For several years Anne Schippel has been the business banker

For several years, Anne Schippel has been the business banker for the company, Dry Supply. After reviewing the company balance sheet, she makes the following observations. Three major asset accounts are on the books of Dry Supply: accounts receivable, inventory, and fixed assets. the amount of accounts receivable and inventory are characteristic of a wholesaler.

Please Review the Dry Supply Income Statement Spread and Balance Sheet Spread on the next two pages and follow the instructions below:

INSTRUCTIONS:

For each of Anne Schippel\'s observations listed below, develop questions you would ask Dry Supply in order to complete your balance sheet analysis.

Observation 1: Accounts receivable have remained in the $114,000 to $118,000 range

Observation 2: Inventory decreased during the period, while sales and accounts receivable increased.

Observation 3: fixed assets increased from $130,000 On December 31, 20 xx, to $163,000 on December 31, 20xy

Observation 4: Accounts payable showed a larger decrease than inventory. Some of the decrease is to be expected because inventory usually is financed by trade creditors.

Observation 5: Loans to shareholders has grown from $48,000 on December 31, 20xx, to $67,000 on December 31, 20xy.

Observation 6: With regard to equity, what two questions immediately come to mind?

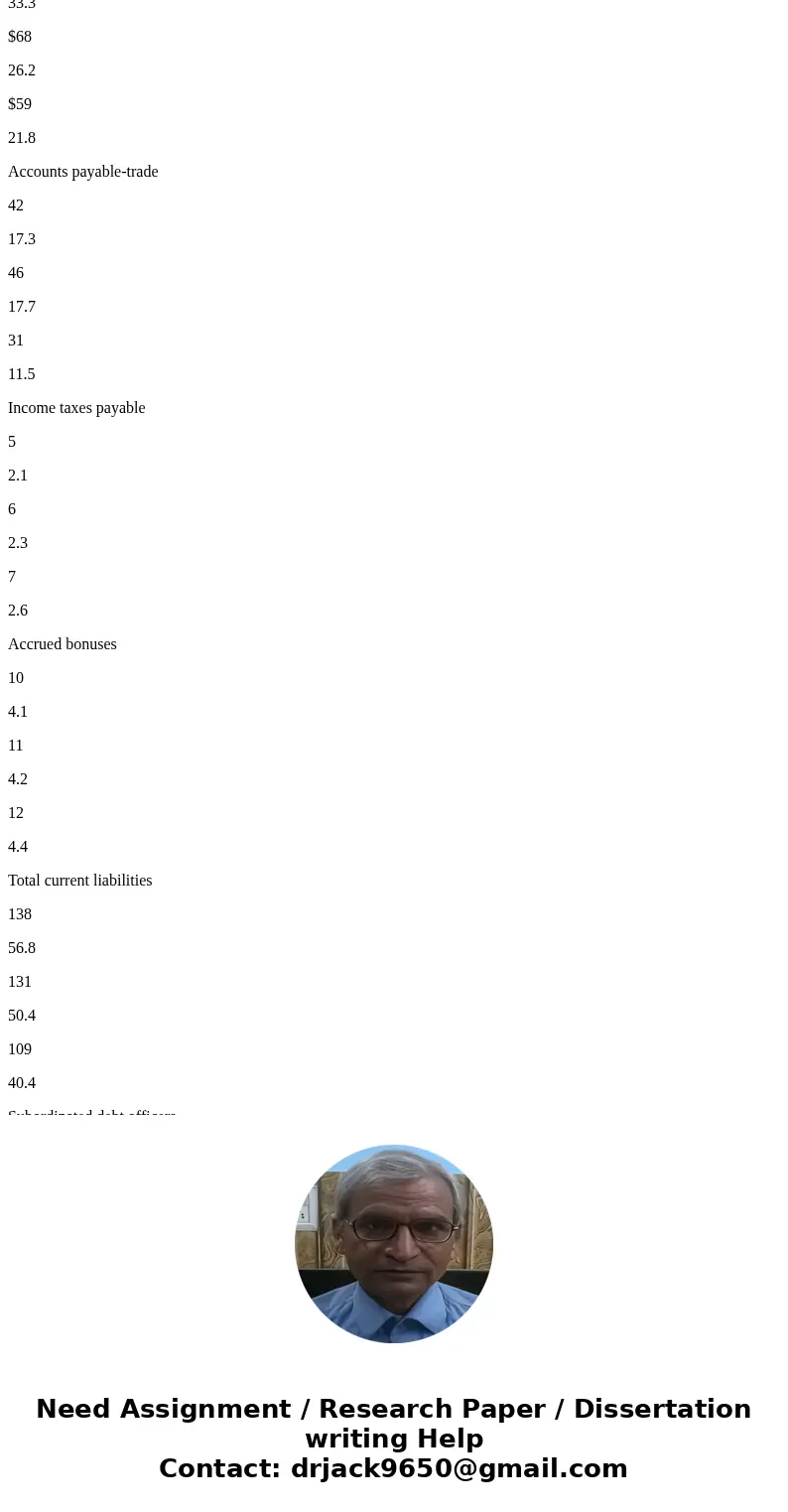

Balance Sheet Spread: DRY SUPPLY

