ACCOUNTING CYCLE PROBLEM 6 Help Save Exi Submit Problem 36A

ACCOUNTING CYCLE PROBLEM 6 Help Save& Exi Submit Problem 3-6A Applying the accounting cycle LO P1, P2, P3, P4, P5 On April 1, 2017, Jiro Nozomi created a new travel agency. Adventure Travel. The following transactions occurred during the company\'s April 1 Nozomi invested $38,860 cash and computer equipment worth $25,000 in the company in exchange for common stock points 2 The company rented furnished office space by paying $2,100 cash for the fiest month\'s (April) rent. 3 The conpany purchased $1,960 of office supplies for cash 1e The company paid $2,900 cash for the premtus on a 12-month insurance policy. Coverage begins on Apr11 11. 24 The company collected $12,500 28 The company paid $1,400 cash for two weeks\" salaries earned by emplayees. 30 The company paid $1,200 cash for this month\'s telephone b11 ts obtained for customer. 30 The company pald $2,300 cash in dividends. The company\'s chart of accounts follows 101 Casth 106 Accounts Receivable 124 office Supplies tqulp 622 Salarles Expense 637 Insurance Expense 640 Rent Expense 6s0 office Supplies Expense 684 Repairs Expense 688 Telephone Expense 01 Incone Sumnary 18 Retained arnngs 319 Dividends Type here to search

