Consolidation at the end of the first year subsequent to dat

Solution

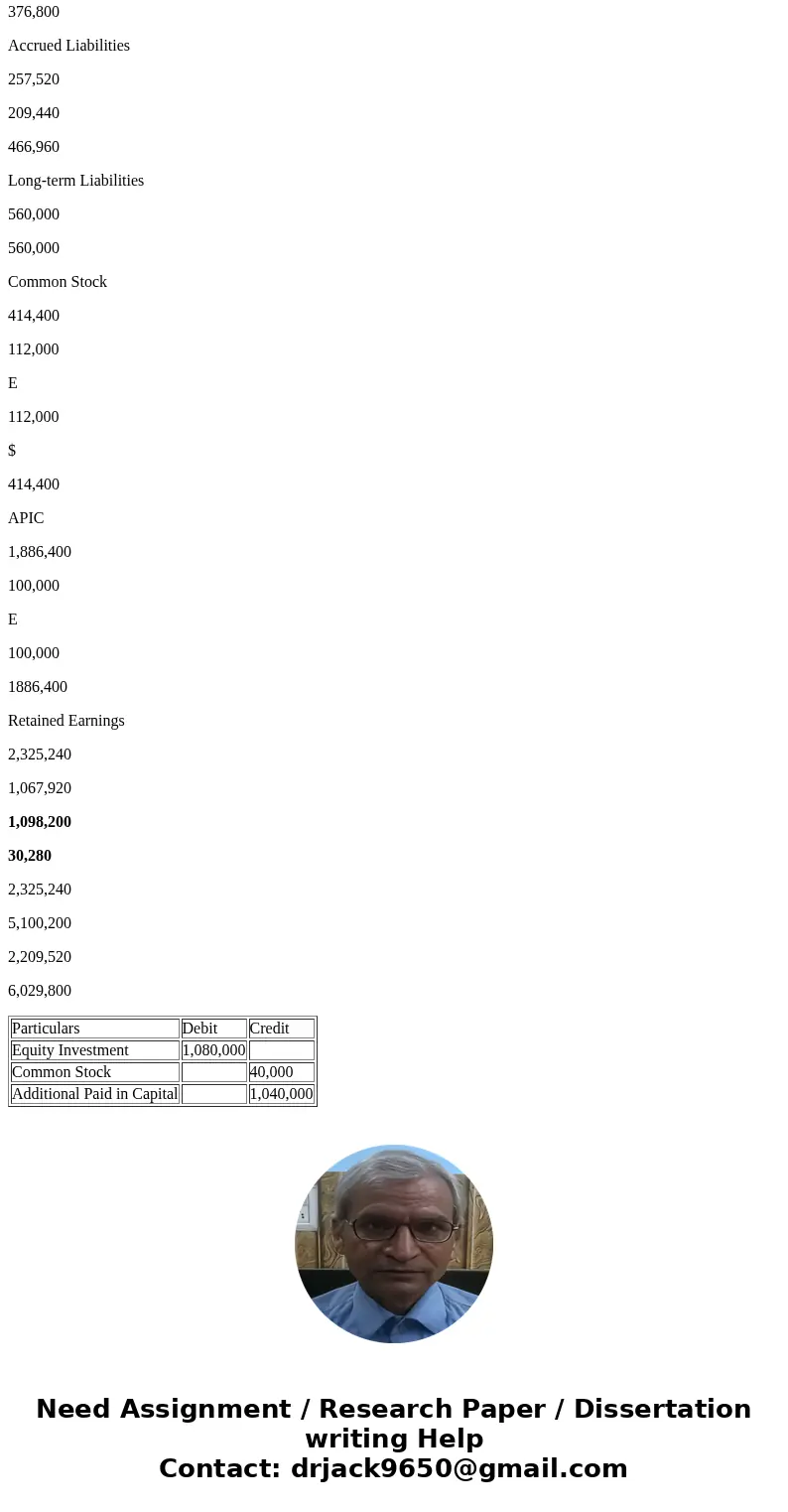

A. Journal Entry at the of date Acquisition

Particulars

Debit

Credit

Equity Investment

1,080,000

Common Stock

40,000

Additional Paid in Capital

1,040,000

b. Computation to yield the Equity Investment Reported by the parent in the amount of $1,279,920