Common-sized report

($ in $000S) Review 12/31/20xx Review 12/31/20xy Review 12/31/20xz

Assets

Amount

%

Amount

%

Amount

%

Cash

$3

1.2

$ 12

4.6

$ 22

8.1

Accounts Receivable

114

46.9

118

45.4

117

43.3

Less:Allowance for doubtful accounts

5

2.1

5

1.9

5

1.9

Net Accounts Receivable

109

44.9

113

43.5

112

41.5

Inventory

73

30

72

27.7

67

24.8

Total Current Assets

185

76.1

197

75.8

201

74.4

Furniture and fixtures

76

31.3

75

28.8

78

28.9

Leasehold Improvements

1

.4

1

.4

0

0.0

Transportation Equipment

53

218

70

26.9

85

31.5

Gross Fixed Assets

130

53.5

146

56.2

163

60.4

Less: Accum. Depreciation

85

35

97

37.3

110

40.7

Net Fixed Assets

45

18.5

49

18.8

53

19.6

Cash-Value Life Insurance

13

5.3

14

5.4

16

5.9

Total Assets

$243

100

$260

100

$270

100

Review 12/31/20xx Review 12/31/20xy Review 12/31/20xz

Liabilities

Amount

%

Amount

%

Amount

%

Notes Payable bank short- term

$81

33.3

$68

26.2

$59

21.8

Accounts payable-trade

42

17.3

46

17.7

31

11.5

Income taxes payable

5

2.1

6

2.3

7

2.6

Accrued bonuses

10

4.1

11

4.2

12

4.4

Total current liabilities

138

56.8

131

50.4

109

40.4

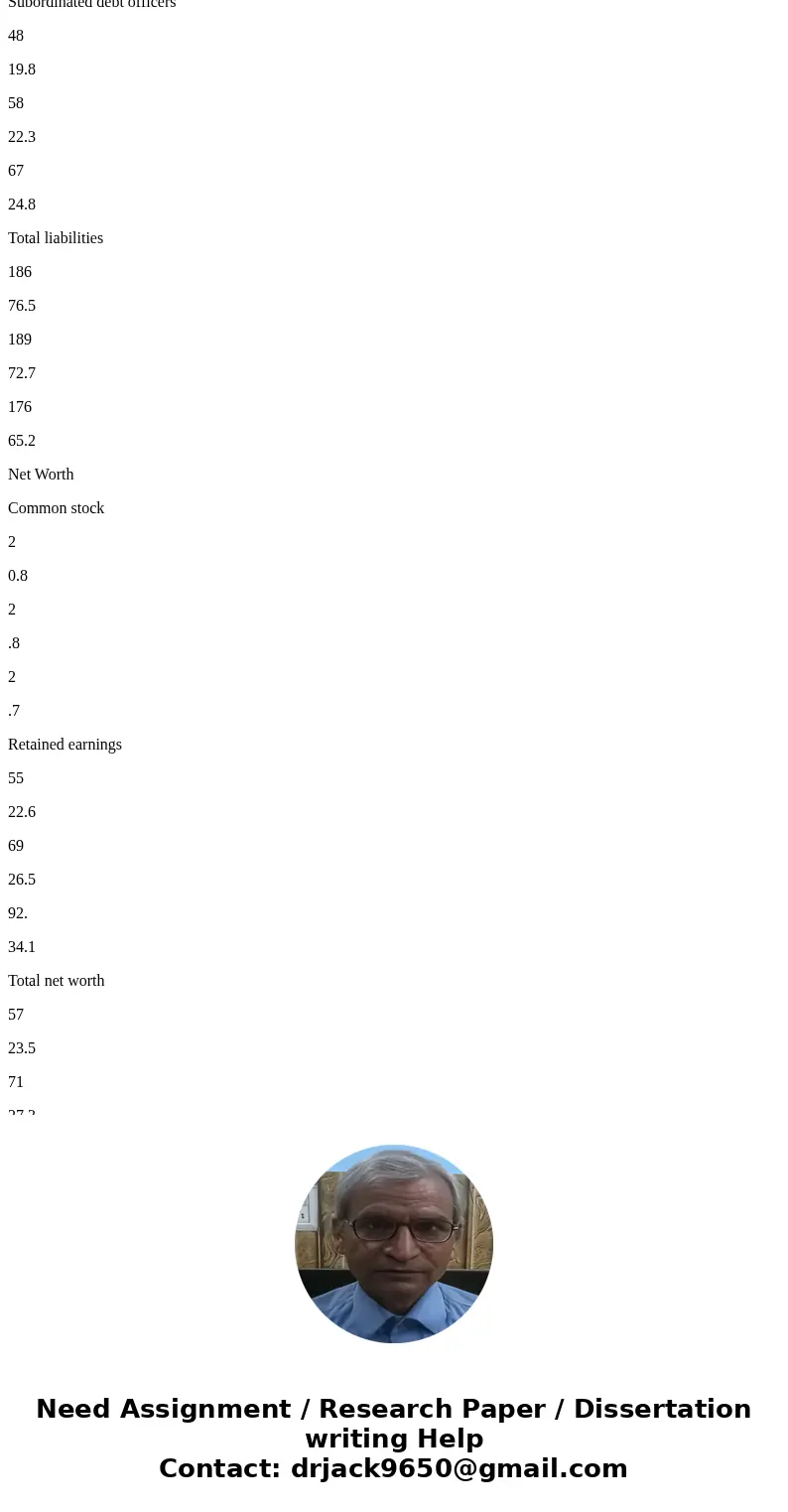

Subordinated debt officers

48

19.8

58

22.3

67

24.8

Total liabilities

186

76.5

189

72.7

176

65.2

Net Worth

Common stock

2

0.8

2

.8

2

.7

Retained earnings

55

22.6

69

26.5

92.

