Binrui is thinking of purchasing a small real estate project

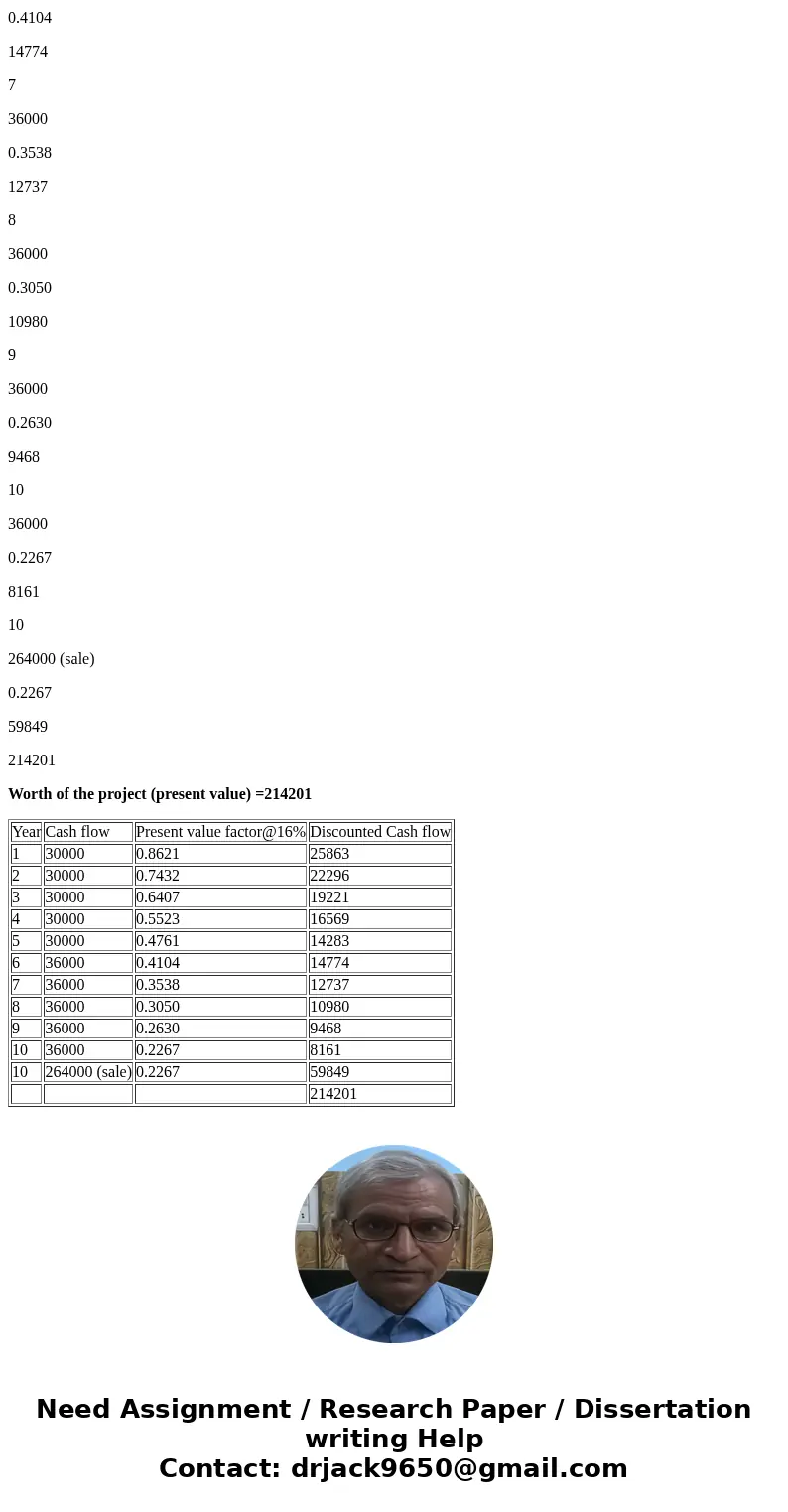

Binrui is thinking of purchasing a small real estate project. The listing price (asking price) is $300,000. Binrui’s best estimate of the after tax cash flows is $30,000 in each year 1-5 and $36,000 in each year 6-10. In addition, he plans to sell the property at the end of 10 years for $264,000 after tax. If Binrui requires a 16 rate of return on his real estate investments, what is this project worth (present value) to him in today’s dollars?

Solution

Year

Cash flow

Present value factor@16%

Discounted Cash flow

1

30000

0.8621

25863

2

30000

0.7432

22296

3

30000

0.6407

19221

4

30000

0.5523

16569

5

30000

0.4761

14283

6

36000

0.4104

14774

7

36000

0.3538

12737

8

36000

0.3050

10980

9

36000

0.2630

9468

10

36000

0.2267

8161

10

264000 (sale)

0.2267

59849

214201

Worth of the project (present value) =214201

| Year | Cash flow | Present value factor@16% | Discounted Cash flow |

| 1 | 30000 | 0.8621 | 25863 |

| 2 | 30000 | 0.7432 | 22296 |

| 3 | 30000 | 0.6407 | 19221 |

| 4 | 30000 | 0.5523 | 16569 |

| 5 | 30000 | 0.4761 | 14283 |

| 6 | 36000 | 0.4104 | 14774 |

| 7 | 36000 | 0.3538 | 12737 |

| 8 | 36000 | 0.3050 | 10980 |

| 9 | 36000 | 0.2630 | 9468 |

| 10 | 36000 | 0.2267 | 8161 |

| 10 | 264000 (sale) | 0.2267 | 59849 |

| 214201 |

Homework Sourse

Homework Sourse