uestion To1S points Columbus Manufactrings stok curently sel

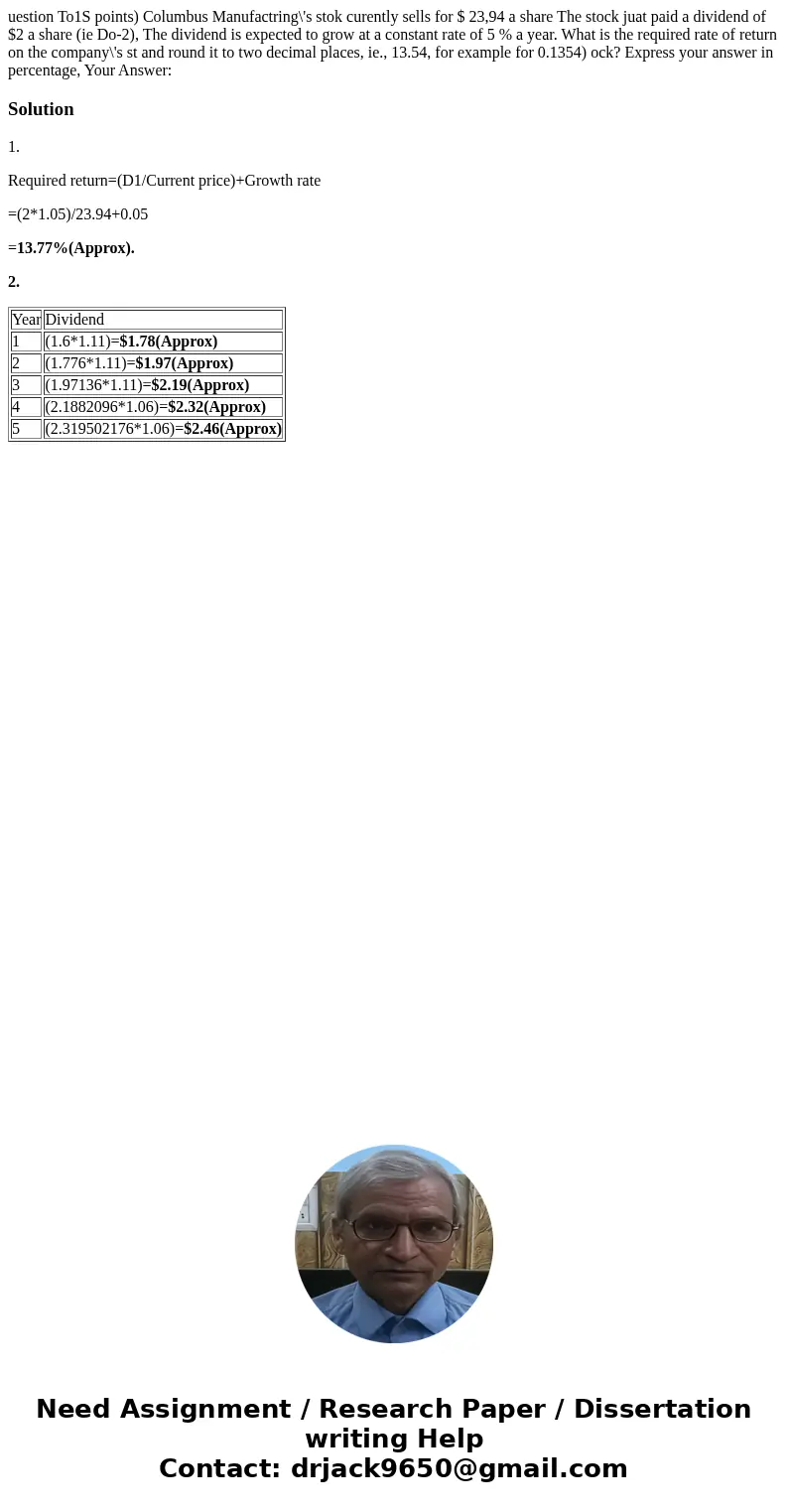

uestion To1S points) Columbus Manufactring\'s stok curently sells for $ 23,94 a share The stock juat paid a dividend of $2 a share (ie Do-2), The dividend is expected to grow at a constant rate of 5 % a year. What is the required rate of return on the company\'s st and round it to two decimal places, ie., 13.54, for example for 0.1354) ock? Express your answer in percentage, Your Answer:

Solution

1.

Required return=(D1/Current price)+Growth rate

=(2*1.05)/23.94+0.05

=13.77%(Approx).

2.

| Year | Dividend |

| 1 | (1.6*1.11)=$1.78(Approx) |

| 2 | (1.776*1.11)=$1.97(Approx) |

| 3 | (1.97136*1.11)=$2.19(Approx) |

| 4 | (2.1882096*1.06)=$2.32(Approx) |

| 5 | (2.319502176*1.06)=$2.46(Approx) |

Homework Sourse

Homework Sourse