34.1

Total net worth

57

23.5

71

27.3

94

34.8

Total liabilities and net worth

243

100

260

100

270

100

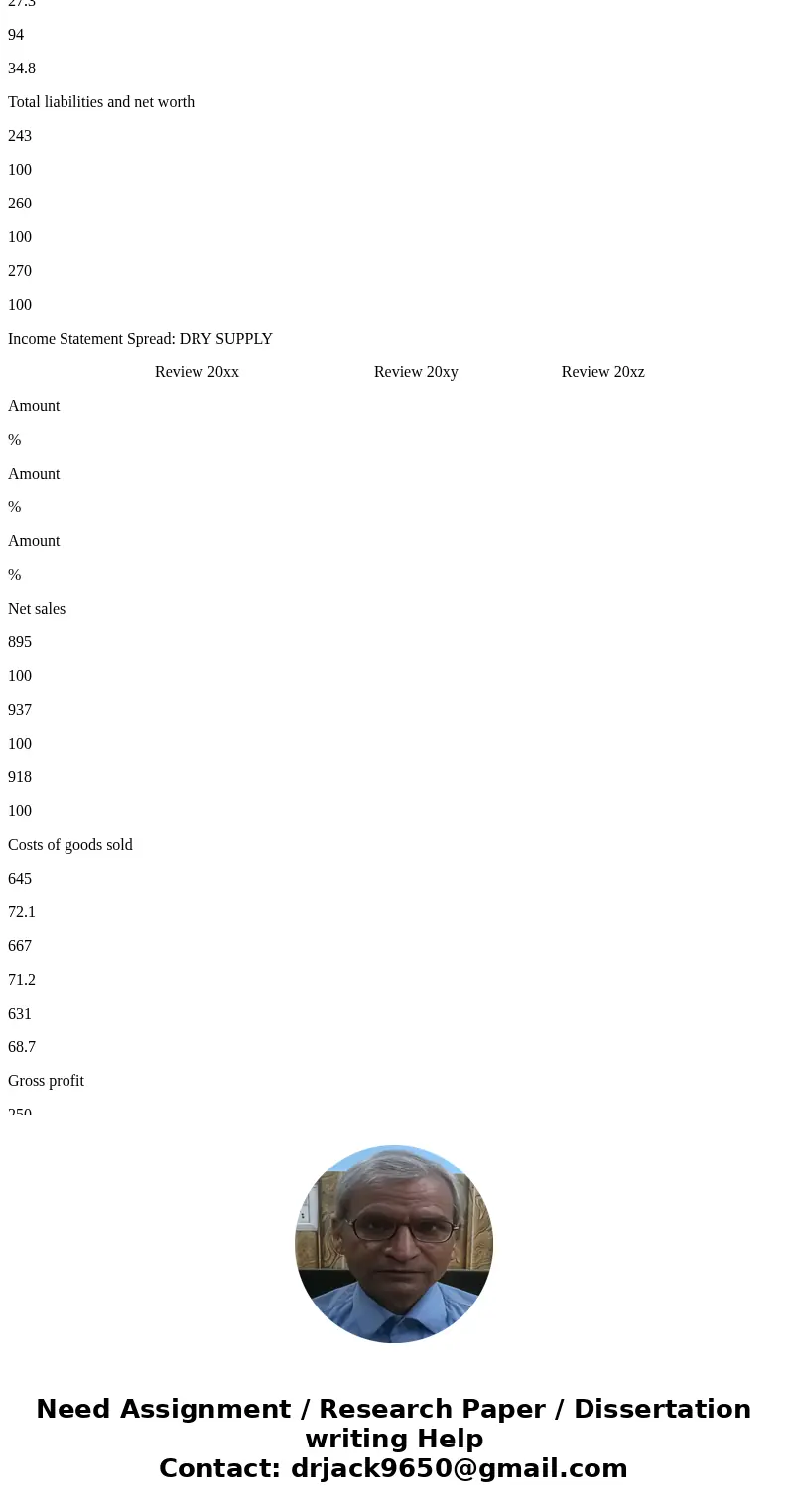

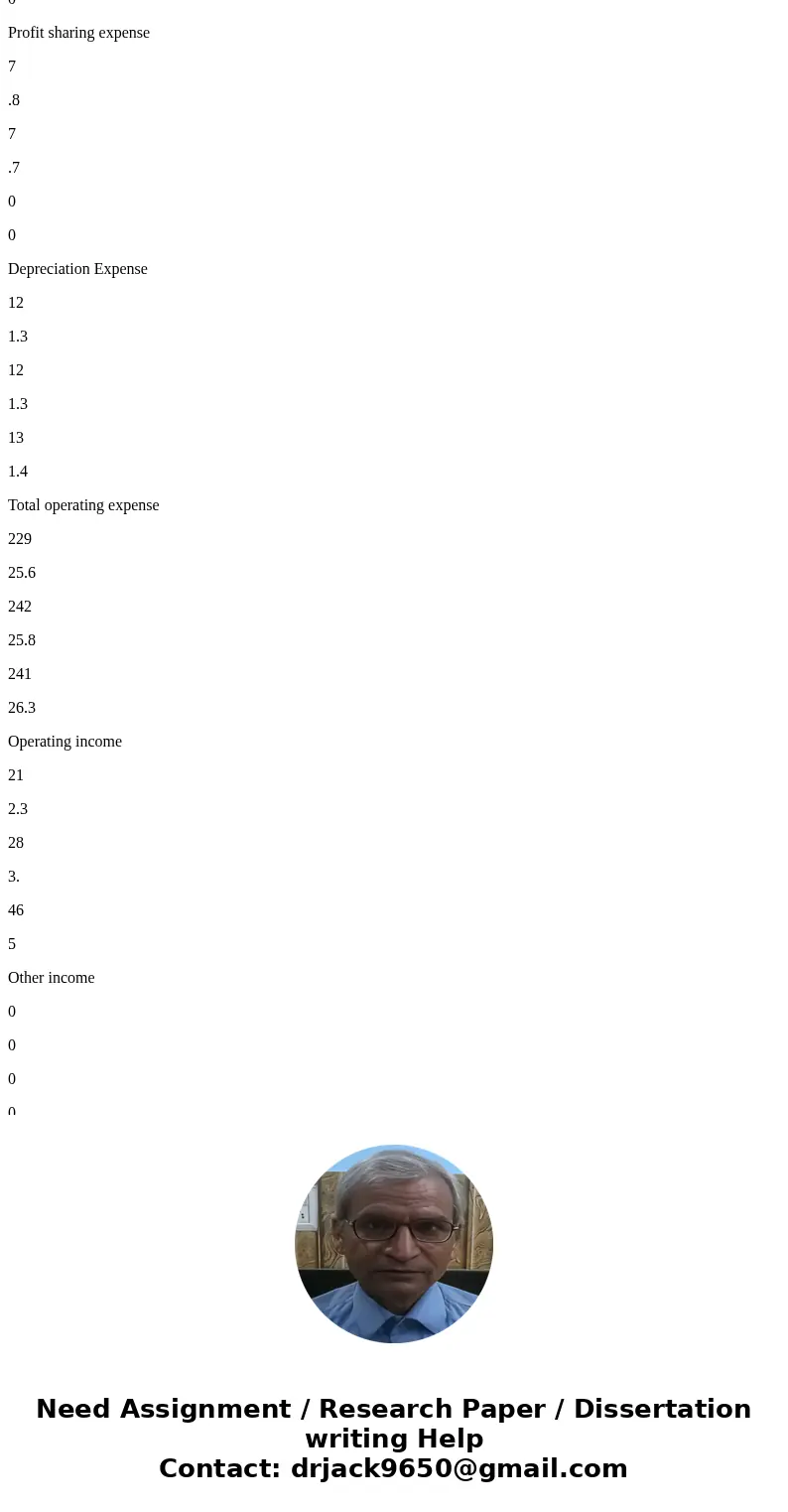

Income Statement Spread: DRY SUPPLY

Review 20xx Review 20xy Review 20xz

Amount

%

Amount

