Journalize a series of transactions LO 12 Grandview Park was

Solution

Answer

Date

Particulars

Dr. $

Cr. $

April 1

Cash

50,000

Common Stock

50,000

(Being Shares Issued)

4

Land

34,000

Cash

34,000

(Being Land Purchased for cash)

8

Advertising Expense

1,800

Accounts payable

1,800

(Being Advertisement expense incurred on account)

11

Salaries and Wages Expense

1,500

Cash

1,500

(Being Salaries paid in cash)

12

NO ENTRY

(As the manager is hired and will join next month. There is no entry for hiring an employee)

13

Prepaid Insurance

2,400

Cash

2,400

(Being Insurance paid in advance)

17

Dividends

1,400

Cash

1,400

(Being dividend declared and paid)

20

Cash

5,700

Service Revenue

5,700

(Being admission fees received in cash)

25

Cash (100 Coupons * $30 each)

3,000

Unearned Service Revenue

3,000

(Being coupons sold in cash)

30

Cash

8,900

Service Revenue

8,900

(Being admission fees received in cash)

30

Accounts Payable

840

Cash

840

(Being cash paid to accounts payable)

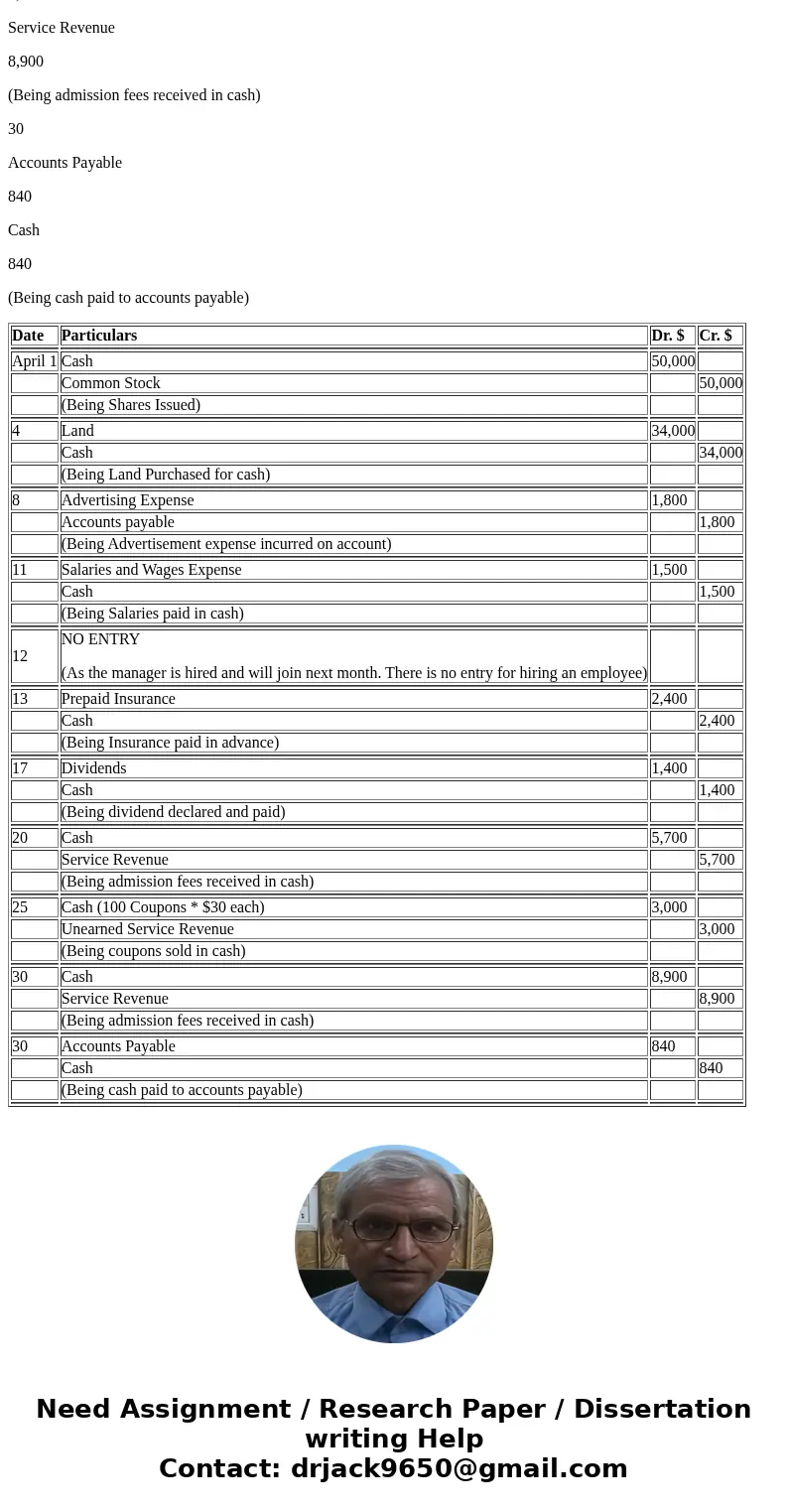

| Date | Particulars | Dr. $ | Cr. $ |

| April 1 | Cash | 50,000 | |

| Common Stock | 50,000 | ||

| (Being Shares Issued) | |||

| 4 | Land | 34,000 | |

| Cash | 34,000 | ||

| (Being Land Purchased for cash) | |||

| 8 | Advertising Expense | 1,800 | |

| Accounts payable | 1,800 | ||

| (Being Advertisement expense incurred on account) | |||

| 11 | Salaries and Wages Expense | 1,500 | |

| Cash | 1,500 | ||

| (Being Salaries paid in cash) | |||

| 12 | NO ENTRY (As the manager is hired and will join next month. There is no entry for hiring an employee) | ||

| 13 | Prepaid Insurance | 2,400 | |

| Cash | 2,400 | ||

| (Being Insurance paid in advance) | |||

| 17 | Dividends | 1,400 | |

| Cash | 1,400 | ||

| (Being dividend declared and paid) | |||

| 20 | Cash | 5,700 | |

| Service Revenue | 5,700 | ||

| (Being admission fees received in cash) | |||

| 25 | Cash (100 Coupons * $30 each) | 3,000 | |

| Unearned Service Revenue | 3,000 | ||

| (Being coupons sold in cash) | |||

| 30 | Cash | 8,900 | |

| Service Revenue | 8,900 | ||

| (Being admission fees received in cash) | |||

| 30 | Accounts Payable | 840 | |

| Cash | 840 | ||

| (Being cash paid to accounts payable) | |||

Homework Sourse

Homework Sourse