Equity Investment at 01/01/16 $

1,080,000

Plus: Equity Income

230,200

Less : Dividends

30,280

199,920

Equity Investment at 12/31/16 $

1,279,920

C. Consolidation Entries for the year ended December 31, 2016

(C )Particulars

Debit

Credit

Equity Income

230,200

Dividend

30,280

Equity Investment

199,920

(E )Particulars

Debit

Credit

Common Stock

112,000

APIC

100,000

BOY Retained Earnings

868,000

Equity Investment

10,80,000

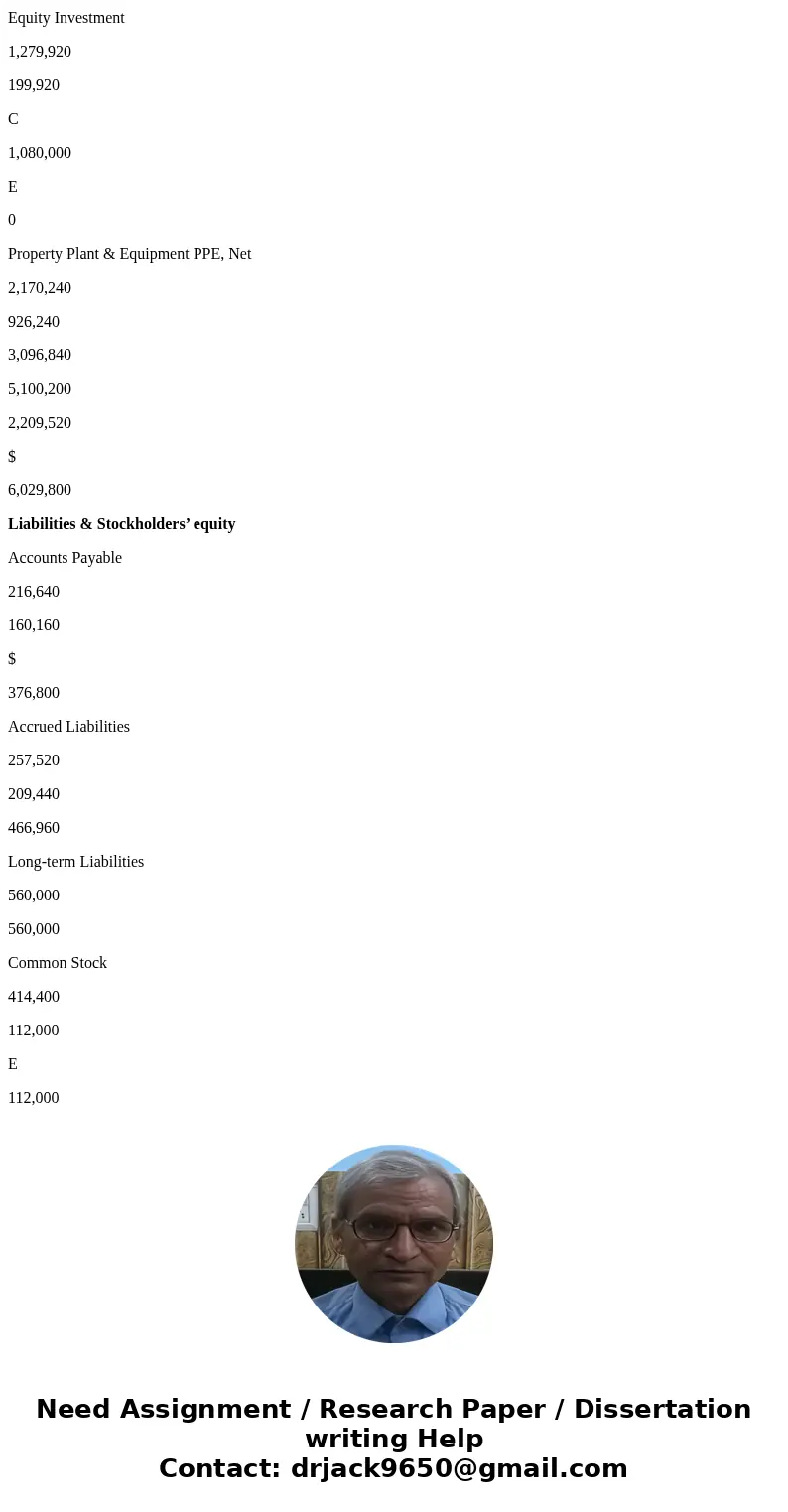

d. Prepare the consolidated spreadsheet for the year Ended December 31,2016

Consolidation Worksheet

Income Statement

Parent

Subsidiary

Dr

Cr

Consolidated

Sales

2,960,000

1,675,000

$

4,635,000

Cost of goods Sold

(2,072,000)

(1,008,000)

(3,080,000)

Gross Profit

888,000

667,000

$

1,555,000

Equity Income

230,200

C

230,200

0

Operating Income

(562,400)

(436,800)

(999,200)

Net Income

555,800

230,200

$

555,800

Statement of retained earnings:

BOY retained Earnings

1,881,600

868,000

E

868,000

$

1,881,600

Net Income

555,800

230,200

230,200

555,800

Dividends

(112,160)

(30,280)

C

30,280

(112,160)

Ending retained Earnings

2,325,240

1,067,920

$

2,325,240

Balance Sheet

Consolidation Worksheet

Assets

Parent

Subsidiary

Dr

Cr

Consolidated

Cash

696,920

432,880

$

1,129,800

Account Receivable

378,880

349,760

728,640

Inventory

574,240

500,640

$

1,074,880

Equity Investment

1,279,920

199,920

C

1,080,000

E

0

Property Plant & Equipment PPE, Net

2,170,240

926,240

3,096,840

5,100,200

2,209,520

$

6,029,800

Liabilities & Stockholders’ equity

Accounts Payable

216,640

160,160

$

376,800

Accrued Liabilities

257,520

209,440

466,960

Long-term Liabilities

560,000

560,000

Common Stock

414,400

112,000

E

112,000

$

414,400

APIC

1,886,400

100,000

E

100,000

1886,400

Retained Earnings

2,325,240

1,067,920

1,098,200

30,280

2,325,240

5,100,200

2,209,520

6,029,800

| Particulars | Debit | Credit |

| Equity Investment | 1,080,000 | |

| Common Stock | 40,000 | |

| Additional Paid in Capital | 1,040,000 |

Homework Sourse

Homework Sourse