Shilling Manufacturing produces and sells oil filters for 32

Shilling Manufacturing produces and sells oil filters for $3.25 each. A retailer has offered to purchase 20,000 oil filters for $1.55 per filter. Of the total manufacturing cost per filter of $2.10, $1.30 is the variable manufacturing cost per filter. For this special order, Shilling would have to buy a special stamping machine that costs $8,000 to mark the customers logo on the special-order oil filters. The machine would be scrapped when the special order is complete. This special order would use manufacturing capacity that would otherwise be idle. No variable nonmanufacturing costs would be incurred by the special order. Regular sales would not be affected by the special order. Would you recommend that Shilling accept the special order under these conditions? Complete the following incremental analysis to help you make your recommendation. (Use parentheses or a minus sign to indicate a decrease in operating income from the special order.) Total Order Incremental Analysis of Special Sales Order Decision Per Unit (20,000 units) Revenue from special order Less variable expense associated with the order: Contribution margin Increase (decrease) in operating income from the special order Shilling accept the special sales order because it will | operating income.

Solution

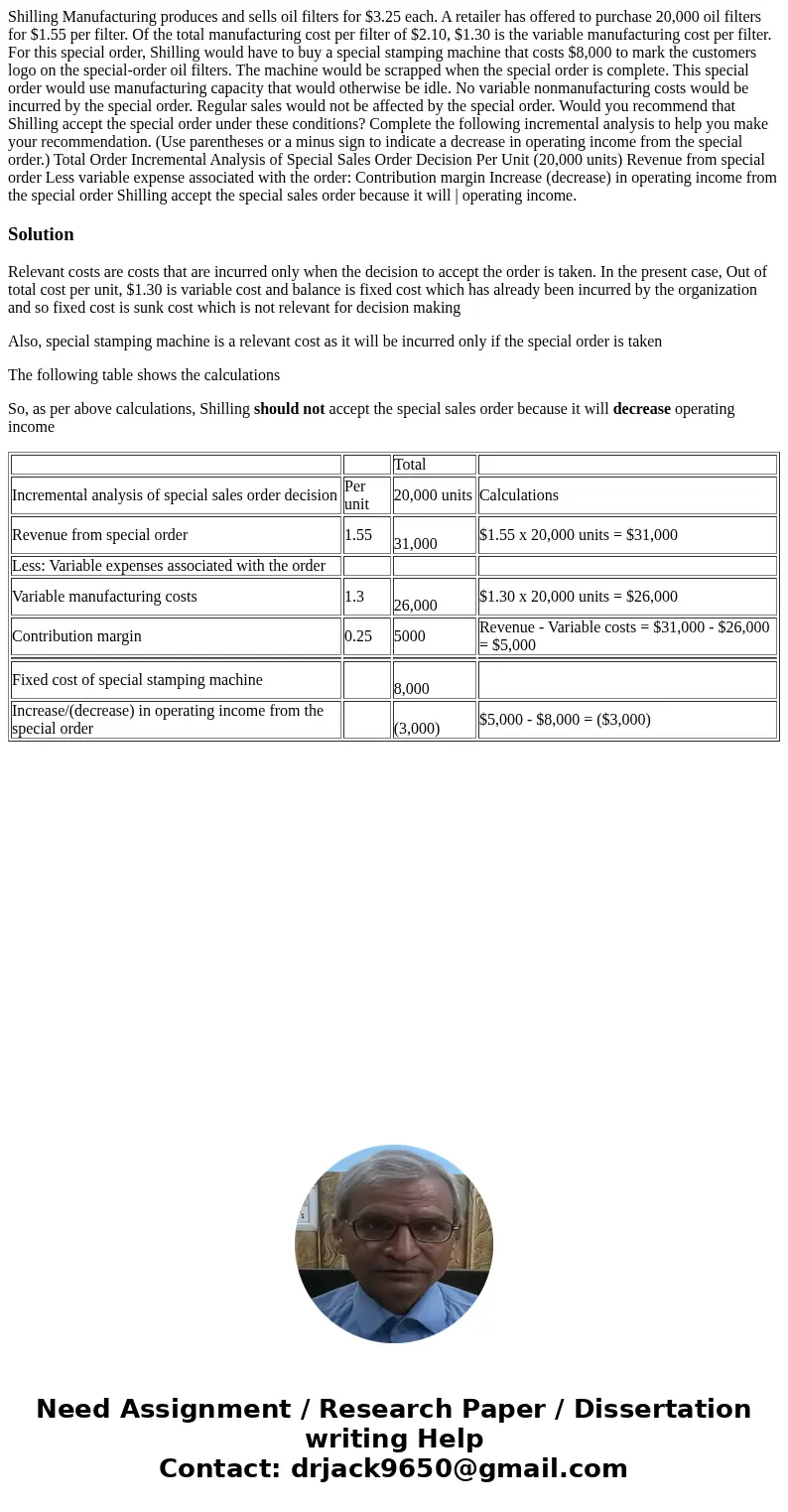

Relevant costs are costs that are incurred only when the decision to accept the order is taken. In the present case, Out of total cost per unit, $1.30 is variable cost and balance is fixed cost which has already been incurred by the organization and so fixed cost is sunk cost which is not relevant for decision making

Also, special stamping machine is a relevant cost as it will be incurred only if the special order is taken

The following table shows the calculations

So, as per above calculations, Shilling should not accept the special sales order because it will decrease operating income

| Total | |||

| Incremental analysis of special sales order decision | Per unit | 20,000 units | Calculations |

| Revenue from special order | 1.55 | 31,000 | $1.55 x 20,000 units = $31,000 |

| Less: Variable expenses associated with the order | |||

| Variable manufacturing costs | 1.3 | 26,000 | $1.30 x 20,000 units = $26,000 |

| Contribution margin | 0.25 | 5000 | Revenue - Variable costs = $31,000 - $26,000 = $5,000 |

| Fixed cost of special stamping machine | 8,000 | ||

| Increase/(decrease) in operating income from the special order | (3,000) | $5,000 - $8,000 = ($3,000) |

Homework Sourse

Homework Sourse