QUESTION Albert Camera Ltd AC manufactures three types of ca

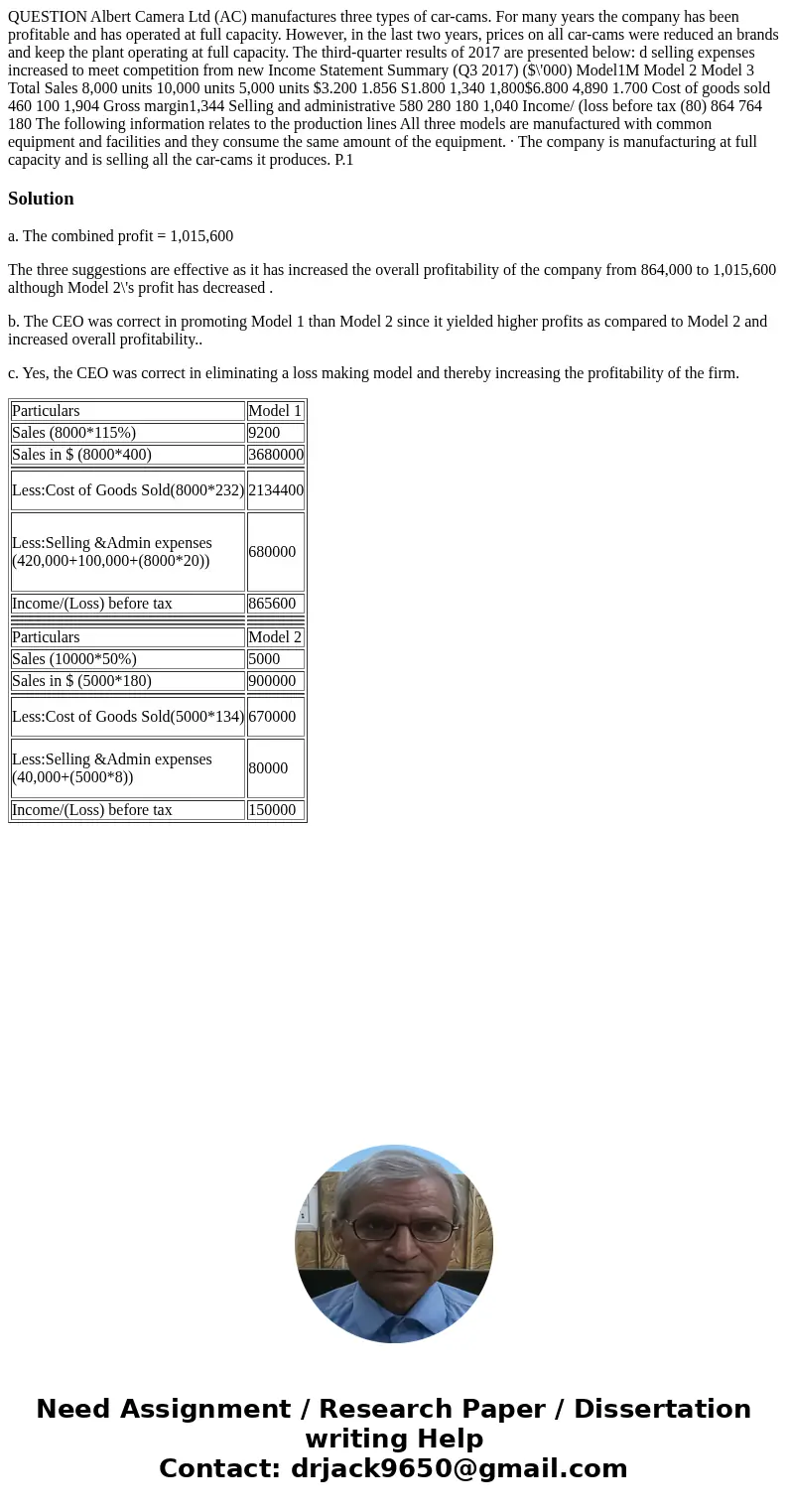

QUESTION Albert Camera Ltd (AC) manufactures three types of car-cams. For many years the company has been profitable and has operated at full capacity. However, in the last two years, prices on all car-cams were reduced an brands and keep the plant operating at full capacity. The third-quarter results of 2017 are presented below: d selling expenses increased to meet competition from new Income Statement Summary (Q3 2017) ($\'000) Model1M Model 2 Model 3 Total Sales 8,000 units 10,000 units 5,000 units $3.200 1.856 S1.800 1,340 1,800$6.800 4,890 1.700 Cost of goods sold 460 100 1,904 Gross margin1,344 Selling and administrative 580 280 180 1,040 Income/ (loss before tax (80) 864 764 180 The following information relates to the production lines All three models are manufactured with common equipment and facilities and they consume the same amount of the equipment. · The company is manufacturing at full capacity and is selling all the car-cams it produces. P.1

Solution

a. The combined profit = 1,015,600

The three suggestions are effective as it has increased the overall profitability of the company from 864,000 to 1,015,600 although Model 2\'s profit has decreased .

b. The CEO was correct in promoting Model 1 than Model 2 since it yielded higher profits as compared to Model 2 and increased overall profitability..

c. Yes, the CEO was correct in eliminating a loss making model and thereby increasing the profitability of the firm.

| Particulars | Model 1 |

| Sales (8000*115%) | 9200 |

| Sales in $ (8000*400) | 3680000 |

| Less:Cost of Goods Sold(8000*232) | 2134400 |

| Less:Selling &Admin expenses (420,000+100,000+(8000*20)) | 680000 |

| Income/(Loss) before tax | 865600 |

| Particulars | Model 2 |

| Sales (10000*50%) | 5000 |

| Sales in $ (5000*180) | 900000 |

| Less:Cost of Goods Sold(5000*134) | 670000 |

| Less:Selling &Admin expenses (40,000+(5000*8)) | 80000 |

| Income/(Loss) before tax | 150000 |

Homework Sourse

Homework Sourse