%

Amount

%

Net sales

895

100

937

100

918

100

Costs of goods sold

645

72.1

667

71.2

631

68.7

Gross profit

250

27.9

270

28.8

287

31.3

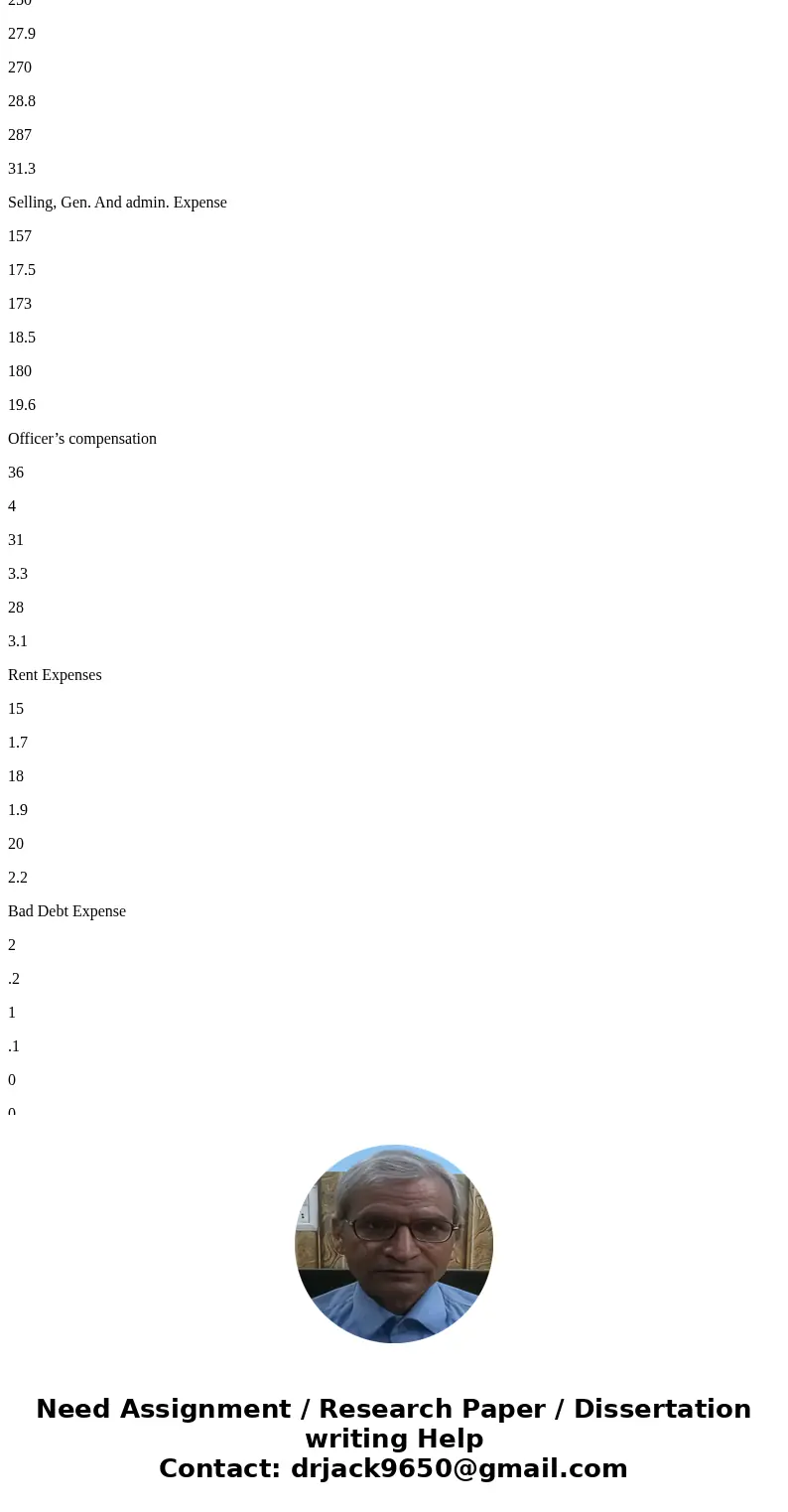

Selling, Gen. And admin. Expense

157

17.5

173

18.5

180

19.6

Officer’s compensation

36

4

31

3.3

28

3.1

Rent Expenses

15

1.7

18

1.9

20

2.2

Bad Debt Expense

2

.2

1

.1

0

0

Profit sharing expense

7

.8

7

.7

0

0

Depreciation Expense

12

1.3

12

1.3

13

1.4

Total operating expense

229

25.6

242

25.8

241

26.3

Operating income

21

2.3

28

3.