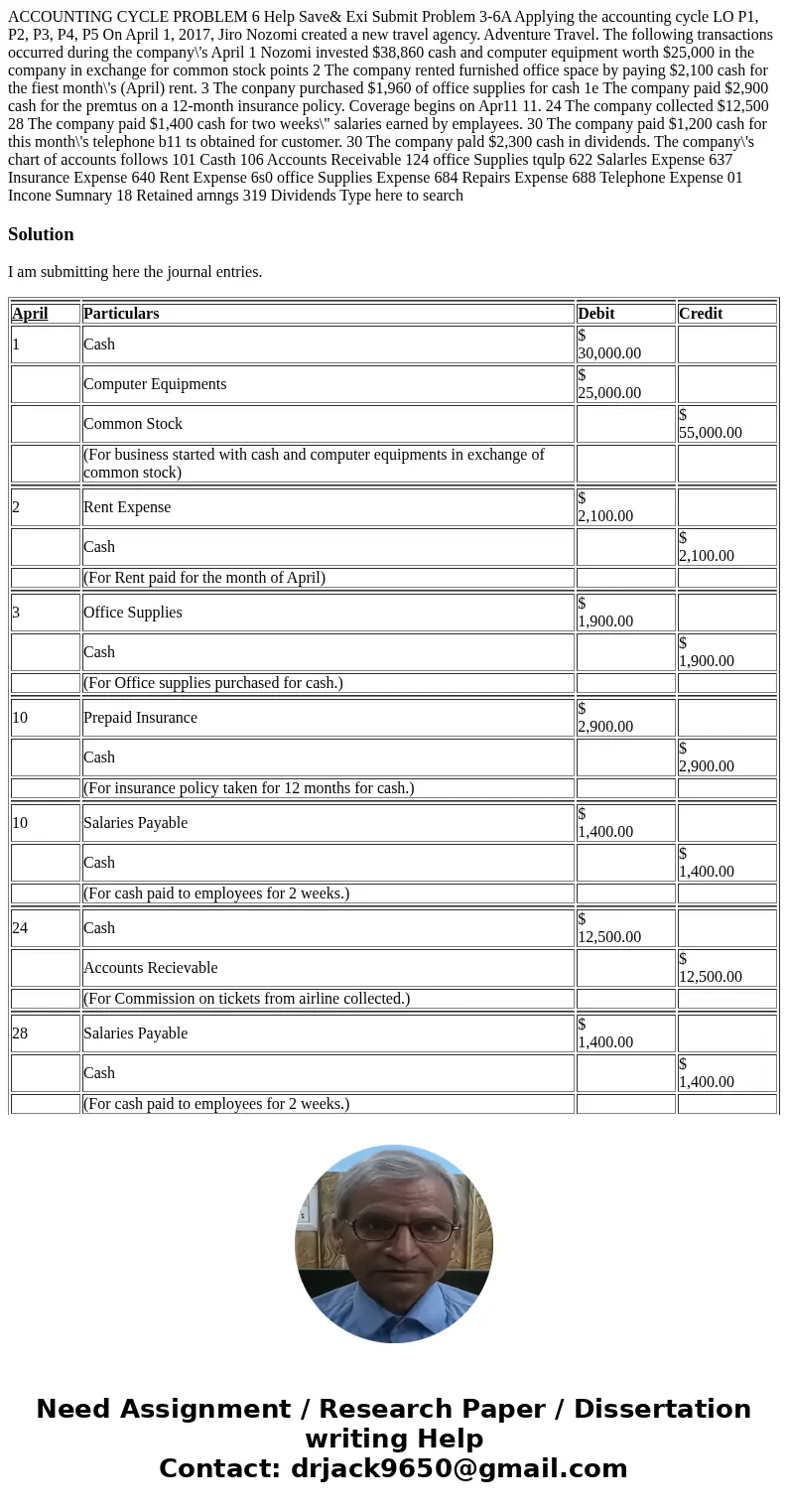

Solution

I am submitting here the journal entries.

| April | Particulars | Debit | Credit |

| 1 | Cash | $ 30,000.00 | |

| Computer Equipments | $ 25,000.00 | ||

| Common Stock | $ 55,000.00 | ||

| (For business started with cash and computer equipments in exchange of common stock) | |||

