Your firm is considering the following mutually exclusive pr

Your firm is considering the following mutually exclusive projects:

-$3,300,000

850,000

The firm uses a discount rate of 12.628%. At that discount rate we find that

A-Project A is clearly preferred

B-Project B is clearly preferred

C-the projects have roughly the same NPV\'s

Given that finding, the firm should select ___________because it\'s NPV is the least sensitive to change

A-Project A

B-Project B

| Year | Project A | Project B |

| 0 | -$3,300,000 | -$3,300,000 |

| 1 | 1,940,000 | 866,000 |

| 2 | 1,350,000 | 1,250,000 |

| 3 | 850,000 | 2,325,000 |

Solution

1.

Correct option > C-the projects have roughly the same NPV\'s

2.

Correct option is > A-Project A

Given that finding, the firm should select Project A because it\'s NPV is the least sensitive to change

.

Reason: The major cash flow for Project A falls in 1st and 2nd years hence it is least sensitive to change. The Project B has largest cash flow in year 3 hence it is sensitive to interest rate change.

---------------------------------------

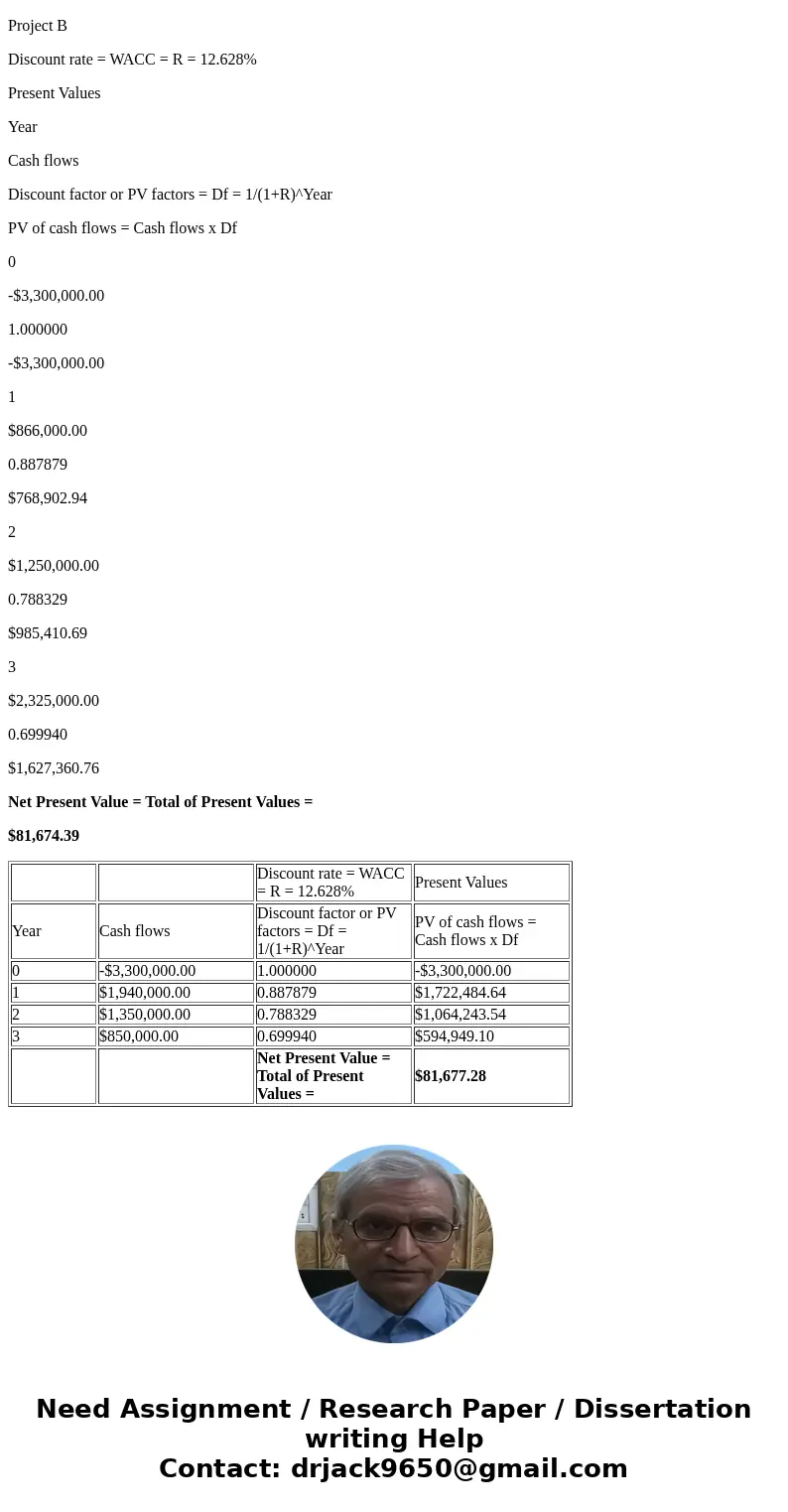

NPV Working:

Project A

Discount rate = WACC = R = 12.628%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$3,300,000.00

1.000000

-$3,300,000.00

1

$1,940,000.00

0.887879

$1,722,484.64

2

$1,350,000.00

0.788329

$1,064,243.54

3

$850,000.00

0.699940

$594,949.10

Net Present Value = Total of Present Values =

$81,677.28

Project B

Discount rate = WACC = R = 12.628%

Present Values

Year

Cash flows

Discount factor or PV factors = Df = 1/(1+R)^Year

PV of cash flows = Cash flows x Df

0

-$3,300,000.00

1.000000

-$3,300,000.00

1

$866,000.00

0.887879

$768,902.94

2

$1,250,000.00

0.788329

$985,410.69

3

$2,325,000.00

0.699940

$1,627,360.76

Net Present Value = Total of Present Values =

$81,674.39

| Discount rate = WACC = R = 12.628% | Present Values | ||

| Year | Cash flows | Discount factor or PV factors = Df = 1/(1+R)^Year | PV of cash flows = Cash flows x Df |

| 0 | -$3,300,000.00 | 1.000000 | -$3,300,000.00 |

| 1 | $1,940,000.00 | 0.887879 | $1,722,484.64 |

| 2 | $1,350,000.00 | 0.788329 | $1,064,243.54 |

| 3 | $850,000.00 | 0.699940 | $594,949.10 |

| Net Present Value = Total of Present Values = | $81,677.28 |

Homework Sourse

Homework Sourse