46

5

Other income

0

0

0

0

0

0

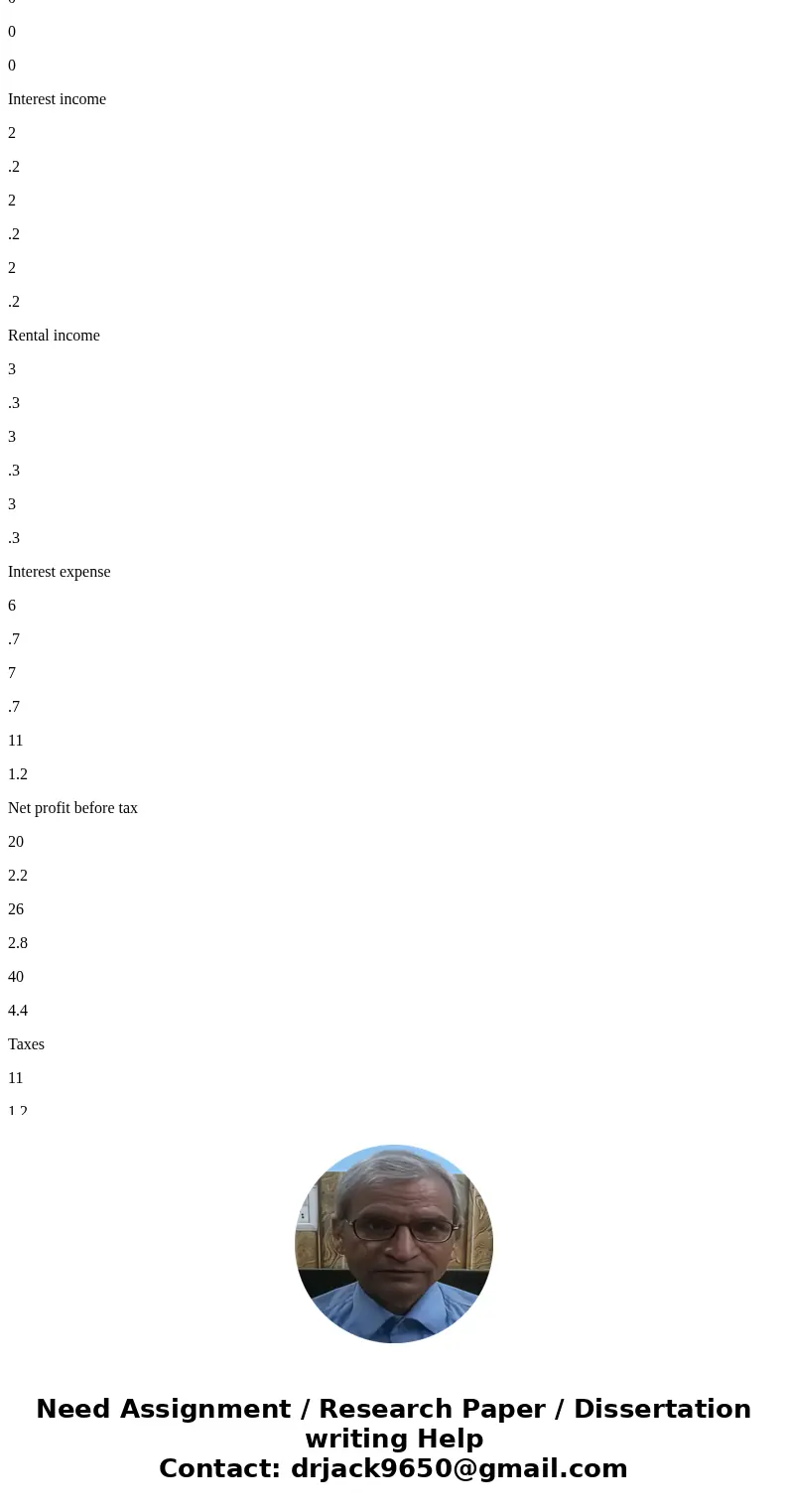

Interest income

2

.2

2

.2

2

.2

Rental income

3

.3

3

.3

3

.3

Interest expense

6

.7

7

.7

11

1.2

Net profit before tax

20

2.2

26

2.8

40

4.4

Taxes

11

1.2

12

1.3

17

1.9

Net profit after tax

9

1

14

1.5

23

2.5

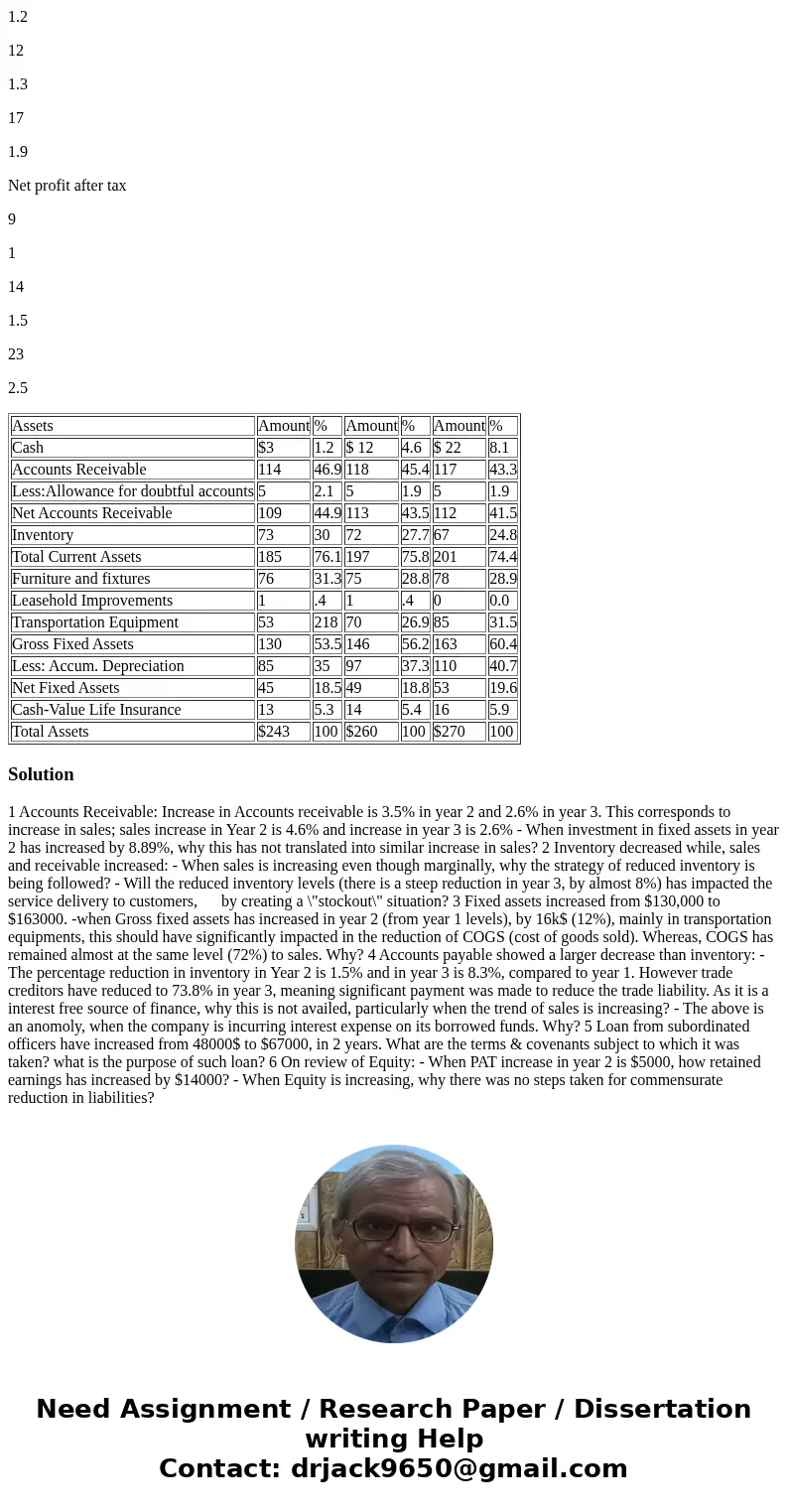

| Assets | Amount | % | Amount | % | Amount | % |

| Cash | $3 | 1.2 | $ 12 | 4.6 | $ 22 | 8.1 |

| Accounts Receivable | 114 | 46.9 | 118 | 45.4 | 117 | 43.3 |

| Less:Allowance for doubtful accounts | 5 | 2.1 | 5 | 1.9 | 5 | 1.9 |

| Net Accounts Receivable | 109 | 44.9 | 113 | 43.5 | 112 | 41.5 |

| Inventory | 73 | 30 | 72 | 27.7 | 67 | 24.8 |

| Total Current Assets | 185 | 76.1 | 197 | 75.8 | 201 | 74.4 |

| Furniture and fixtures | 76 | 31.3 | 75 | 28.8 | 78 | 28.9 |

| Leasehold Improvements | 1 | .4 | 1 | .4 | 0 | 0.0 |

| Transportation Equipment | 53 | 218 | 70 | 26.9 | 85 | 31.5 |

| Gross Fixed Assets | 130 | 53.5 | 146 | 56.2 | 163 | 60.4 |

| Less: Accum. Depreciation | 85 | 35 | 97 | 37.3 | 110 | 40.7 |

