On 1116 Alpha Company purchased 2500 of the 10000 shares of

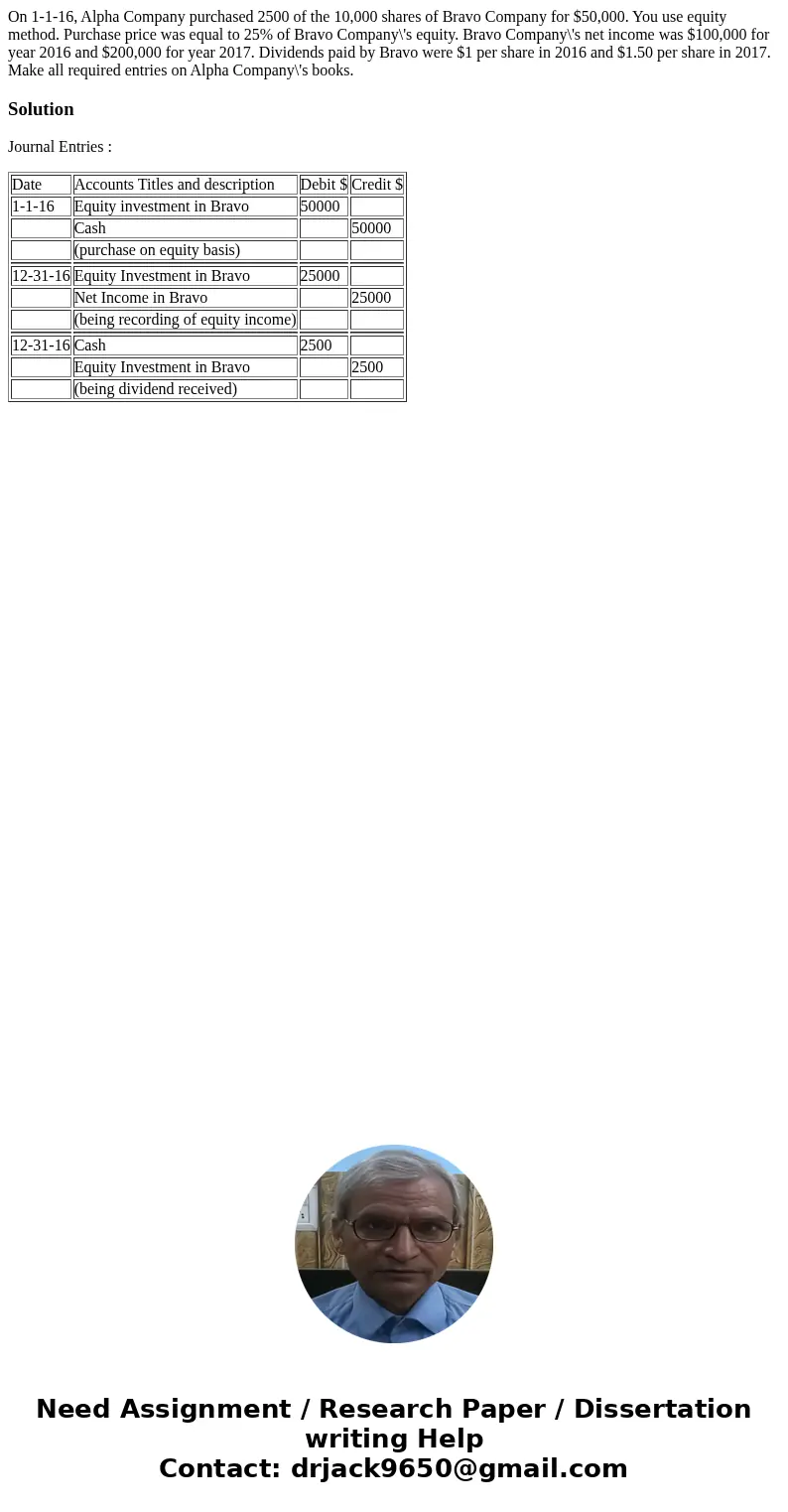

On 1-1-16, Alpha Company purchased 2500 of the 10,000 shares of Bravo Company for $50,000. You use equity method. Purchase price was equal to 25% of Bravo Company\'s equity. Bravo Company\'s net income was $100,000 for year 2016 and $200,000 for year 2017. Dividends paid by Bravo were $1 per share in 2016 and $1.50 per share in 2017. Make all required entries on Alpha Company\'s books.

Solution

Journal Entries :

| Date | Accounts Titles and description | Debit $ | Credit $ |

| 1-1-16 | Equity investment in Bravo | 50000 | |

| Cash | 50000 | ||

| (purchase on equity basis) | |||

| 12-31-16 | Equity Investment in Bravo | 25000 | |

| Net Income in Bravo | 25000 | ||

| (being recording of equity income) | |||

| 12-31-16 | Cash | 2500 | |

| Equity Investment in Bravo | 2500 | ||

| (being dividend received) |

Homework Sourse

Homework Sourse