Received shareholders cash contributions on February 1 total

Received shareholders\' cash contributions on February 1 totaling $20,000 to form the corporation issued 1.000 shares of common stock Paid $2,565 cash on February 2 for three months\' rent for office space TIP: For convenience, simply record the full amount of the payment as an asset (Prepaid Rent). At the end of the month, this account will be adjusted to its proper balance Purchased supplies on February 3 for $625 cash Signed a promissory note on February 4, payable in two years; deposited $19,900 in the company\'s bank account On February 5, purchased equipment for $7,700 and land for $12,200 Placed an advertisement in the local paper on February 6 for $415 cash. Recorded sales on February 7 totaling $2,100; $1,650 was in cash and the rest on accounts receivable 1. 2. 3. 4. 5. 6. 8. Collected accounts receivable of $52 from customers on February 8 9. On February 9, repaired one of the computers for $138 cash. 10. Incurred and paid employee wages on February 28 of $67.5 TIP: Most repairs involve costs that do not provide additional future economic benefits Required 1. Prepare the journal entry for each of the above transactions. (lf no entry is required for a transaction/event, select \"No Journal Entry Required\" in the first account field.) View transaction list Journal entry worksheet |1|2 3 4 5 6 7 8 9 10 Received shareholders\' cash contributions on February 1 totaling $20,000 to form the corporation; issued 1,000 shares of common stock. Record the transaction Note: Enter debits before credits Transaction General Journal Debit Credit Record entry Clear entry View general journal 2. Post the transaction activity from requirement 1 to the T-Accounts below. All accounts begin with