| Net Fixed Assets | 45 | 18.5 | 49 | 18.8 | 53 | 19.6 |

| Cash-Value Life Insurance | 13 | 5.3 | 14 | 5.4 | 16 | 5.9 |

| Total Assets | $243 | 100 | $260 | 100 | $270 | 100 |

Solution

1 Accounts Receivable: Increase in Accounts receivable is 3.5% in year 2 and 2.6% in year 3. This corresponds to increase in sales; sales increase in Year 2 is 4.6% and increase in year 3 is 2.6% - When investment in fixed assets in year 2 has increased by 8.89%, why this has not translated into similar increase in sales? 2 Inventory decreased while, sales and receivable increased: - When sales is increasing even though marginally, why the strategy of reduced inventory is being followed? - Will the reduced inventory levels (there is a steep reduction in year 3, by almost 8%) has impacted the service delivery to customers, by creating a \"stockout\" situation? 3 Fixed assets increased from $130,000 to $163000. -when Gross fixed assets has increased in year 2 (from year 1 levels), by 16k$ (12%), mainly in transportation equipments, this should have significantly impacted in the reduction of COGS (cost of goods sold). Whereas, COGS has remained almost at the same level (72%) to sales. Why? 4 Accounts payable showed a larger decrease than inventory: - The percentage reduction in inventory in Year 2 is 1.5% and in year 3 is 8.3%, compared to year 1. However trade creditors have reduced to 73.8% in year 3, meaning significant payment was made to reduce the trade liability. As it is a interest free source of finance, why this is not availed, particularly when the trend of sales is increasing? - The above is an anomoly, when the company is incurring interest expense on its borrowed funds. Why? 5 Loan from subordinated officers have increased from 48000$ to $67000, in 2 years. What are the terms & covenants subject to which it was taken? what is the purpose of such loan? 6 On review of Equity: - When PAT increase in year 2 is $5000, how retained earnings has increased by $14000? - When Equity is increasing, why there was no steps taken for commensurate reduction in liabilities?

Homework Sourse

Homework Sourse