procedure using the rate determined in part a The actual ove

procedure, using the rate determined in part (a The actual overhead C. During January, the operating room was used 240 hours. incurred for January were $67.250. Determine the overhead un the period. der or overappliedsor EX 2-12 Entry for jobs completed; cost of unfinished jobs The following account appears in the ledger prior to recogn izing the jobs completed it Balance, August 1 Direct materials 462,000 210,000 Jobs finished during August are summarized as follows: Job 210 Job 216 $197,800 240.000 Job 224 Job 130 $160,000 364,000 a. Journalize the entry to record the jobs completed. b. Determine the cost of the unfinished jobs at August 31. EX 2-13 Entries for factory costs and jobs completed Old School Publishing Inc began printing operations on January 1, Jobs 201 and 301 were completed during the month, and all costs applic ble to them were recorded on related cost sheets. JobsMS and 304 are still in pr-athe end of The glue is not a significant cost, so it is treated as indirect materials (a a. Journalize the entry to record the purchase of materials in April. b. Journalize the entry to record the requisition of materials in April. C. Determine the April 30 balances that would be shown in the materials EX 2-6 Entry for factory labor costs A surnmary of the time tickets for the current month follows: Job No. Job No. Indirect 7,120 8 32,000 3 Journalize the entry to record the factory labor costs. EX 2-7 Entry for factory labor costs The weekly time tickets indicate the following distribution of labor hours for labor employees:

Solution

Ex2 -2)cost of goods sold =sales -Gross profit

= 3,600,000 -650,000

= $ 2,950,000

b)Direct material used =Beginning +purchase- ending raw material inventory -indirect material

= 0+1224000-98800-120000

= 1,005,200

c)Total manufacturing cost = Direct material used +direct labor+ overhead

2640000 = 1,005,200+ DL +381000

Direct labor = 2640000-1005200-381000

= $ 1253800

**overhead:216000+120000+45000=381000

Ex 2-6)

ex 2-12)

2)Total work in process=60000+325000+462000+210000=1057000

Unfinished jobs =total WIP-Finished goods transfered

=1057000- 961800

= 95200

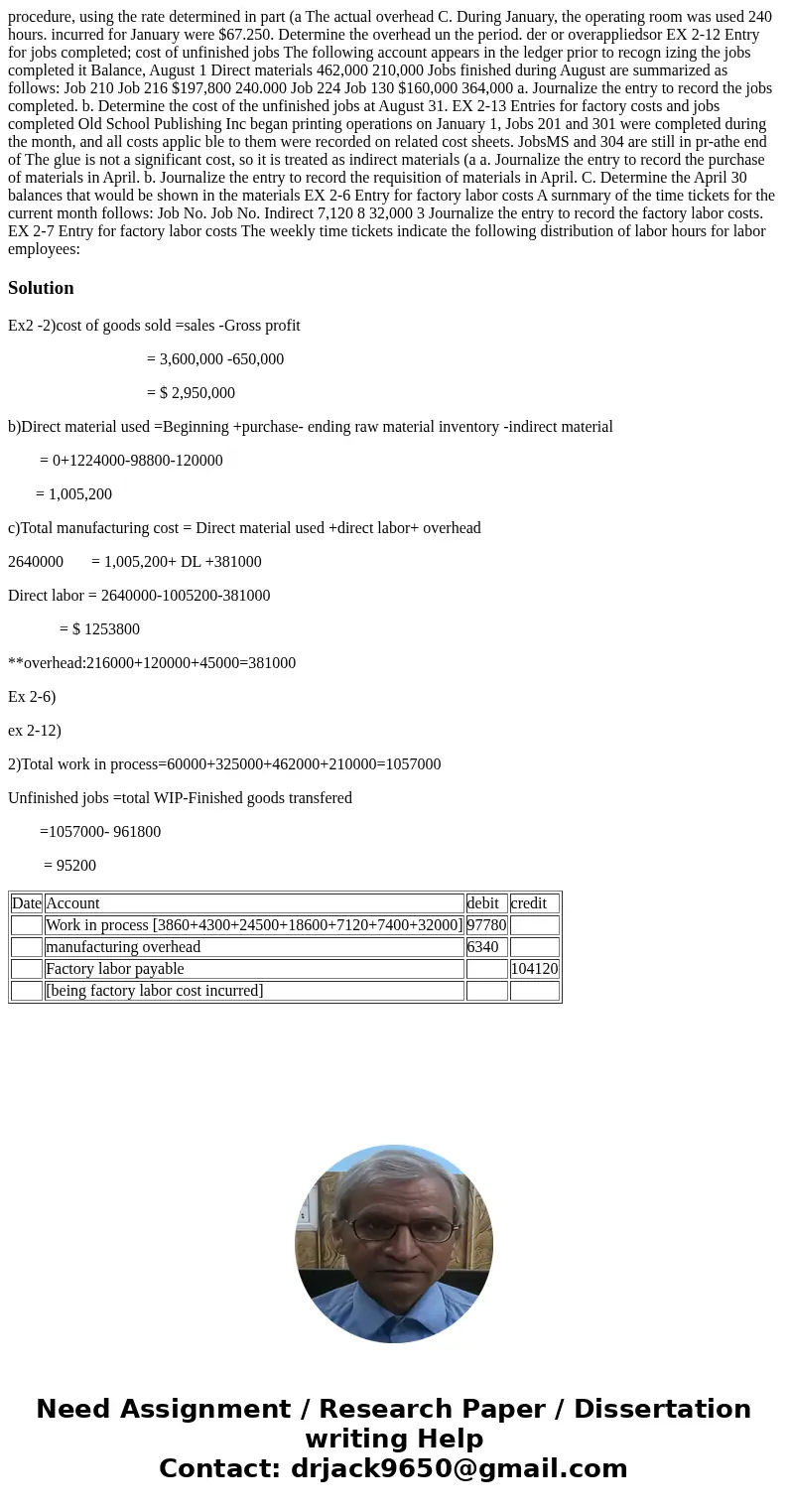

| Date | Account | debit | credit |

| Work in process [3860+4300+24500+18600+7120+7400+32000] | 97780 | ||

| manufacturing overhead | 6340 | ||

| Factory labor payable | 104120 | ||

| [being factory labor cost incurred] |

Homework Sourse

Homework Sourse