In 2017 Lisa and Fred a married couple had taxable income of

In 2017, Lisa and Fred, a married couple, had taxable income of $490,000. If they were to file separate tax returns, Lisa would have reported taxable income of $210,000 and Fred would have reported taxable income of $280,000. What is the couple’s marriage penalty or benefit?

Solution

Particulars

Lisa($)

Fred($)

Jointly($)

Income

210000

280000

490000

Standard deduction

(6300)

(6300)

(12600)

Dependent deduction

(4050)

(4050)

(8100)

Taxable amount

199650

269650

469300

Tax

49284

72384

121668

Jointly tax

131138

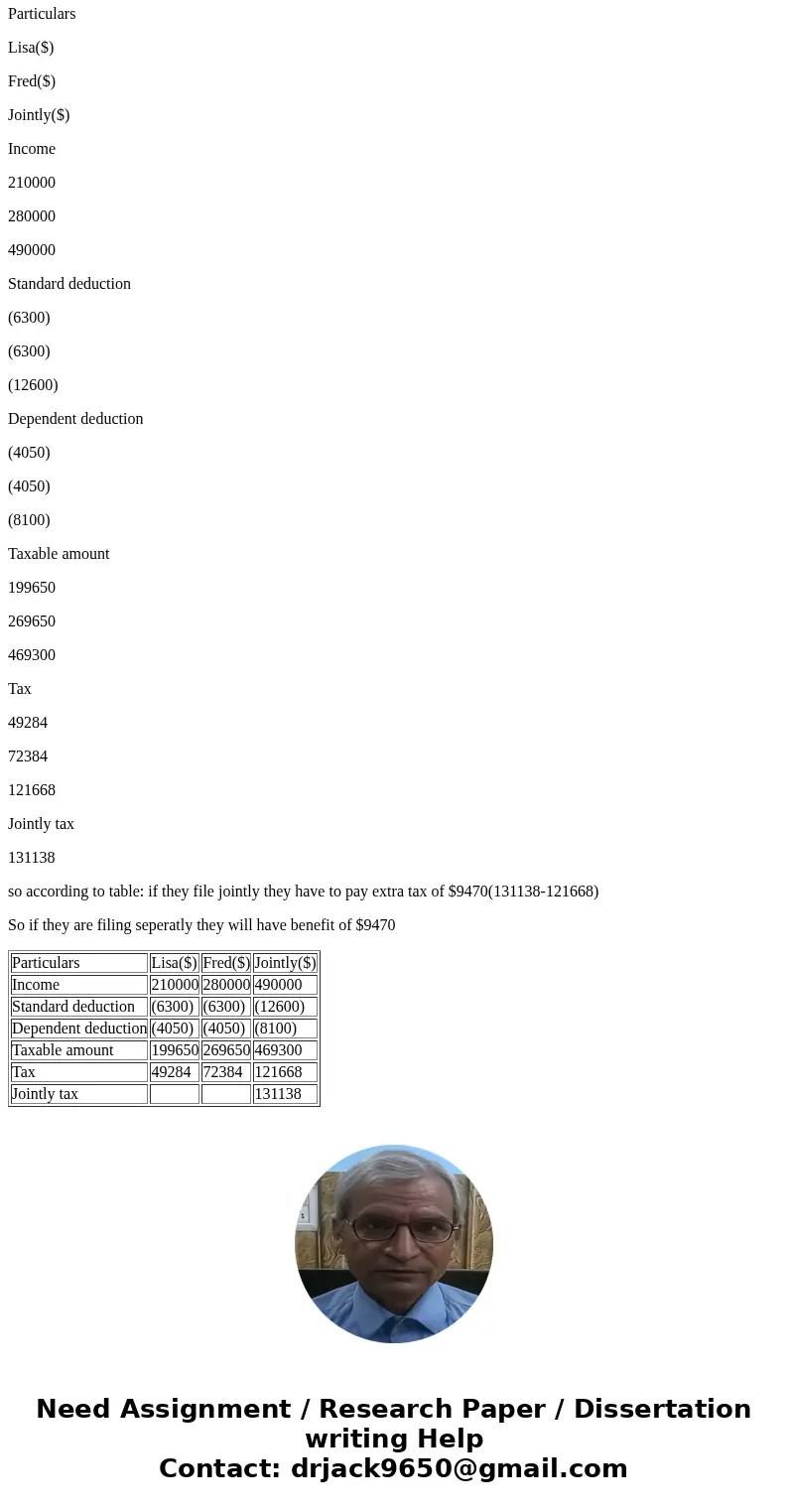

so according to table: if they file jointly they have to pay extra tax of $9470(131138-121668)

So if they are filing seperatly they will have benefit of $9470

| Particulars | Lisa($) | Fred($) | Jointly($) |

| Income | 210000 | 280000 | 490000 |

| Standard deduction | (6300) | (6300) | (12600) |

| Dependent deduction | (4050) | (4050) | (8100) |

| Taxable amount | 199650 | 269650 | 469300 |

| Tax | 49284 | 72384 | 121668 |

| Jointly tax | 131138 |

Homework Sourse

Homework Sourse