On October 1 2017 Ivanhoe Inc entered into a contract to sel

On October 1, 2017, Ivanhoe Inc. entered into a contract to sell a custom van to Smith Tours for $36,600. Under the contract Smith is to pay Ivanhoe $4,900 on October 10, 2017 and pay the remainder of the purchase price upon delivery (scheduled for October 31, 2017). Smith makes the $4,900 payment in a timely manner. Ivanhoe delivers the van (with cost of $27,100) on October 31, 2017.

Prepare Ivanhoe\'s journal entry on October 1, 2017

Account Titles and Explanation. Debt. credit

( 2 entries)

Prepare Ivanhoe journal entry on October 10, 2017

Account Titles and Explanation. Debit. credit

(2 entries)

I wasn\'t sure if you would be able to see the photo.

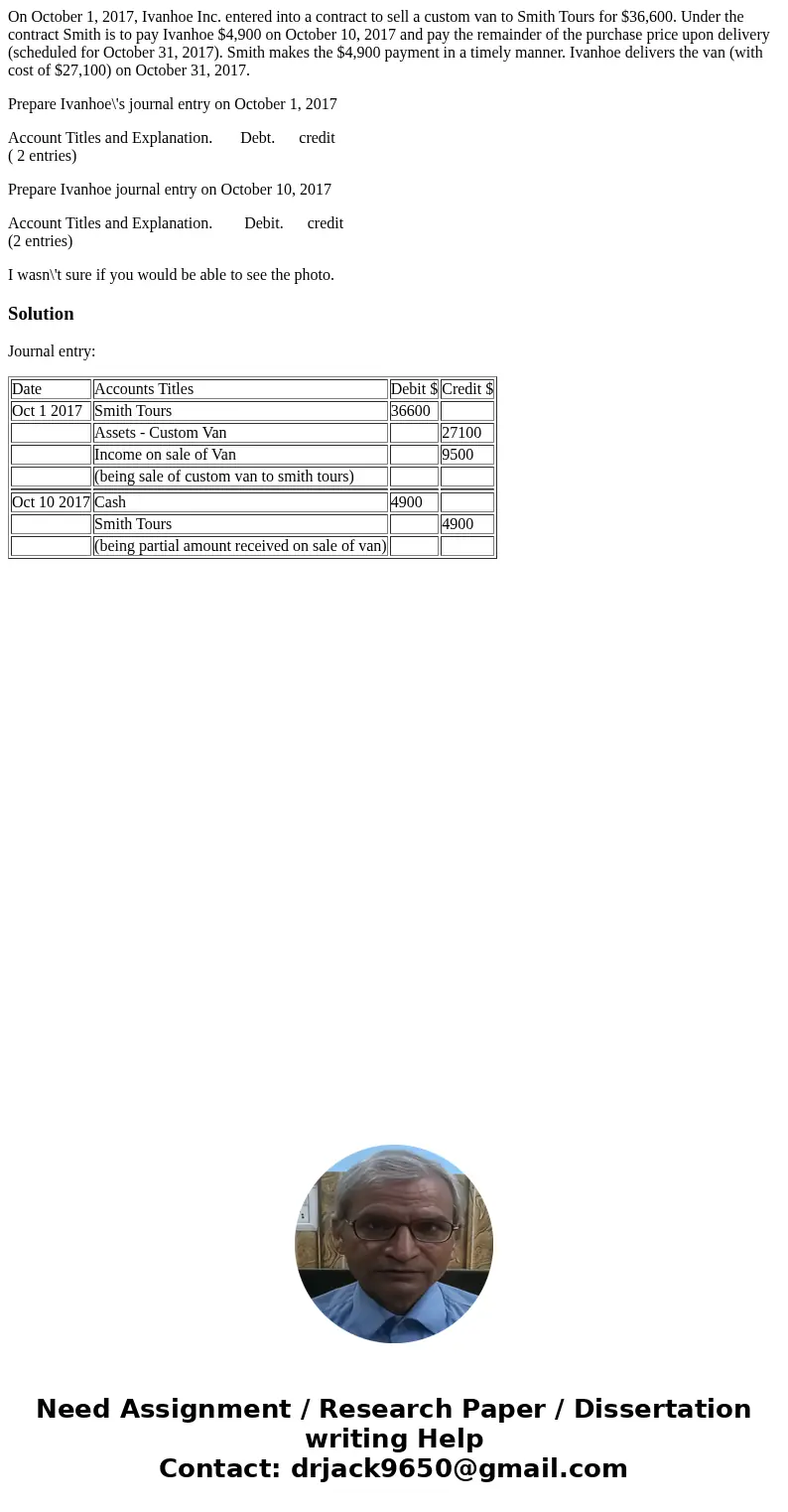

Solution

Journal entry:

| Date | Accounts Titles | Debit $ | Credit $ |

| Oct 1 2017 | Smith Tours | 36600 | |

| Assets - Custom Van | 27100 | ||

| Income on sale of Van | 9500 | ||

| (being sale of custom van to smith tours) | |||

| Oct 10 2017 | Cash | 4900 | |

| Smith Tours | 4900 | ||

| (being partial amount received on sale of van) |

Homework Sourse

Homework Sourse