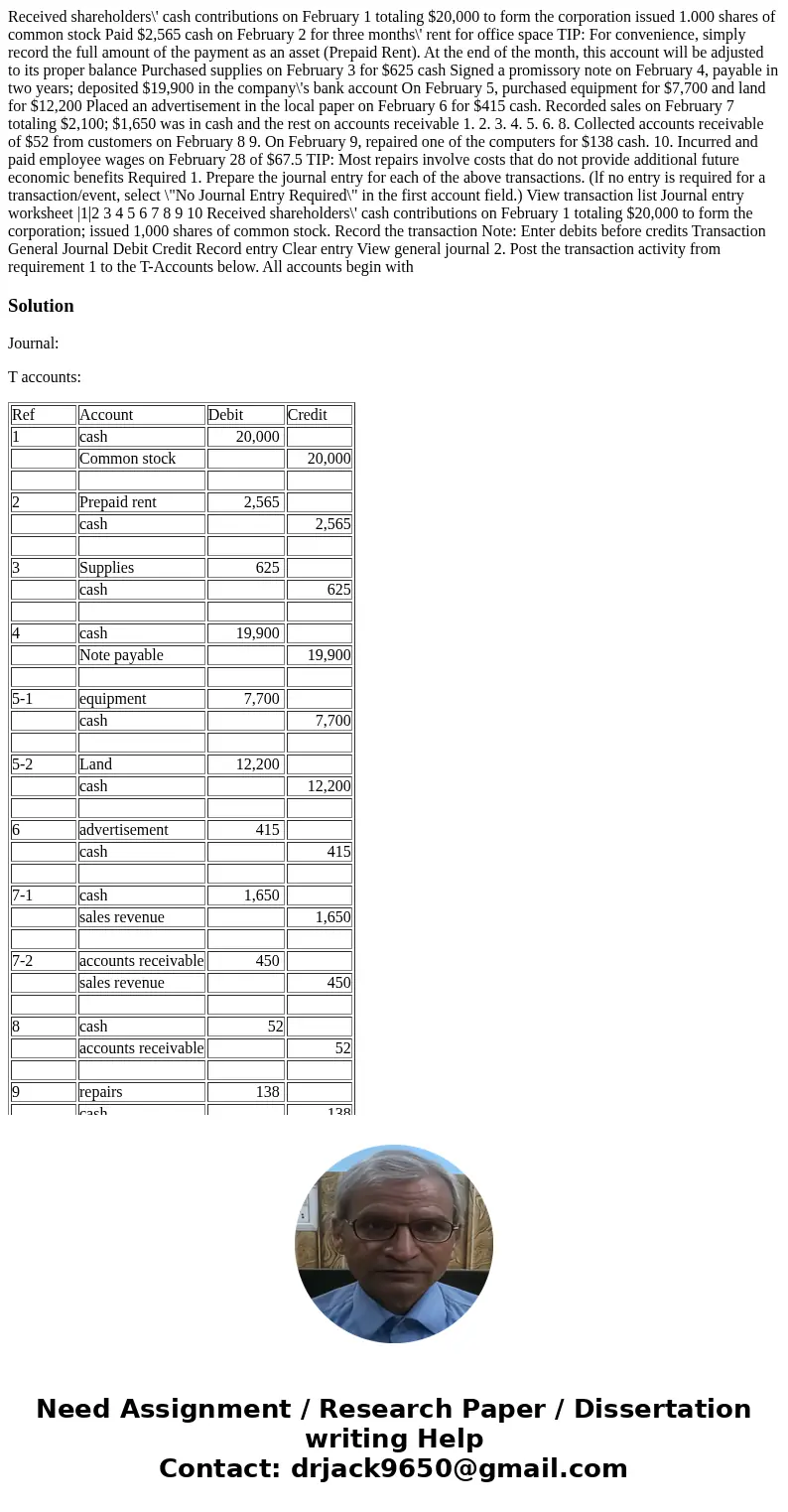

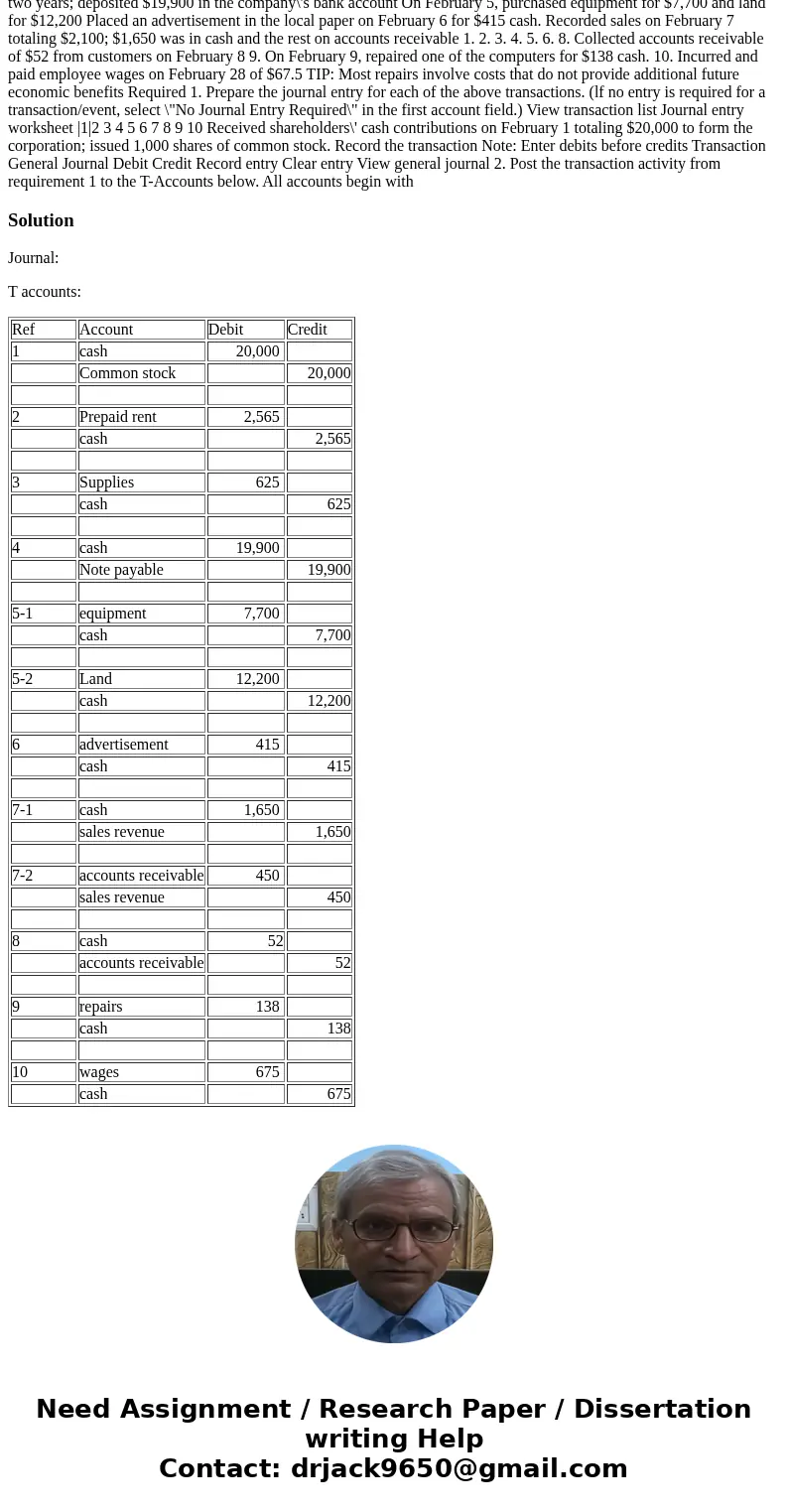

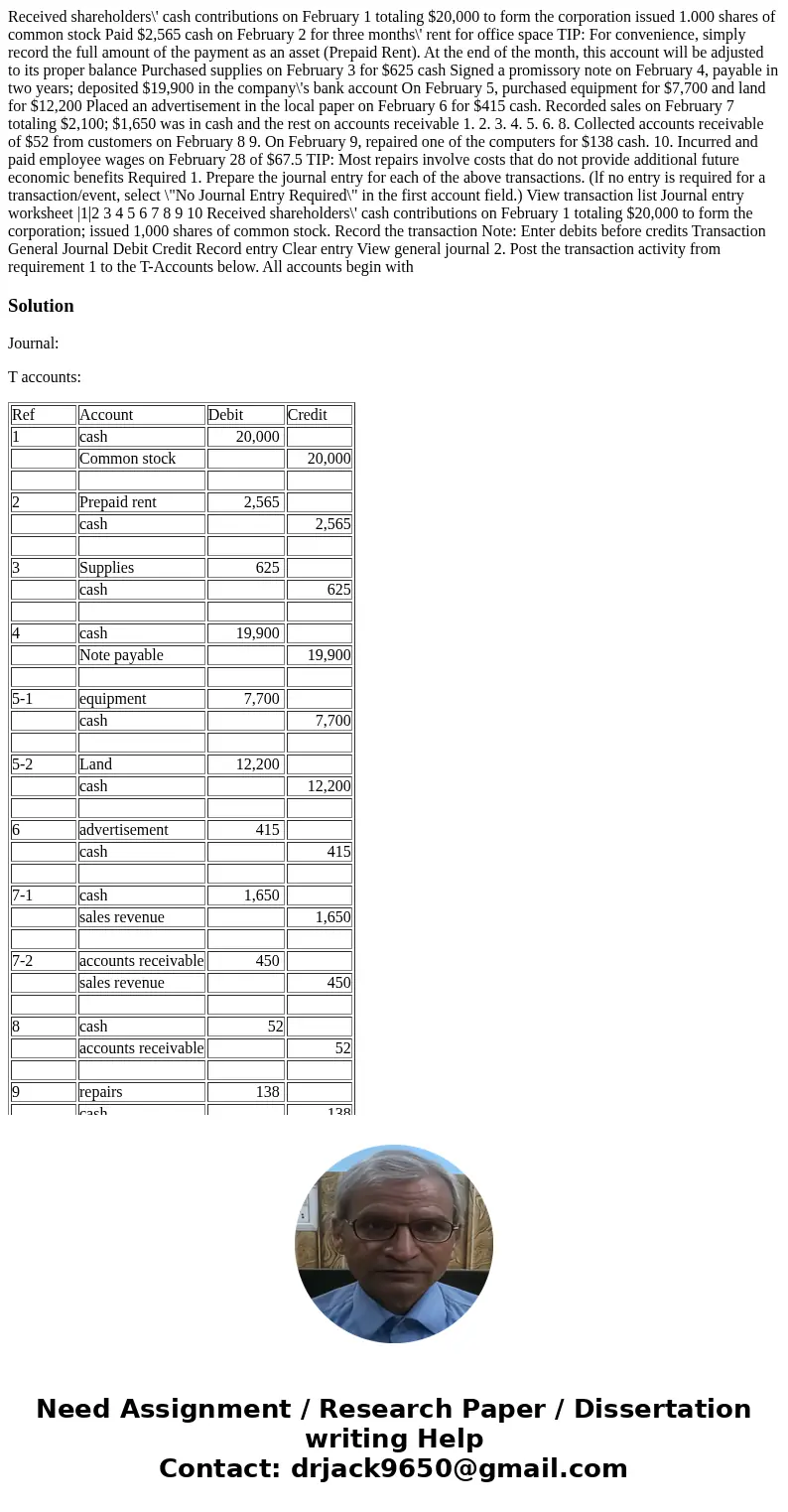

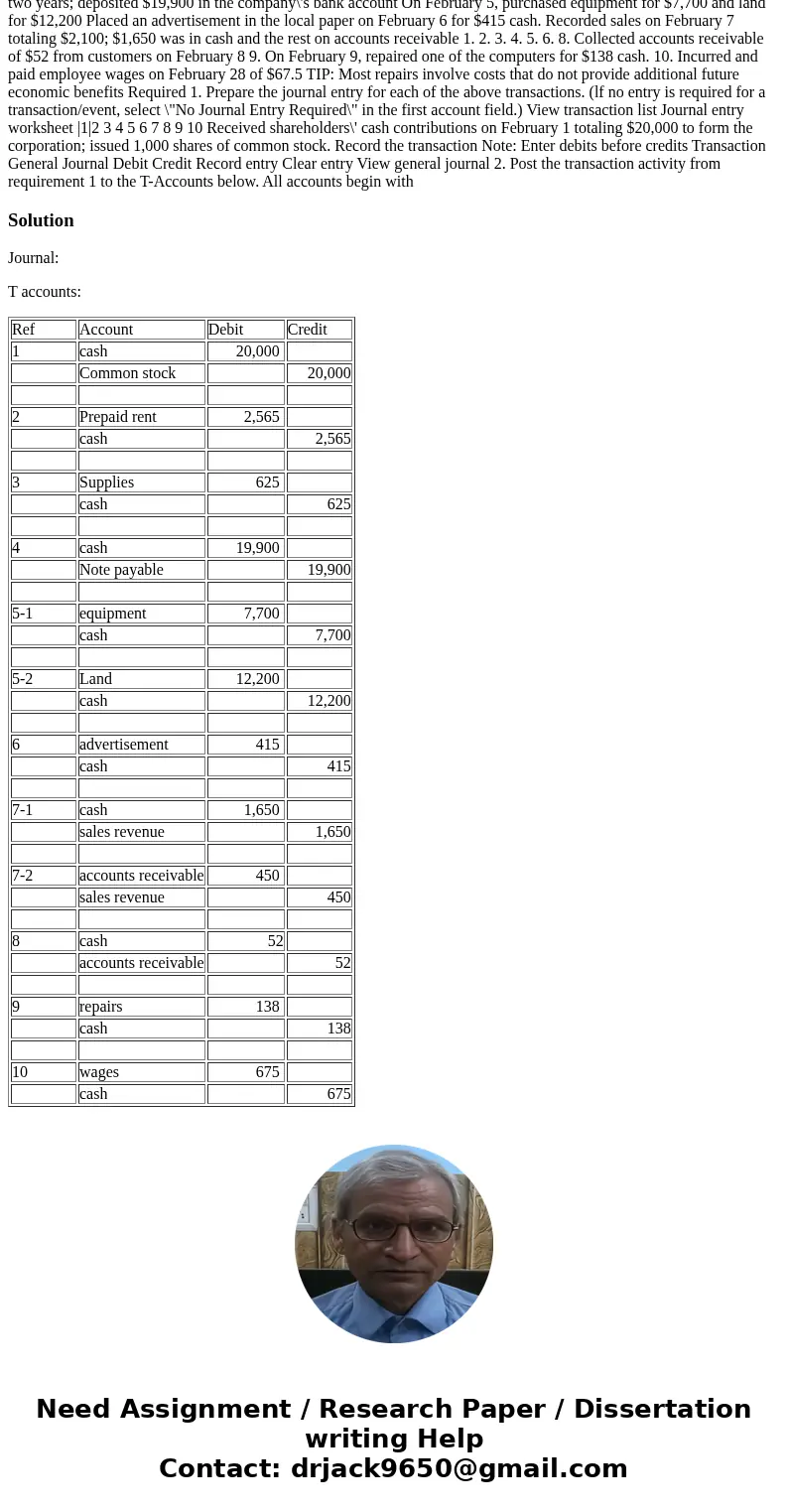

Solution

Journal:

T accounts:

| Ref | Account | Debit | Credit |

| 1 | cash | 20,000 | |

| Common stock | 20,000 | ||

| 2 | Prepaid rent | 2,565 | |

| cash | 2,565 | ||

| 3 | Supplies | 625 | |

| cash | 625 | ||

| 4 | cash | 19,900 | |

| Note payable | 19,900 | ||

| 5-1 | equipment | 7,700 | |

| cash | 7,700 | ||

| 5-2 | Land | 12,200 | |

| cash | 12,200 | ||

| 6 | advertisement | 415 | |

| cash | 415 | ||

| 7-1 | cash | 1,650 | |

| sales revenue | 1,650 | ||

| 7-2 | accounts receivable | 450 | |

| sales revenue | 450 | ||

| 8 | cash | 52 | |

| accounts receivable | 52 | ||

| 9 | repairs | 138 | |

| cash | 138 | ||

| 10 | wages | 675 | |

| cash | 675 |

Homework Sourse

Homework Sourse