Revenue Account Title and Amount ctivity Craigs collected 15

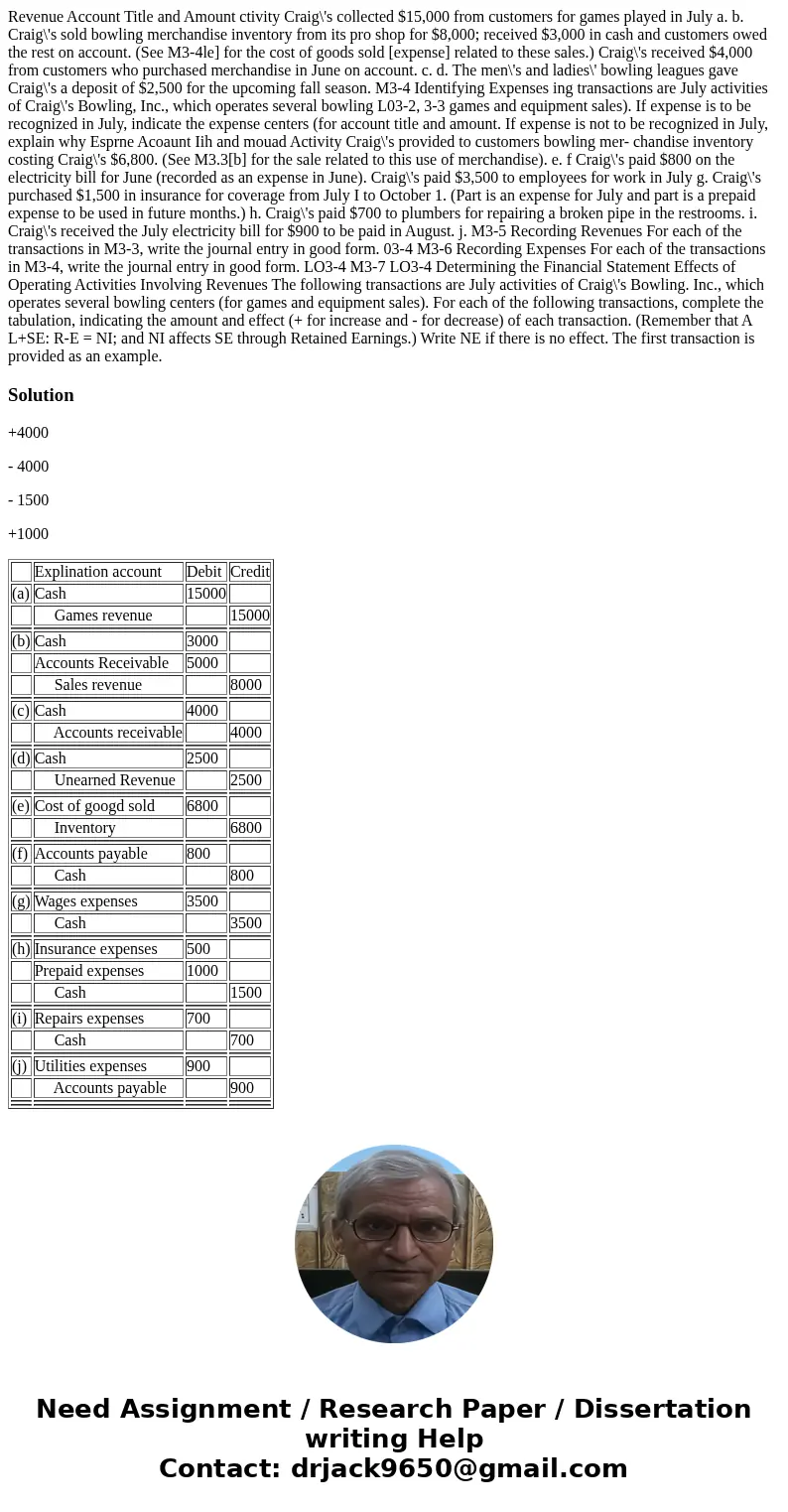

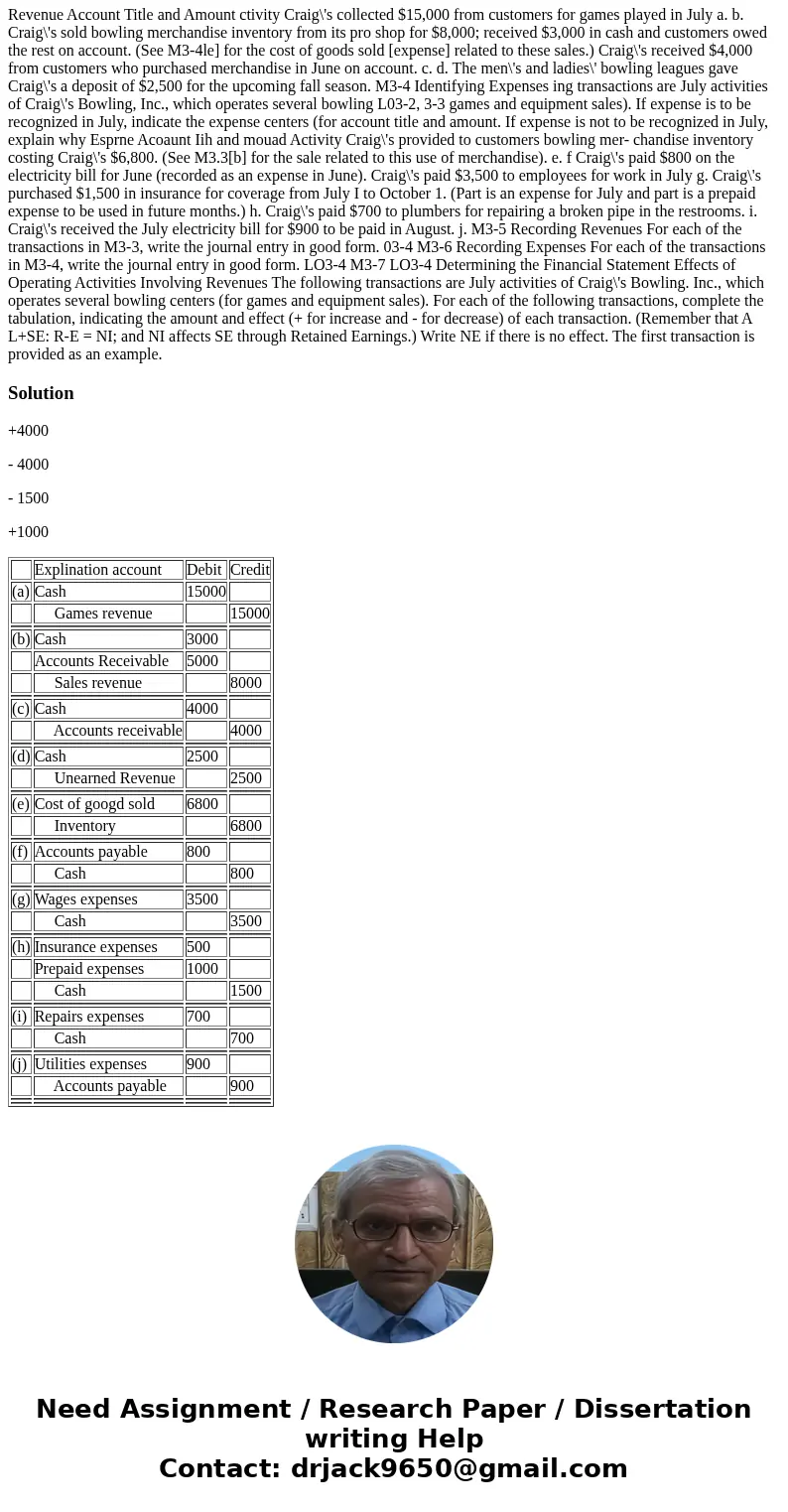

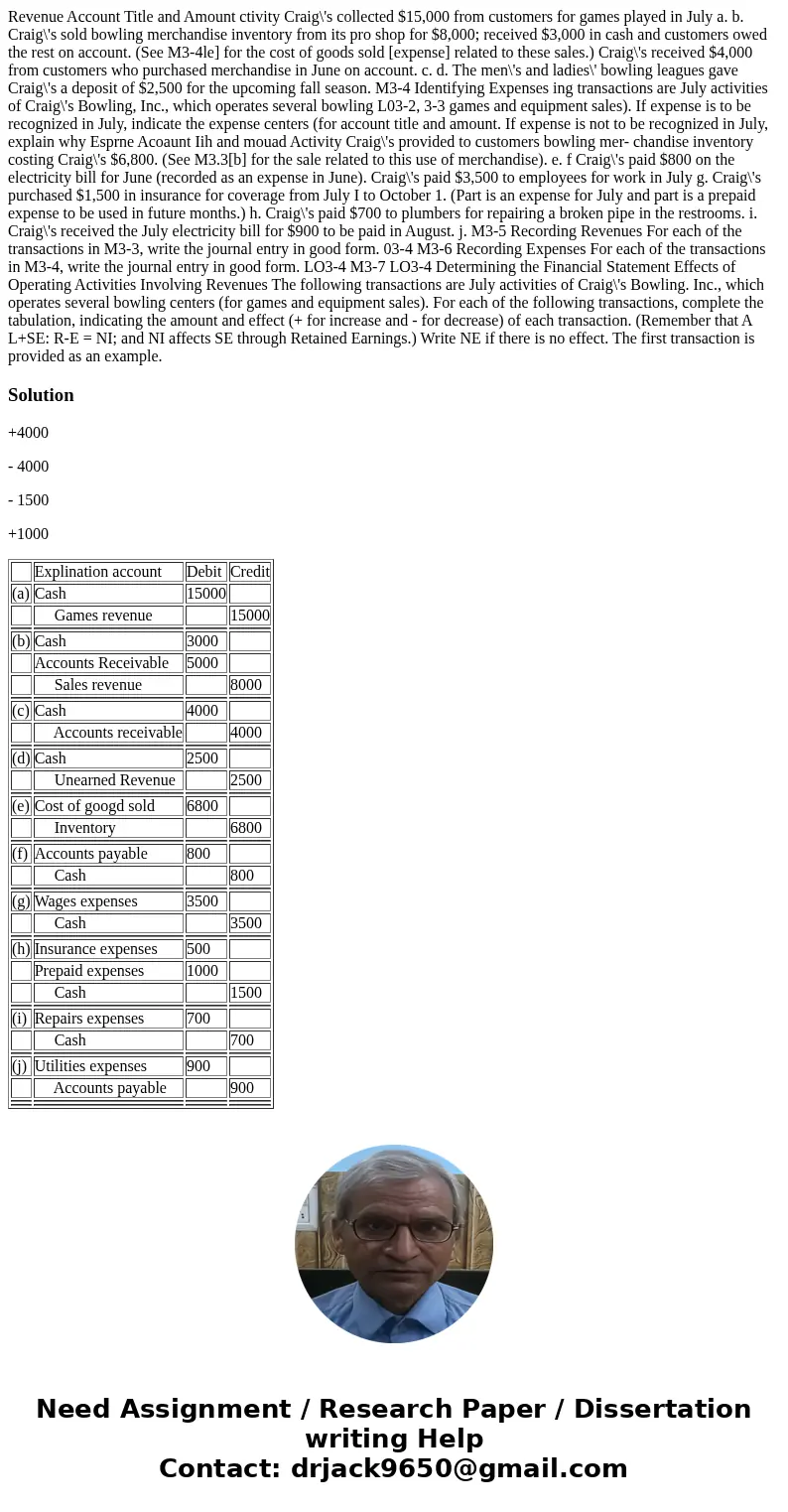

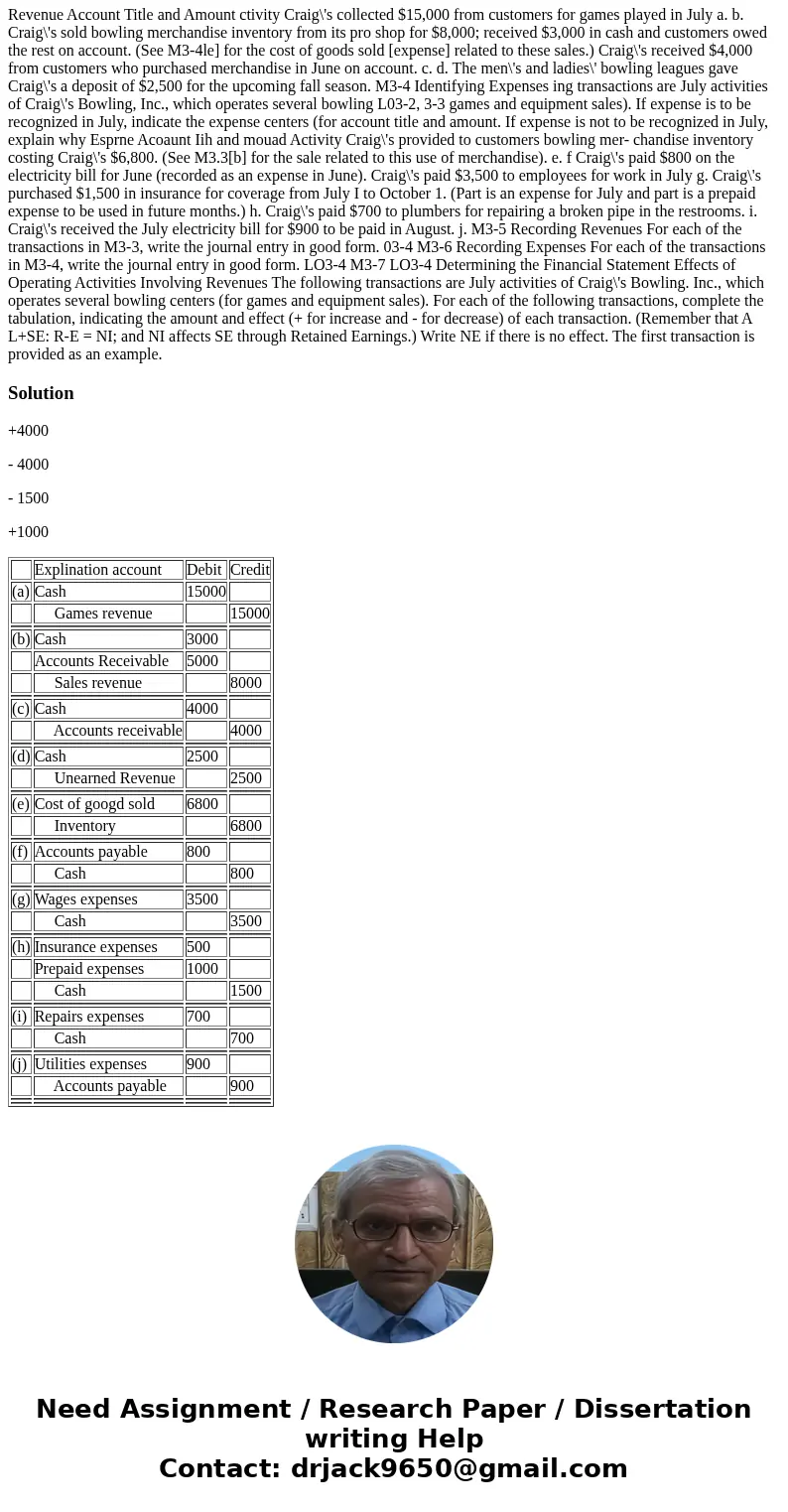

Revenue Account Title and Amount ctivity Craig\'s collected $15,000 from customers for games played in July a. b. Craig\'s sold bowling merchandise inventory from its pro shop for $8,000; received $3,000 in cash and customers owed the rest on account. (See M3-4le] for the cost of goods sold [expense] related to these sales.) Craig\'s received $4,000 from customers who purchased merchandise in June on account. c. d. The men\'s and ladies\' bowling leagues gave Craig\'s a deposit of $2,500 for the upcoming fall season. M3-4 Identifying Expenses ing transactions are July activities