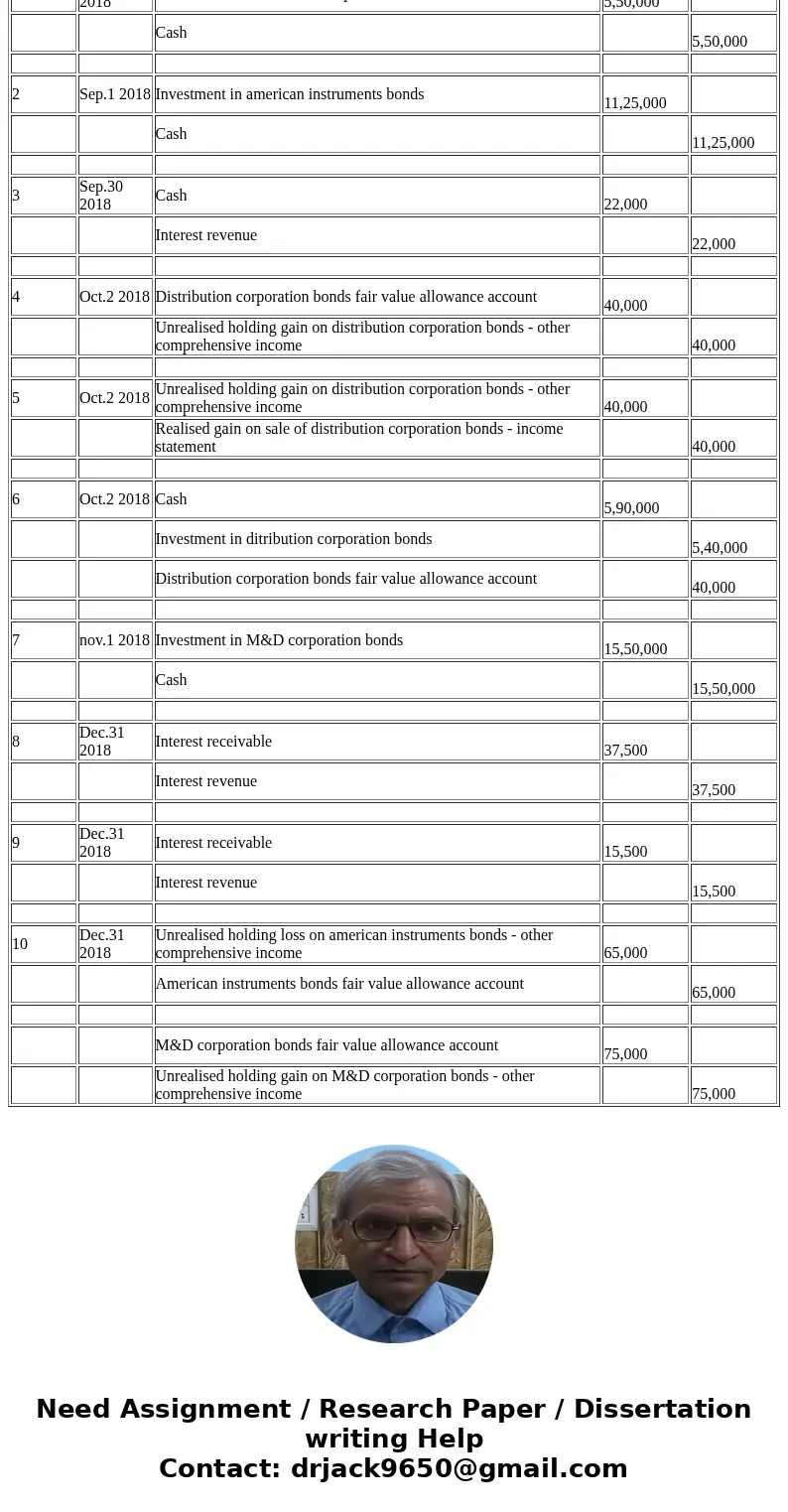

| 6 | Oct.2 2018 | Cash | 5,90,000 | |

| Investment in ditribution corporation bonds | 5,40,000 | |||

| Distribution corporation bonds fair value allowance account | 40,000 | |||

| 7 | nov.1 2018 | Investment in M&D corporation bonds | 15,50,000 | |

| Cash | 15,50,000 | |||

| 8 | Dec.31 2018 | Interest receivable | 37,500 | |

| Interest revenue | 37,500 | |||

| 9 | Dec.31 2018 | Interest receivable | 15,500 | |

| Interest revenue | 15,500 | |||

| 10 | Dec.31 2018 | Unrealised holding loss on american instruments bonds - other comprehensive income | 65,000 | |

| American instruments bonds fair value allowance account | 65,000 | |||

| M&D corporation bonds fair value allowance account | 75,000 | |||

| Unrealised holding gain on M&D corporation bonds - other comprehensive income | 75,000 |

Homework Sourse

Homework Sourse