1000 points Anchor Corporation paid cash of 175000 to acquir

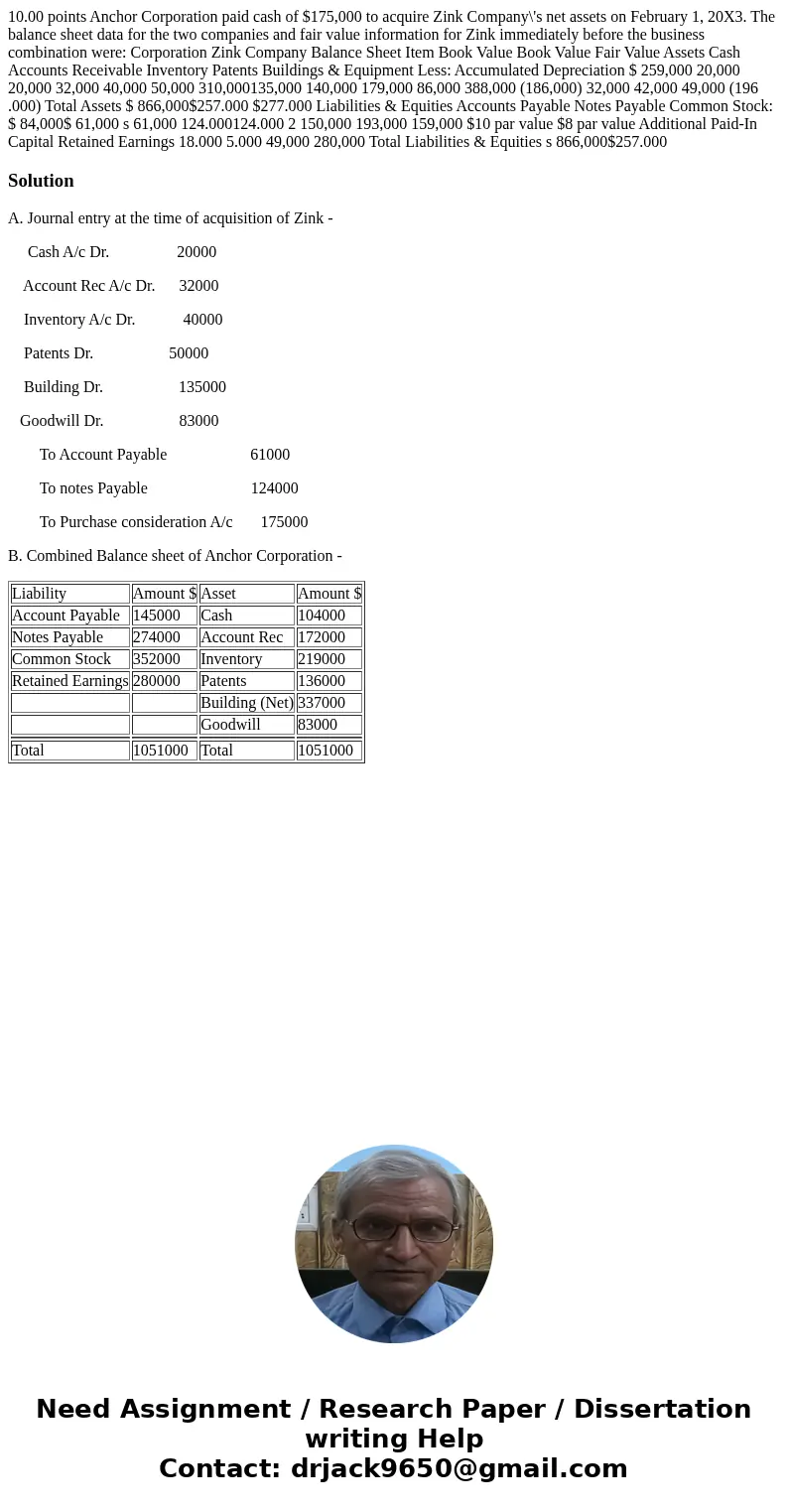

10.00 points Anchor Corporation paid cash of $175,000 to acquire Zink Company\'s net assets on February 1, 20X3. The balance sheet data for the two companies and fair value information for Zink immediately before the business combination were: Corporation Zink Company Balance Sheet Item Book Value Book Value Fair Value Assets Cash Accounts Receivable Inventory Patents Buildings & Equipment Less: Accumulated Depreciation $ 259,000 20,000 20,000 32,000 40,000 50,000 310,000135,000 140,000 179,000 86,000 388,000 (186,000) 32,000 42,000 49,000 (196 .000) Total Assets $ 866,000$257.000 $277.000 Liabilities & Equities Accounts Payable Notes Payable Common Stock: $ 84,000$ 61,000 s 61,000 124.000124.000 2 150,000 193,000 159,000 $10 par value $8 par value Additional Paid-In Capital Retained Earnings 18.000 5.000 49,000 280,000 Total Liabilities & Equities s 866,000$257.000

Solution

A. Journal entry at the time of acquisition of Zink -

Cash A/c Dr. 20000

Account Rec A/c Dr. 32000

Inventory A/c Dr. 40000

Patents Dr. 50000

Building Dr. 135000

Goodwill Dr. 83000

To Account Payable 61000

To notes Payable 124000

To Purchase consideration A/c 175000

B. Combined Balance sheet of Anchor Corporation -

| Liability | Amount $ | Asset | Amount $ |

| Account Payable | 145000 | Cash | 104000 |

| Notes Payable | 274000 | Account Rec | 172000 |

| Common Stock | 352000 | Inventory | 219000 |

| Retained Earnings | 280000 | Patents | 136000 |

| Building (Net) | 337000 | ||

| Goodwill | 83000 | ||

| Total | 1051000 | Total | 1051000 |

Homework Sourse

Homework Sourse