of Craig\'s Bowling, Inc., which operates several bowling L03-2, 3-3 games and equipment sales). If expense is to be recognized in July, indicate the expense centers (for account title and amount. If expense is not to be recognized in July, explain why Esprne Acoaunt Iih and mouad Activity Craig\'s provided to customers bowling mer- chandise inventory costing Craig\'s $6,800. (See M3.3[b] for the sale related to this use of merchandise). e. f Craig\'s paid $800 on the electricity bill for June (recorded as an expense in June). Craig\'s paid $3,500 to employees for work in July g. Craig\'s purchased $1,500 in insurance for coverage from July I to October 1. (Part is an expense for July and part is a prepaid expense to be used in future months.) h. Craig\'s paid $700 to plumbers for repairing a broken pipe in the restrooms. i. Craig\'s received the July electricity bill for $900 to be paid in August. j. M3-5 Recording Revenues For each of the transactions in M3-3, write the journal entry in good form. 03-4 M3-6 Recording Expenses For each of the transactions in M3-4, write the journal entry in good form. LO3-4 M3-7 LO3-4 Determining the Financial Statement Effects of Operating Activities Involving Revenues The following transactions are July activities of Craig\'s Bowling. Inc., which operates several bowling centers (for games and equipment sales). For each of the following transactions, complete the tabulation, indicating the amount and effect (+ for increase and - for decrease) of each transaction. (Remember that A L+SE: R-E = NI; and NI affects SE through Retained Earnings.) Write NE if there is no effect. The first transaction is provided as an example.

Solution

+4000

- 4000

- 1500

+1000

| Explination account | Debit | Credit | |

| (a) | Cash | 15000 | |

| Games revenue | 15000 | ||

| (b) | Cash | 3000 | |

| Accounts Receivable | 5000 | ||

| Sales revenue | 8000 | ||

| (c) | Cash | 4000 | |

| Accounts receivable | 4000 | ||

| (d) | Cash | 2500 | |

| Unearned Revenue | 2500 | ||

| (e) | Cost of googd sold | 6800 | |

| Inventory | 6800 | ||

| (f) | Accounts payable | 800 | |

| Cash | 800 | ||

| (g) | Wages expenses | 3500 | |

| Cash | 3500 | ||

| (h) | Insurance expenses | 500 | |

| Prepaid expenses | 1000 | ||

| Cash | 1500 | ||

| (i) | Repairs expenses | 700 | |

| Cash | 700 | ||

| (j) | Utilities expenses | 900 | |

| Accounts payable | 900 | ||

Homework Sourse

Homework Sourse