A company has a fiscal yearend of December 31 1 on October 1

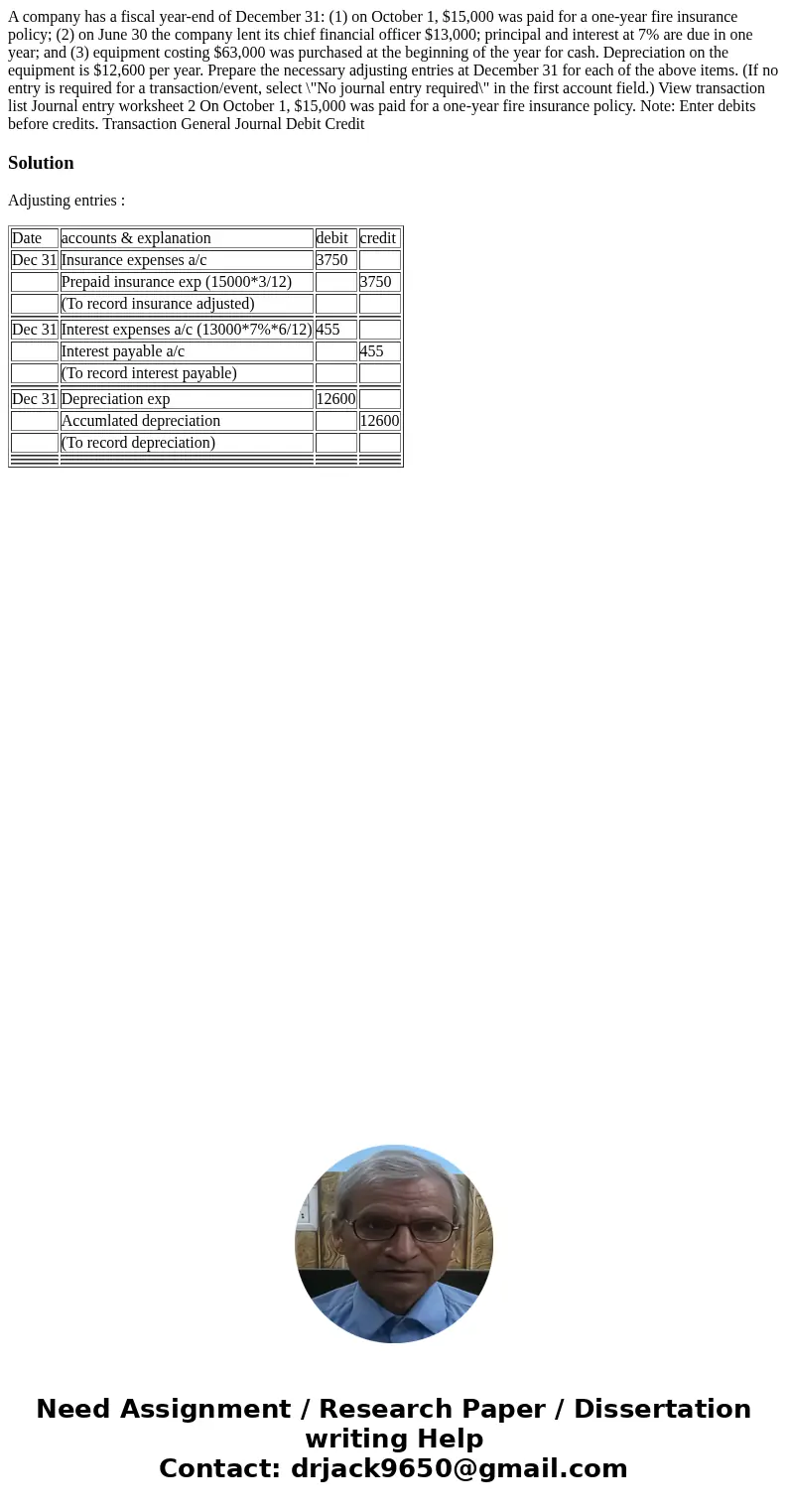

A company has a fiscal year-end of December 31: (1) on October 1, $15,000 was paid for a one-year fire insurance policy; (2) on June 30 the company lent its chief financial officer $13,000; principal and interest at 7% are due in one year; and (3) equipment costing $63,000 was purchased at the beginning of the year for cash. Depreciation on the equipment is $12,600 per year. Prepare the necessary adjusting entries at December 31 for each of the above items. (If no entry is required for a transaction/event, select \"No journal entry required\" in the first account field.) View transaction list Journal entry worksheet 2 On October 1, $15,000 was paid for a one-year fire insurance policy. Note: Enter debits before credits. Transaction General Journal Debit Credit

Solution

Adjusting entries :

| Date | accounts & explanation | debit | credit |

| Dec 31 | Insurance expenses a/c | 3750 | |

| Prepaid insurance exp (15000*3/12) | 3750 | ||

| (To record insurance adjusted) | |||

| Dec 31 | Interest expenses a/c (13000*7%*6/12) | 455 | |

| Interest payable a/c | 455 | ||

| (To record interest payable) | |||

| Dec 31 | Depreciation exp | 12600 | |

| Accumlated depreciation | 12600 | ||

| (To record depreciation) | |||

Homework Sourse

Homework Sourse