The following information was taken from the records of Conc

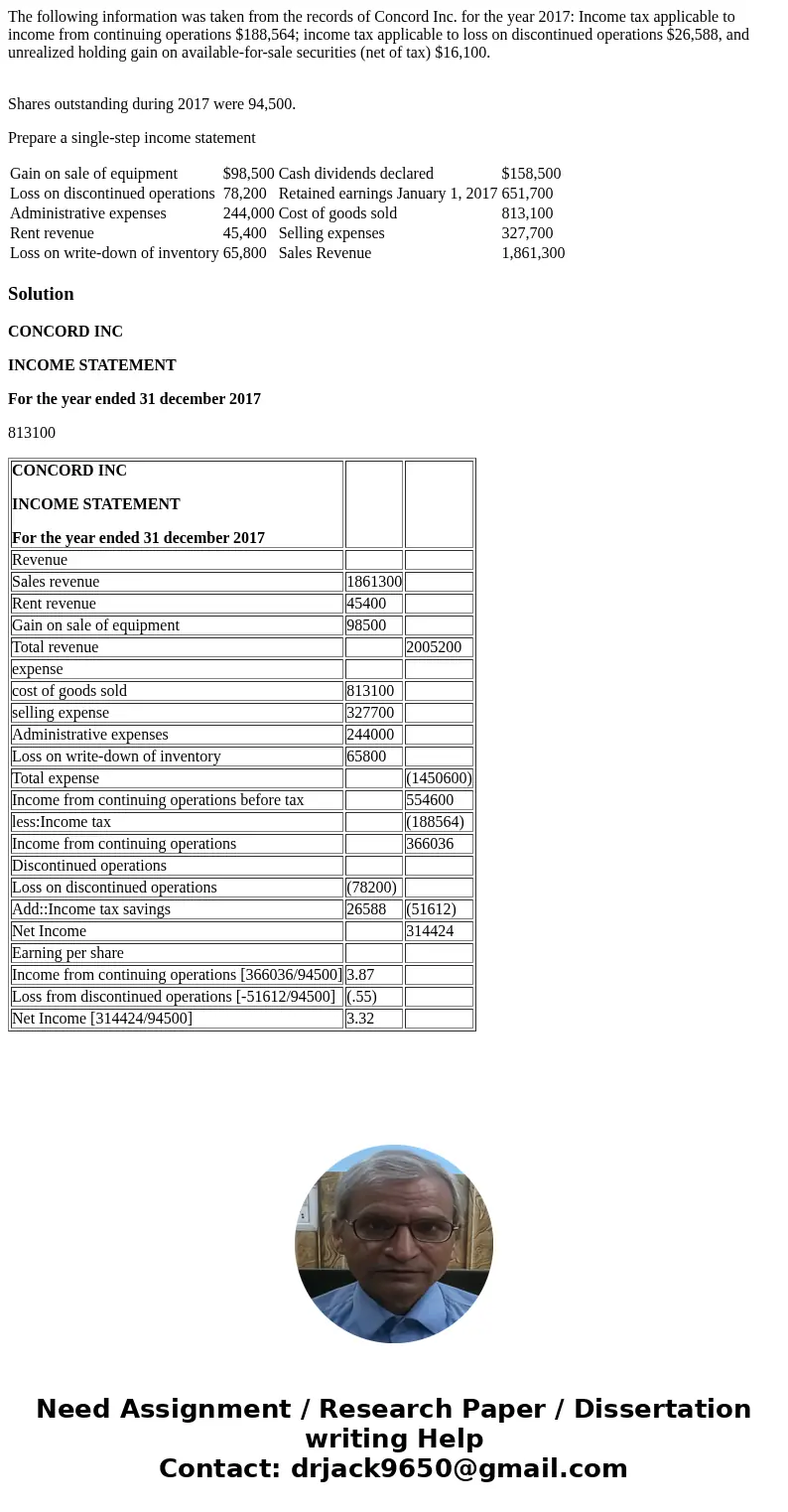

The following information was taken from the records of Concord Inc. for the year 2017: Income tax applicable to income from continuing operations $188,564; income tax applicable to loss on discontinued operations $26,588, and unrealized holding gain on available-for-sale securities (net of tax) $16,100.

Shares outstanding during 2017 were 94,500.

Prepare a single-step income statement

| Gain on sale of equipment | $98,500 | Cash dividends declared | $158,500 | |||

| Loss on discontinued operations | 78,200 | Retained earnings January 1, 2017 | 651,700 | |||

| Administrative expenses | 244,000 | Cost of goods sold | 813,100 | |||

| Rent revenue | 45,400 | Selling expenses | 327,700 | |||

| Loss on write-down of inventory | 65,800 | Sales Revenue | 1,861,300 |

Solution

CONCORD INC

INCOME STATEMENT

For the year ended 31 december 2017

813100

| CONCORD INC INCOME STATEMENT For the year ended 31 december 2017 | ||

| Revenue | ||

| Sales revenue | 1861300 | |

| Rent revenue | 45400 | |

| Gain on sale of equipment | 98500 | |

| Total revenue | 2005200 | |

| expense | ||

| cost of goods sold | 813100 | |

| selling expense | 327700 | |

| Administrative expenses | 244000 | |

| Loss on write-down of inventory | 65800 | |

| Total expense | (1450600) | |

| Income from continuing operations before tax | 554600 | |

| less:Income tax | (188564) | |

| Income from continuing operations | 366036 | |

| Discontinued operations | ||

| Loss on discontinued operations | (78200) | |

| Add::Income tax savings | 26588 | (51612) |

| Net Income | 314424 | |

| Earning per share | ||

| Income from continuing operations [366036/94500] | 3.87 | |

| Loss from discontinued operations [-51612/94500] | (.55) | |

| Net Income [314424/94500] | 3.32 |

Homework Sourse

Homework Sourse