| 2 | Rent Expense | $ 2,100.00 | |

| Cash | $ 2,100.00 | ||

| (For Rent paid for the month of April) | |||

| 3 | Office Supplies | $ 1,900.00 | |

| Cash | $ 1,900.00 | ||

| (For Office supplies purchased for cash.) | |||

| 10 | Prepaid Insurance | $ 2,900.00 | |

| Cash | $ 2,900.00 | ||

| (For insurance policy taken for 12 months for cash.) | |||

| 10 | Salaries Payable | $ 1,400.00 | |

| Cash | $ 1,400.00 | ||

| (For cash paid to employees for 2 weeks.) | |||

| 24 | Cash | $ 12,500.00 | |

| Accounts Recievable | $ 12,500.00 | ||

| (For Commission on tickets from airline collected.) | |||

| 28 | Salaries Payable | $ 1,400.00 | |

| Cash | $ 1,400.00 | ||

| (For cash paid to employees for 2 weeks.) | |||

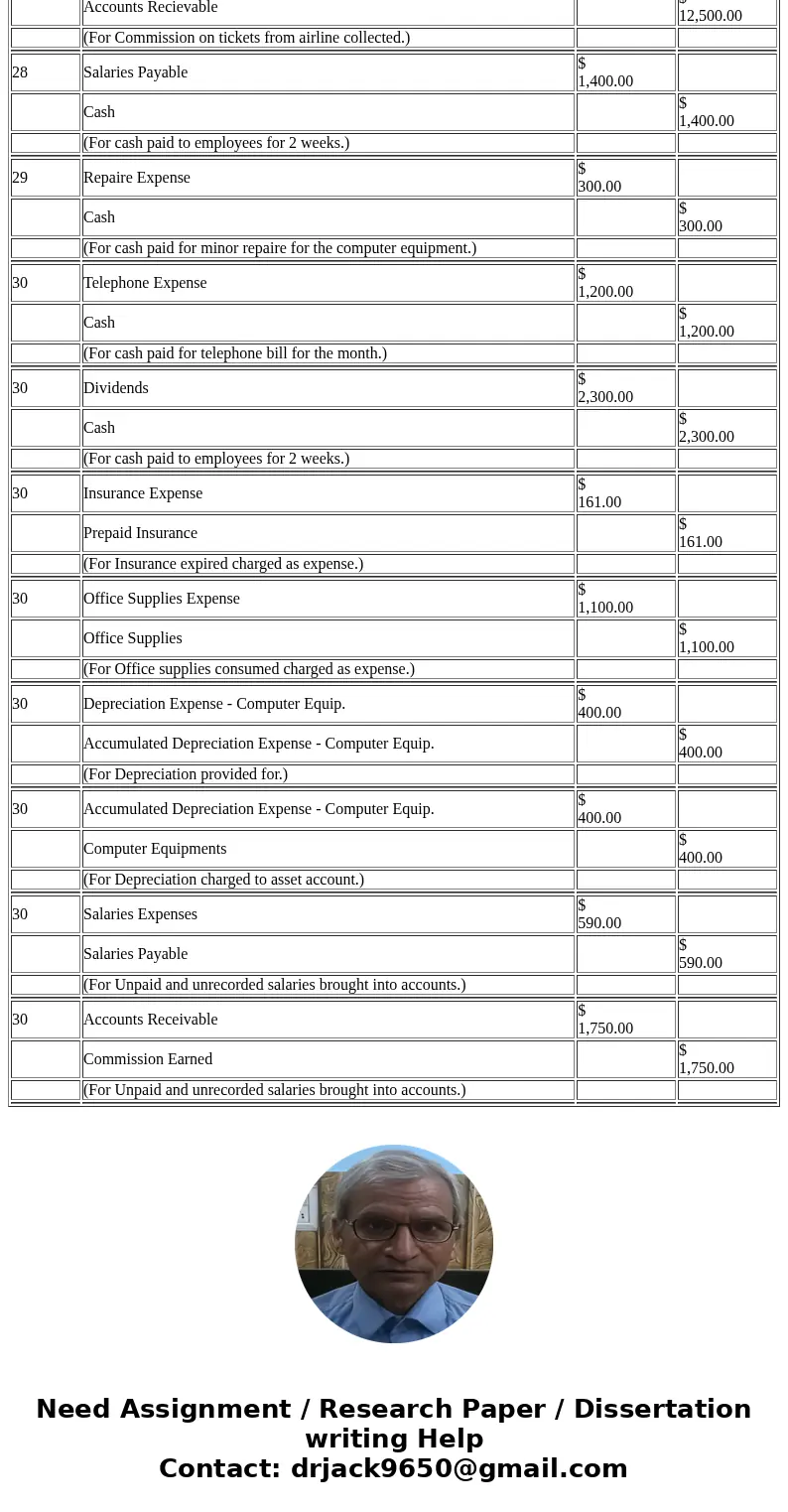

| 29 | Repaire Expense | $ 300.00 | |

| Cash | $ 300.00 | ||

| (For cash paid for minor repaire for the computer equipment.) | |||

| 30 | Telephone Expense | $ 1,200.00 | |

| Cash | $ 1,200.00 | ||

| (For cash paid for telephone bill for the month.) | |||

| 30 | Dividends | $ 2,300.00 | |

| Cash | $ 2,300.00 | ||

| (For cash paid to employees for 2 weeks.) | |||

| 30 | Insurance Expense | $ 161.00 | |

| Prepaid Insurance | $ 161.00 | ||

| (For Insurance expired charged as expense.) | |||

| 30 | Office Supplies Expense | $ 1,100.00 | |

| Office Supplies | $ 1,100.00 | ||

| (For Office supplies consumed charged as expense.) | |||

| 30 | Depreciation Expense - Computer Equip. | $ 400.00 | |

| Accumulated Depreciation Expense - Computer Equip. | $ 400.00 | ||

| (For Depreciation provided for.) | |||

| 30 | Accumulated Depreciation Expense - Computer Equip. | $ 400.00 | |

| Computer Equipments | $ 400.00 | ||

| (For Depreciation charged to asset account.) | |||

| 30 | Salaries Expenses | $ 590.00 | |

| Salaries Payable | $ 590.00 | ||

| (For Unpaid and unrecorded salaries brought into accounts.) | |||

| 30 | Accounts Receivable | $ 1,750.00 | |

| Commission Earned | $ 1,750.00 | ||

| (For Unpaid and unrecorded salaries brought into accounts.) | |||

Homework Sourse

Homework Sourse