You are the portfolio manager of the BOGUS Fund that contain

You are the portfolio manager of the BOGUS Fund, that contains the below listed stocks. The required rate of return on the market is 9.00% and the risk-free rate is 3.2%. Stock Amount Beta Appel $1,500,000 1.20 Bakre 1,000,000 0.50 Chiner 750,000 1.40 Dufus 50,000 0.75 What rate of return should investors require on this fund? 9.15% 11.38% 10.83% 10.56%

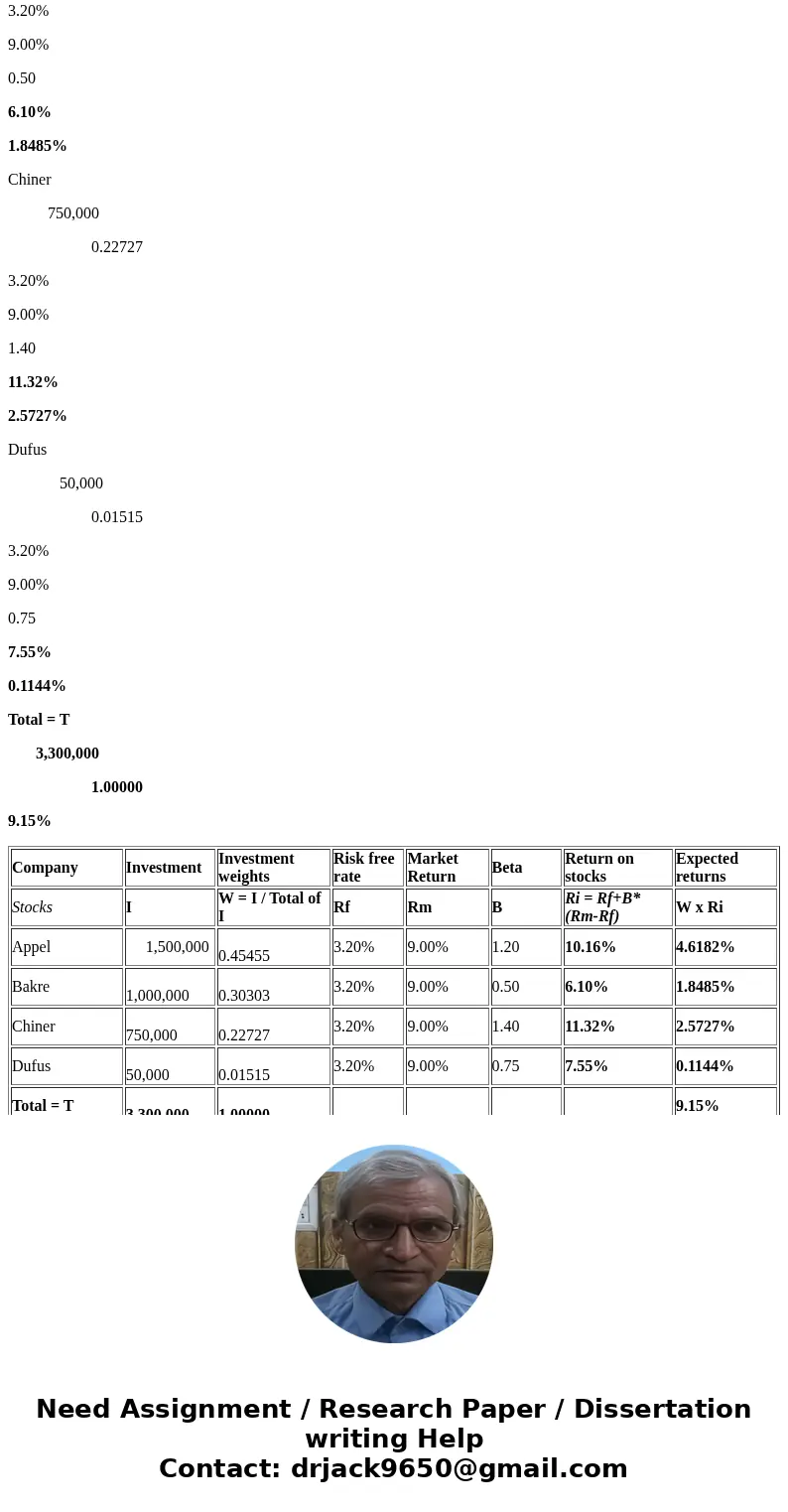

Solution

Correct option is > 9.15%

Company

Investment

Investment weights

Risk free rate

Market Return

Beta

Return on stocks

Expected returns

Stocks

I

W = I / Total of I

Rf

Rm

B

Ri = Rf+B*(Rm-Rf)

