Determine the missing amounts in each of the following indep

Solution

Case A

Case B

Case C

Sales

$1,600,000

$240,000

Beginning inventory, raw material

$120,000

$60,000

$7,500

Ending inventory, raw material

$180,000

$30,000

$15,000

Purchases of raw material

$200,000

$255,000

$ 35,000

Direct material used

$140,000

$285,000

$27,500

Direct Labor

$400,000

$300,000

$62,500

Manufacturing overhead

$500,000

$450,000

$80,000

Total manufacturing costs

$1,040,000

$1,035,000

$170,000

Beginning inventory, work in process

$70,000

$60,000

$7,500

Ending inventory, work in process

$60,000

$105,000

$2,500

Cost of goods manufactured

$1,050,000

$990,000

$175,000

Beginning inventory, finished goods

$100,000

$120,000

$10,000

Cost of goods available for sale

$1,150,000

$1,100,000

$185,000

Ending inventory, finished goods

$60,000

$120,000

$12,500

Cost of goods sold

$1,090,000

$990,000

$172,500

Gross margin

$510,000

$510,000

$67,500

Selling and administrative expenses

$210,000

$225,000

$225,000

Income before taxes

300,000

$285,000

$45,000

Income tax expense

$80,000

$135,000

$17,500

Net income

$220,000

$150,000

$ 27,500

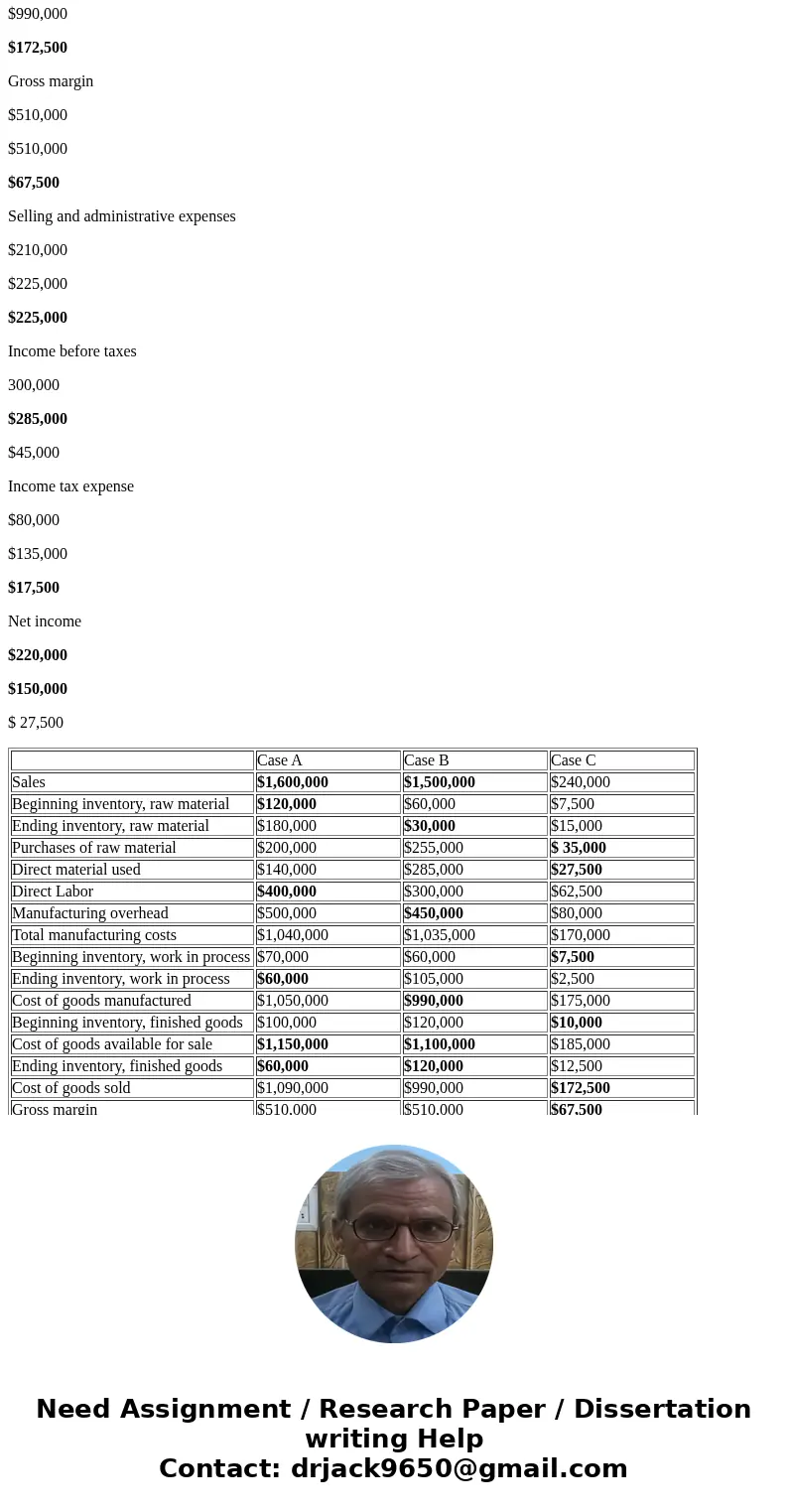

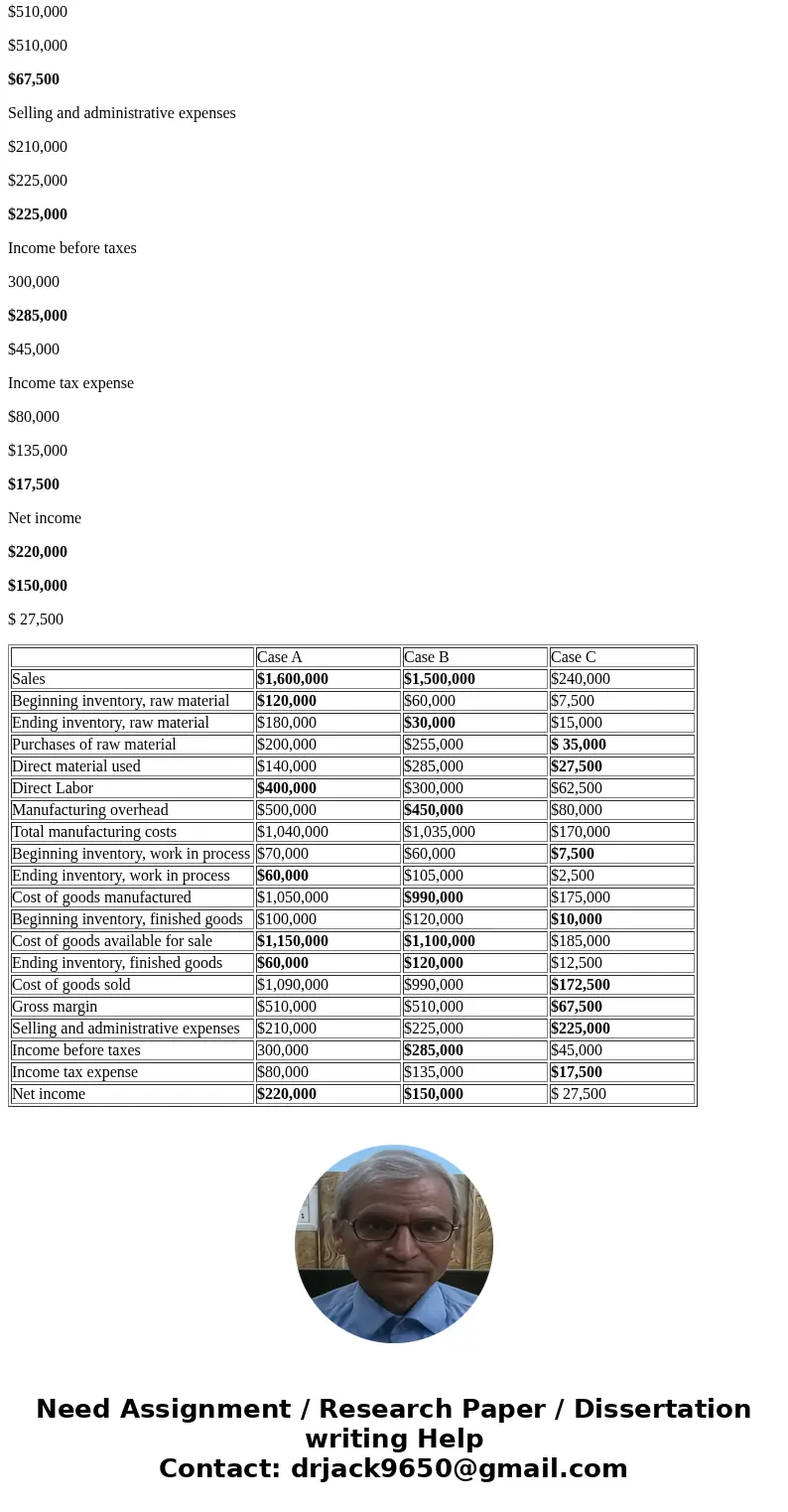

| Case A | Case B | Case C | |

