Question 7 5 pts and its Weaver Brothers expects to earn S35

Question 7 5 pts and its Weaver Brothers expects to earn S3.50 per share Ei), and has an expected dividend payout ratio of 60%. Its expected constant dividend growth rate is 4.4%, common stock currently sells for S30 per share. New stock can be sold to the public at the current price, but a flotation cost of 5% would be incurred what would be the cost of equity from new common stock? Your answer should be between 10.15 and 16.90, rounded to 2 decimal places, with no special characters.

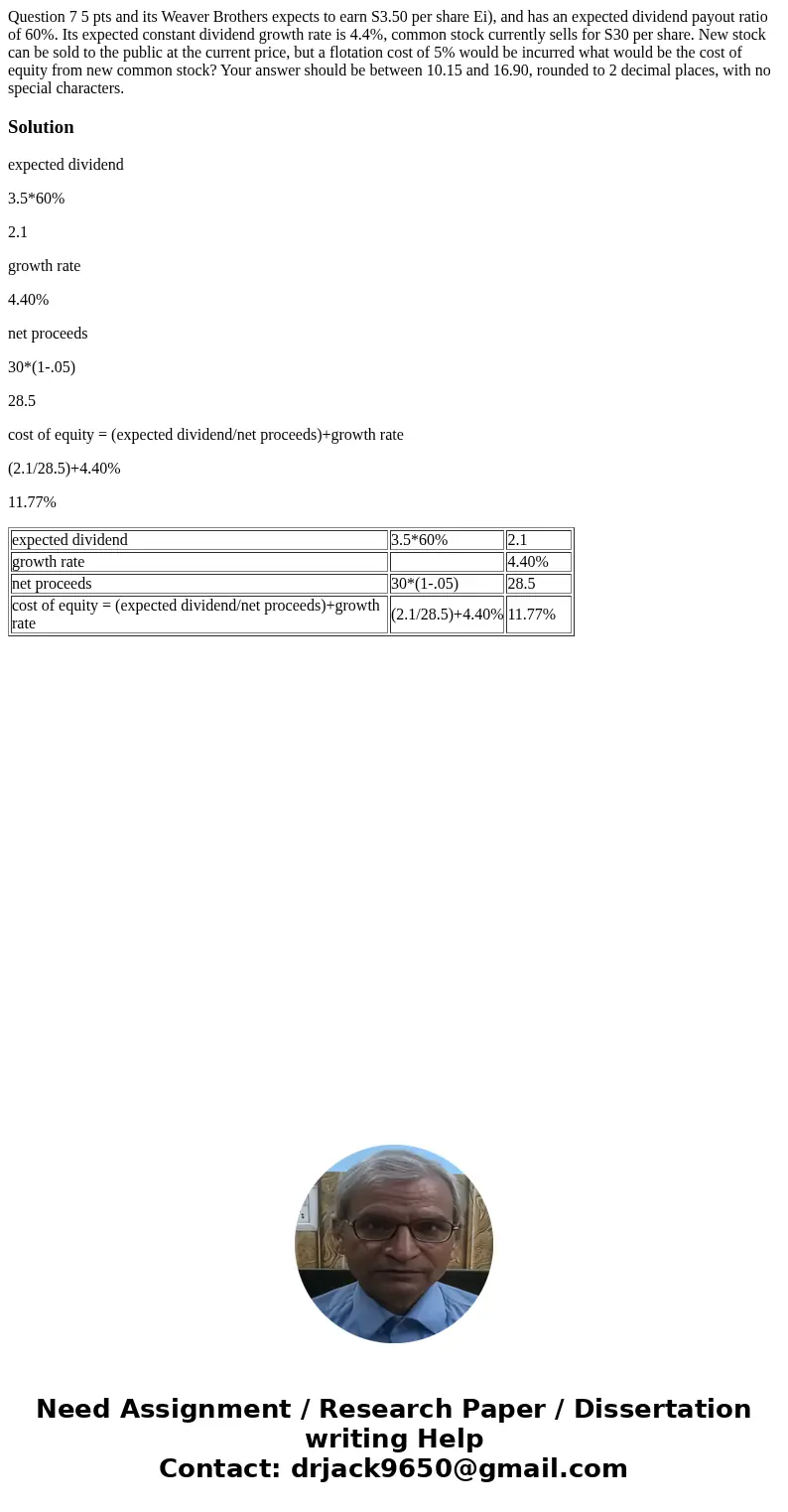

Solution

expected dividend

3.5*60%

2.1

growth rate

4.40%

net proceeds

30*(1-.05)

28.5

cost of equity = (expected dividend/net proceeds)+growth rate

(2.1/28.5)+4.40%

11.77%

| expected dividend | 3.5*60% | 2.1 |

| growth rate | 4.40% | |

| net proceeds | 30*(1-.05) | 28.5 |

| cost of equity = (expected dividend/net proceeds)+growth rate | (2.1/28.5)+4.40% | 11.77% |

Homework Sourse

Homework Sourse