Is the answer correct if yes would you please explaine the h

Is the answer correct? if yes,

would you please explaine the highlighted numbers in yellow and pink? (should I just subtract one from the original value?)

I also highlighted number 6 (in green).. why did we choose this number?

this equation could be useful

Problem 3: (25 points) Assume that you have payments of2.000 QAR in year three and increasing by 5% per year through year 8. Find the equivalent uniform payments in years five through eight at an interest rate of 10% per year Answer: Compute the Pg in year 2 Pg--2.000* { 1-[( 1 + 0.05)/( 1 + 0. I 0)19 /(0. I 0-0.05)--9.742.04 Pg 9,742.04 in year 2 should be converted to year 4(F/P,10%,2) Py-9,742.04 (1.21)--11,787.87 Then, A-PAP. 10%,4)--11 ,78 7.87 (0.31 547)--3,7 18.72Solution

Your answer, 3718.50 is correct.

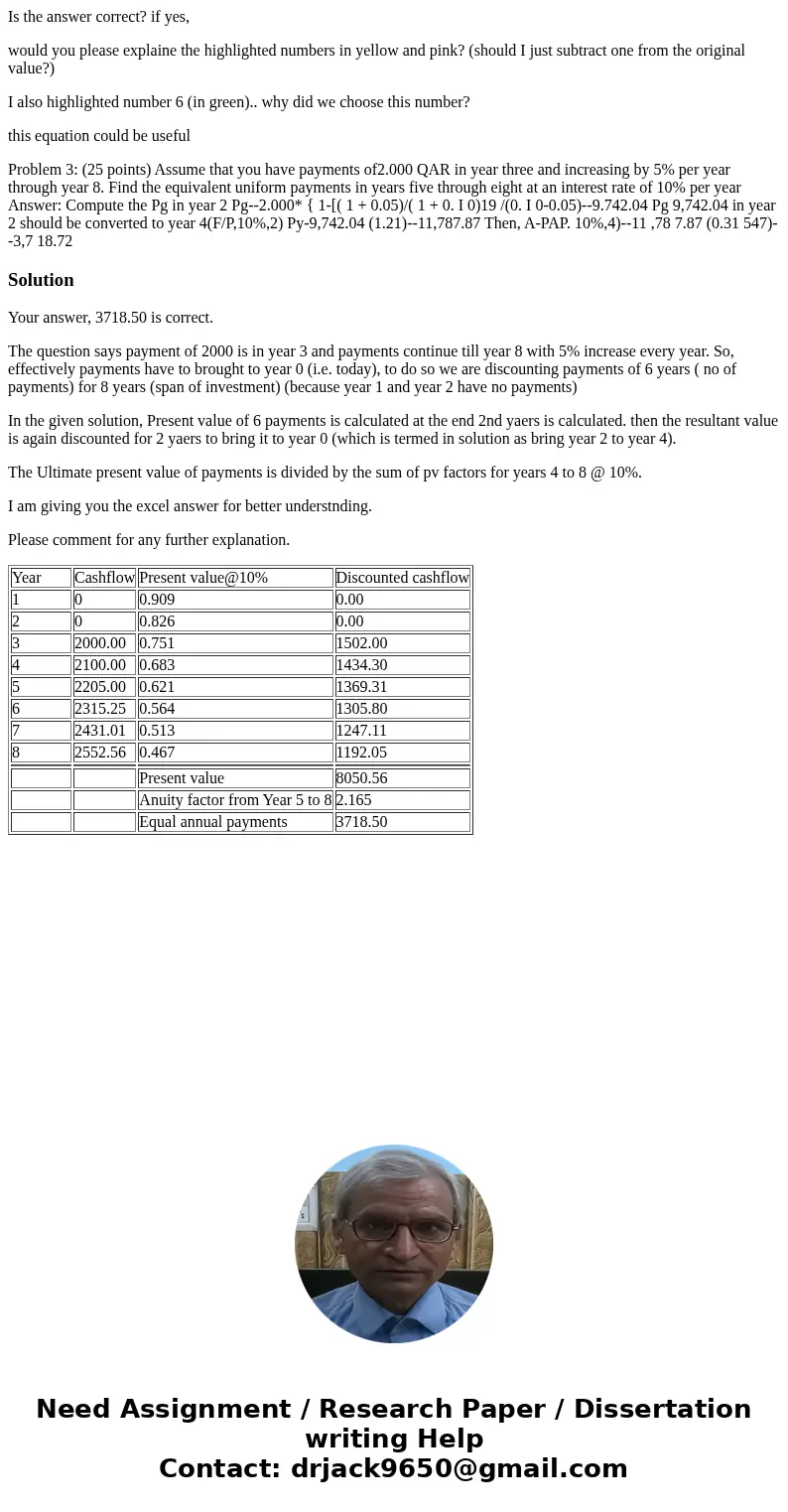

The question says payment of 2000 is in year 3 and payments continue till year 8 with 5% increase every year. So, effectively payments have to brought to year 0 (i.e. today), to do so we are discounting payments of 6 years ( no of payments) for 8 years (span of investment) (because year 1 and year 2 have no payments)

In the given solution, Present value of 6 payments is calculated at the end 2nd yaers is calculated. then the resultant value is again discounted for 2 yaers to bring it to year 0 (which is termed in solution as bring year 2 to year 4).

The Ultimate present value of payments is divided by the sum of pv factors for years 4 to 8 @ 10%.

I am giving you the excel answer for better understnding.

Please comment for any further explanation.

| Year | Cashflow | Present value@10% | Discounted cashflow |

| 1 | 0 | 0.909 | 0.00 |

| 2 | 0 | 0.826 | 0.00 |

| 3 | 2000.00 | 0.751 | 1502.00 |

| 4 | 2100.00 | 0.683 | 1434.30 |

| 5 | 2205.00 | 0.621 | 1369.31 |

| 6 | 2315.25 | 0.564 | 1305.80 |

| 7 | 2431.01 | 0.513 | 1247.11 |

| 8 | 2552.56 | 0.467 | 1192.05 |

| Present value | 8050.56 | ||

| Anuity factor from Year 5 to 8 | 2.165 | ||

| Equal annual payments | 3718.50 |

Homework Sourse

Homework Sourse