| Sales | $1,600,000 | $1,500,000 | $240,000 |

| Beginning inventory, raw material | $120,000 | $60,000 | $7,500 |

| Ending inventory, raw material | $180,000 | $30,000 | $15,000 |

| Purchases of raw material | $200,000 | $255,000 | $ 35,000 |

| Direct material used | $140,000 | $285,000 | $27,500 |

| Direct Labor | $400,000 | $300,000 | $62,500 |

| Manufacturing overhead | $500,000 | $450,000 | $80,000 |

| Total manufacturing costs | $1,040,000 | $1,035,000 | $170,000 |

| Beginning inventory, work in process | $70,000 | $60,000 | $7,500 |

| Ending inventory, work in process | $60,000 | $105,000 | $2,500 |

| Cost of goods manufactured | $1,050,000 | $990,000 | $175,000 |

| Beginning inventory, finished goods | $100,000 | $120,000 | $10,000 |

| Cost of goods available for sale | $1,150,000 | $1,100,000 | $185,000 |

| Ending inventory, finished goods | $60,000 | $120,000 | $12,500 |

| Cost of goods sold | $1,090,000 | $990,000 | $172,500 |

| Gross margin | $510,000 | $510,000 | $67,500 |

| Selling and administrative expenses | $210,000 | $225,000 | $225,000 |

| Income before taxes | 300,000 | $285,000 | $45,000 |

| Income tax expense | $80,000 | $135,000 | $17,500 |

| Net income | $220,000 | $150,000 | $ 27,500 |

Homework Sourse

Homework Sourse