Define 1 Risk return 2 Standalone assets expected return an

Define 1) Risk & return 2) Stand-alone asset’s expected return and standard deviation. What method would you use to calculate expected return and standard deviation?

Solution

Risk and Return: Risk and return are directly related to each other, as we keep increasing the risk factor in any investment the return or reward also keep increasing. An investor tries to maintain a balance of risk and return depending upon its expected return.

Expected return and standard deviation of a stand-alone asset: Expected return is the average of returns which is arithmetically calculated number for a period. The expected return is also desired return of the investor for his investment. Standard deviation is the deviation of return from one period to another. Standard deviation is also called risk measure for an asset. In simple terms standard deviation measure the variation and reliability of return for the asset.

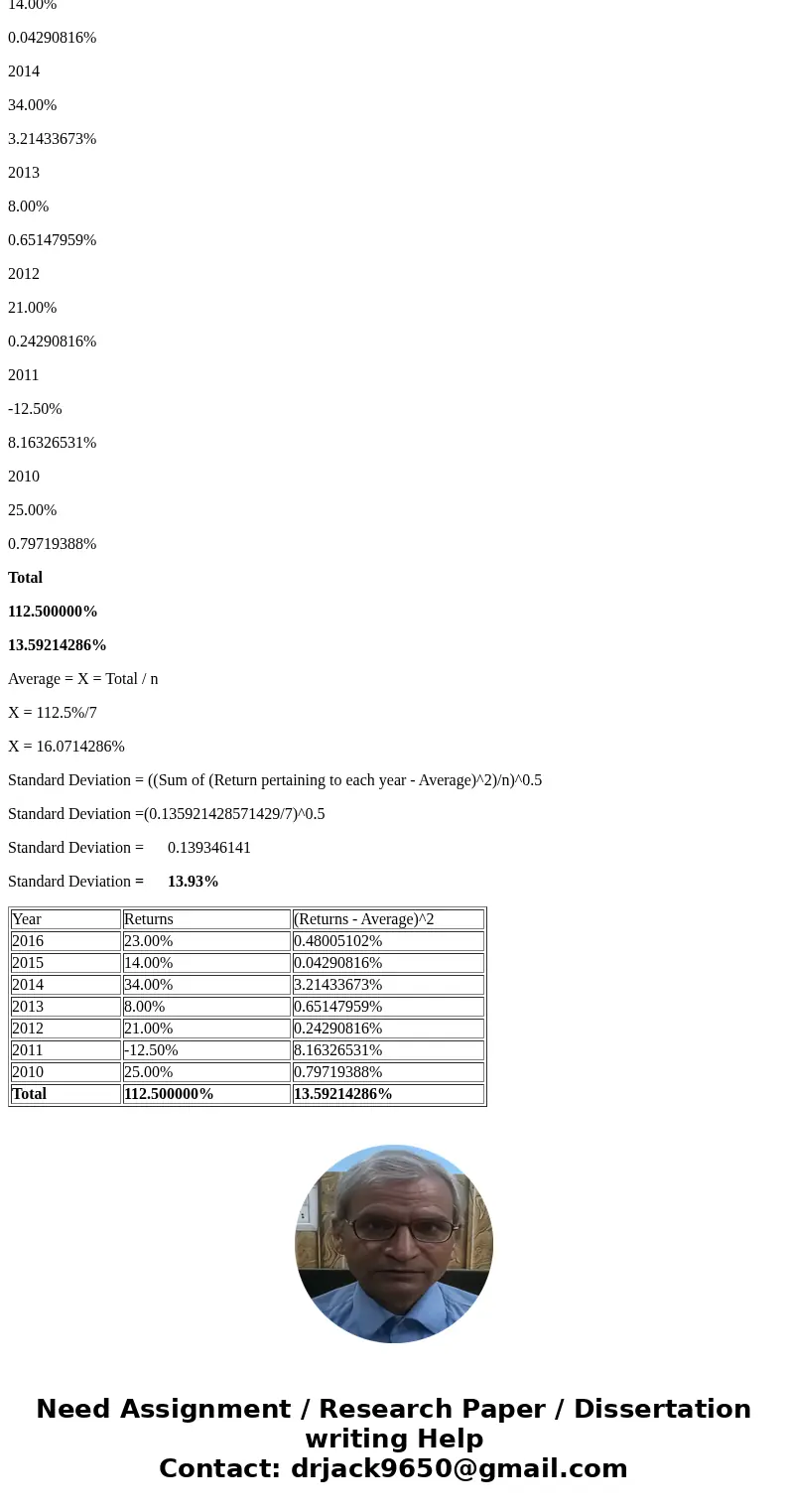

Expected return and standard deviation is calculated as below:

Year

Returns

(Returns - Average)^2

2016

23.00%

0.48005102%

2015

14.00%

0.04290816%

2014

34.00%

3.21433673%

2013

8.00%

0.65147959%

2012

21.00%

0.24290816%

2011

-12.50%

8.16326531%

2010

25.00%

0.79719388%

Total

112.500000%

13.59214286%

Average = X = Total / n

X = 112.5%/7

X = 16.0714286%

Standard Deviation = ((Sum of (Return pertaining to each year - Average)^2)/n)^0.5

Standard Deviation =(0.135921428571429/7)^0.5

Standard Deviation = 0.139346141

Standard Deviation = 13.93%

| Year | Returns | (Returns - Average)^2 |

| 2016 | 23.00% | 0.48005102% |

| 2015 | 14.00% | 0.04290816% |

| 2014 | 34.00% | 3.21433673% |

| 2013 | 8.00% | 0.65147959% |

| 2012 | 21.00% | 0.24290816% |

| 2011 | -12.50% | 8.16326531% |

| 2010 | 25.00% | 0.79719388% |

| Total | 112.500000% | 13.59214286% |

Homework Sourse

Homework Sourse