8 Abandonment options Aa Aa Shan Co is considering a fouryea

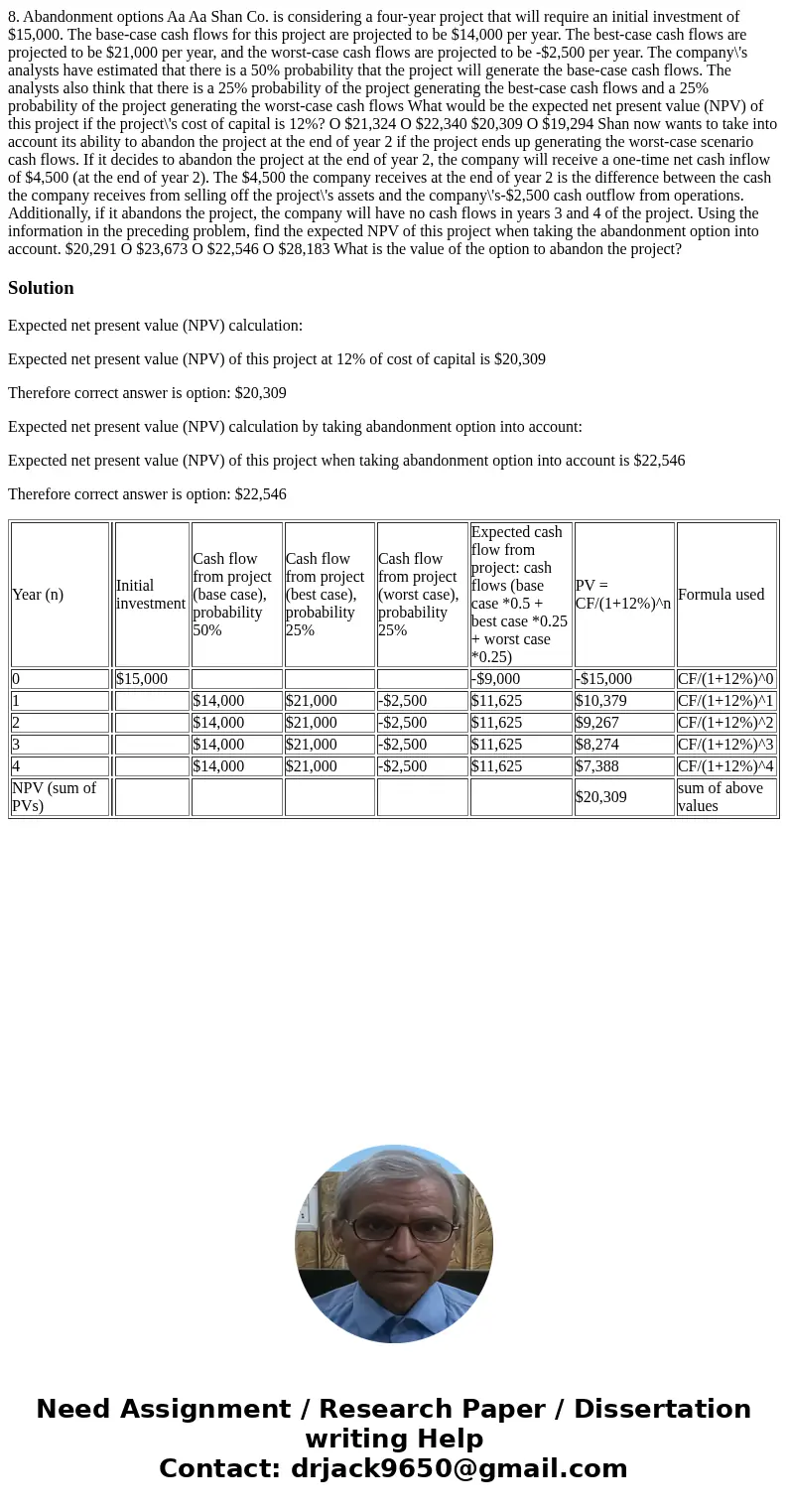

8. Abandonment options Aa Aa Shan Co. is considering a four-year project that will require an initial investment of $15,000. The base-case cash flows for this project are projected to be $14,000 per year. The best-case cash flows are projected to be $21,000 per year, and the worst-case cash flows are projected to be -$2,500 per year. The company\'s analysts have estimated that there is a 50% probability that the project will generate the base-case cash flows. The analysts also think that there is a 25% probability of the project generating the best-case cash flows and a 25% probability of the project generating the worst-case cash flows What would be the expected net present value (NPV) of this project if the project\'s cost of capital is 12%? O $21,324 O $22,340 $20,309 O $19,294 Shan now wants to take into account its ability to abandon the project at the end of year 2 if the project ends up generating the worst-case scenario cash flows. If it decides to abandon the project at the end of year 2, the company will receive a one-time net cash inflow of $4,500 (at the end of year 2). The $4,500 the company receives at the end of year 2 is the difference between the cash the company receives from selling off the project\'s assets and the company\'s-$2,500 cash outflow from operations. Additionally, if it abandons the project, the company will have no cash flows in years 3 and 4 of the project. Using the information in the preceding problem, find the expected NPV of this project when taking the abandonment option into account. $20,291 O $23,673 O $22,546 O $28,183 What is the value of the option to abandon the project?

Solution

Expected net present value (NPV) calculation:

Expected net present value (NPV) of this project at 12% of cost of capital is $20,309

Therefore correct answer is option: $20,309

Expected net present value (NPV) calculation by taking abandonment option into account:

Expected net present value (NPV) of this project when taking abandonment option into account is $22,546

Therefore correct answer is option: $22,546

| Year (n) | Initial investment | Cash flow from project (base case), probability 50% | Cash flow from project (best case), probability 25% | Cash flow from project (worst case), probability 25% | Expected cash flow from project: cash flows (base case *0.5 + best case *0.25 + worst case *0.25) | PV = CF/(1+12%)^n | Formula used | |

| 0 | $15,000 | -$9,000 | -$15,000 | CF/(1+12%)^0 | ||||

| 1 | $14,000 | $21,000 | -$2,500 | $11,625 | $10,379 | CF/(1+12%)^1 | ||

| 2 | $14,000 | $21,000 | -$2,500 | $11,625 | $9,267 | CF/(1+12%)^2 | ||

| 3 | $14,000 | $21,000 | -$2,500 | $11,625 | $8,274 | CF/(1+12%)^3 | ||

| 4 | $14,000 | $21,000 | -$2,500 | $11,625 | $7,388 | CF/(1+12%)^4 | ||

| NPV (sum of PVs) | $20,309 | sum of above values |

Homework Sourse

Homework Sourse