W x Ri

Appel

1,500,000

0.45455

3.20%

9.00%

1.20

10.16%

4.6182%

Bakre

1,000,000

0.30303

3.20%

9.00%

0.50

6.10%

1.8485%

Chiner

750,000

0.22727

3.20%

9.00%

1.40

11.32%

2.5727%

Dufus

50,000

0.01515

3.20%

9.00%

0.75

7.55%

0.1144%

Total = T

3,300,000

1.00000

9.15%

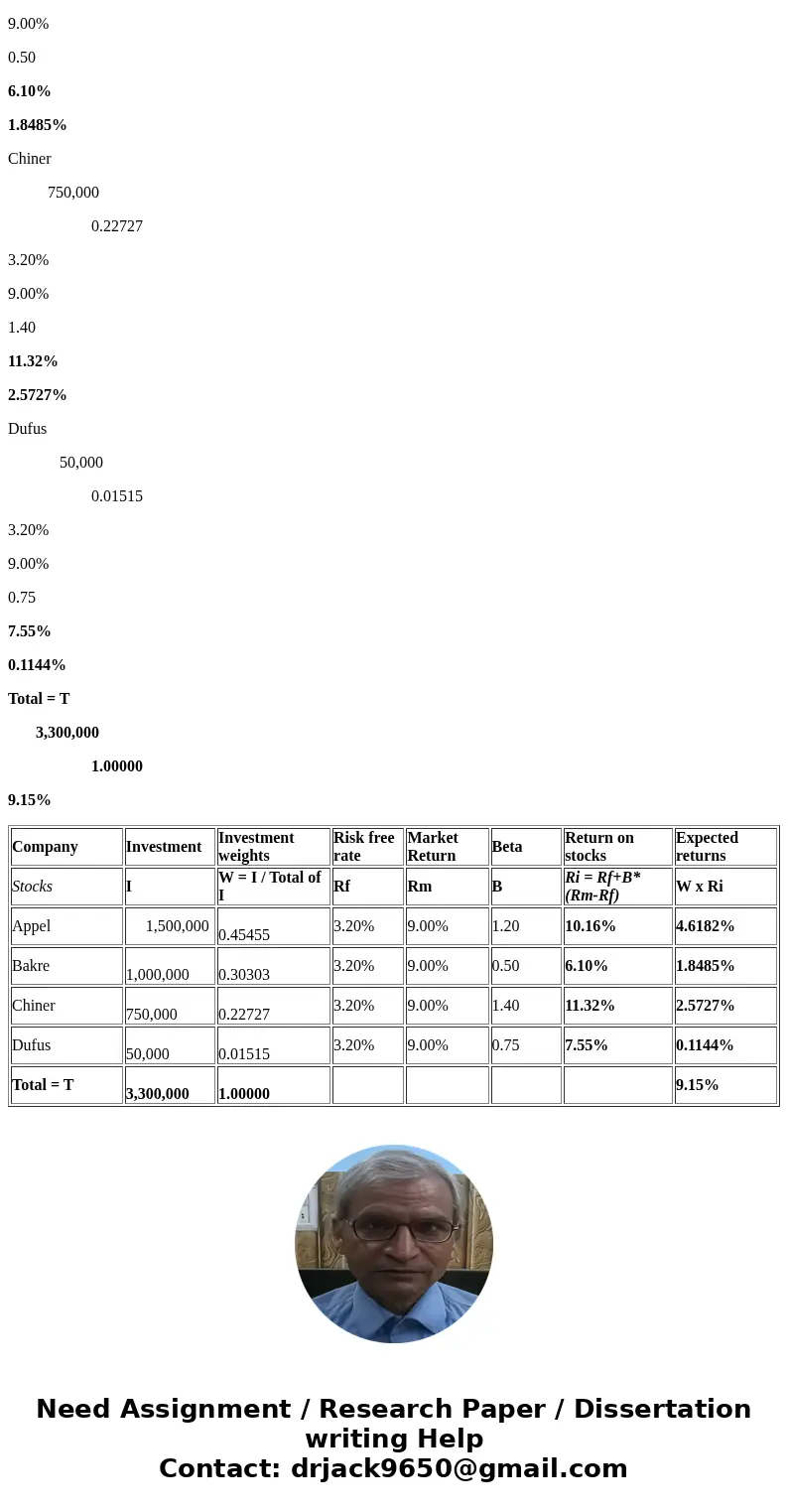

| Company | Investment | Investment weights | Risk free rate | Market Return | Beta | Return on stocks | Expected returns |

| Stocks | I | W = I / Total of I | Rf | Rm | B | Ri = Rf+B*(Rm-Rf) | W x Ri |

| Appel | 1,500,000 | 0.45455 | 3.20% | 9.00% | 1.20 | 10.16% | 4.6182% |

| Bakre | 1,000,000 | 0.30303 | 3.20% | 9.00% | 0.50 | 6.10% | 1.8485% |

| Chiner | 750,000 | 0.22727 | 3.20% | 9.00% | 1.40 | 11.32% | 2.5727% |

| Dufus | 50,000 | 0.01515 | 3.20% | 9.00% | 0.75 | 7.55% | 0.1144% |

| Total = T | 3,300,000 | 1.00000 | 9.15% |

Homework Sourse

Homework Sourse