A seller uses a perpetual inventory system and on April 4 it

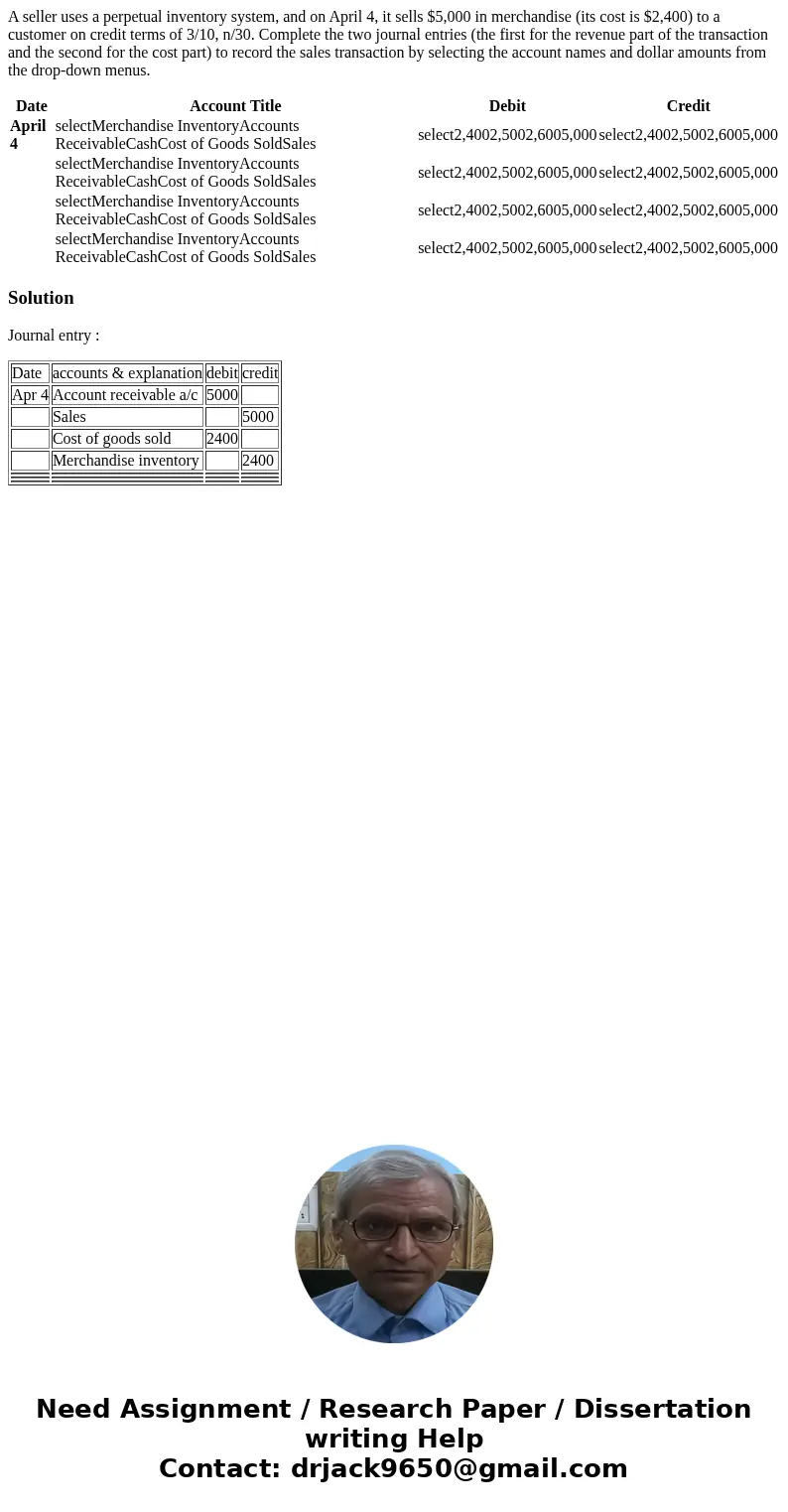

A seller uses a perpetual inventory system, and on April 4, it sells $5,000 in merchandise (its cost is $2,400) to a customer on credit terms of 3/10, n/30. Complete the two journal entries (the first for the revenue part of the transaction and the second for the cost part) to record the sales transaction by selecting the account names and dollar amounts from the drop-down menus.

| Date | Account Title | Debit | Credit |

|---|---|---|---|

| April 4 | selectMerchandise InventoryAccounts ReceivableCashCost of Goods SoldSales | select2,4002,5002,6005,000 | select2,4002,5002,6005,000 |

| selectMerchandise InventoryAccounts ReceivableCashCost of Goods SoldSales | select2,4002,5002,6005,000 | select2,4002,5002,6005,000 | |

| selectMerchandise InventoryAccounts ReceivableCashCost of Goods SoldSales | select2,4002,5002,6005,000 | select2,4002,5002,6005,000 | |

| selectMerchandise InventoryAccounts ReceivableCashCost of Goods SoldSales | select2,4002,5002,6005,000 | select2,4002,5002,6005,000 |

Solution

Journal entry :

| Date | accounts & explanation | debit | credit |

| Apr 4 | Account receivable a/c | 5000 | |

| Sales | 5000 | ||

| Cost of goods sold | 2400 | ||

| Merchandise inventory | 2400 | ||

Homework Sourse

Homework Sourse