AppsPowerteache Chapter 2 Problems 4 Growth has 83000 in tax

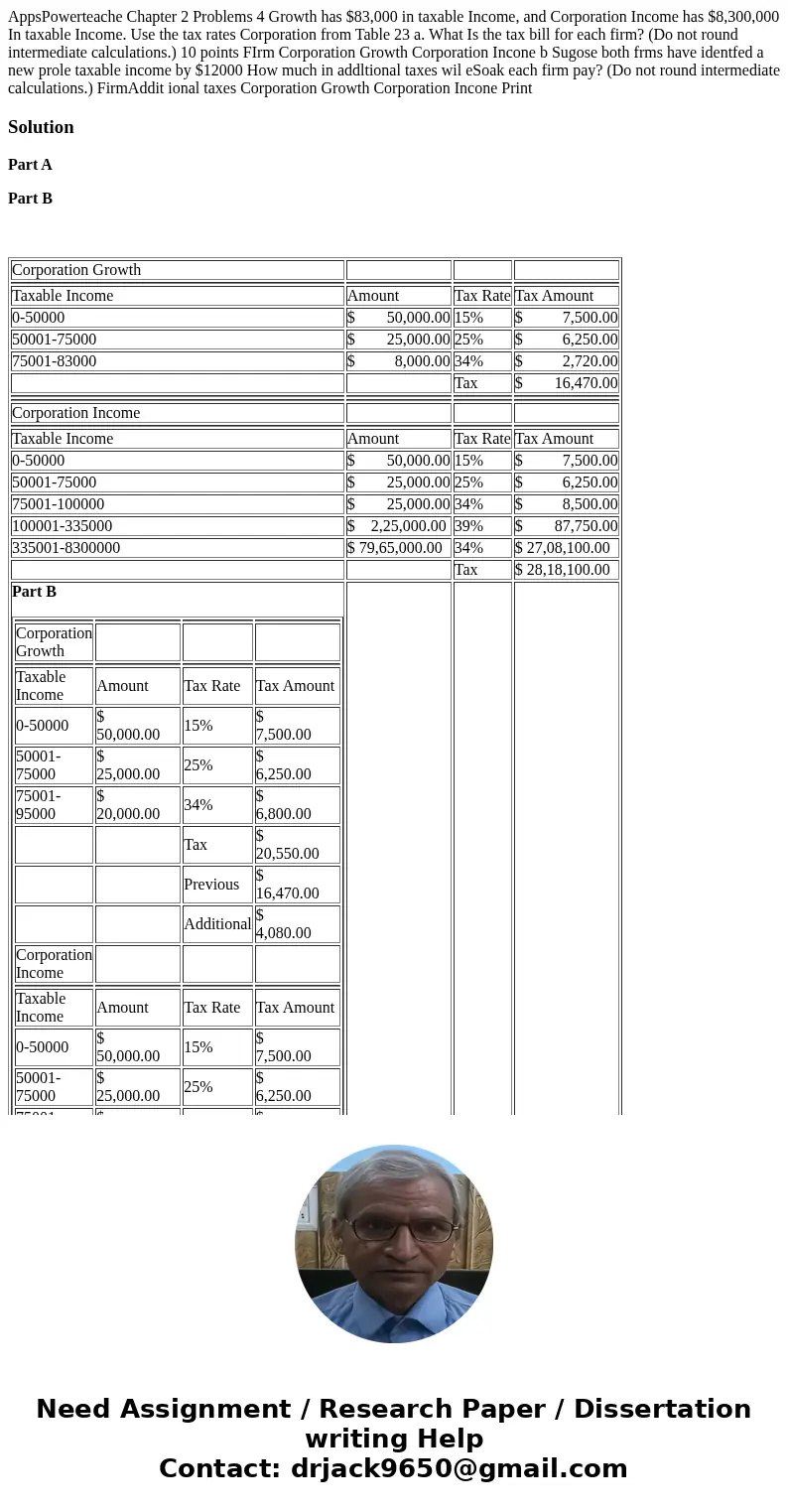

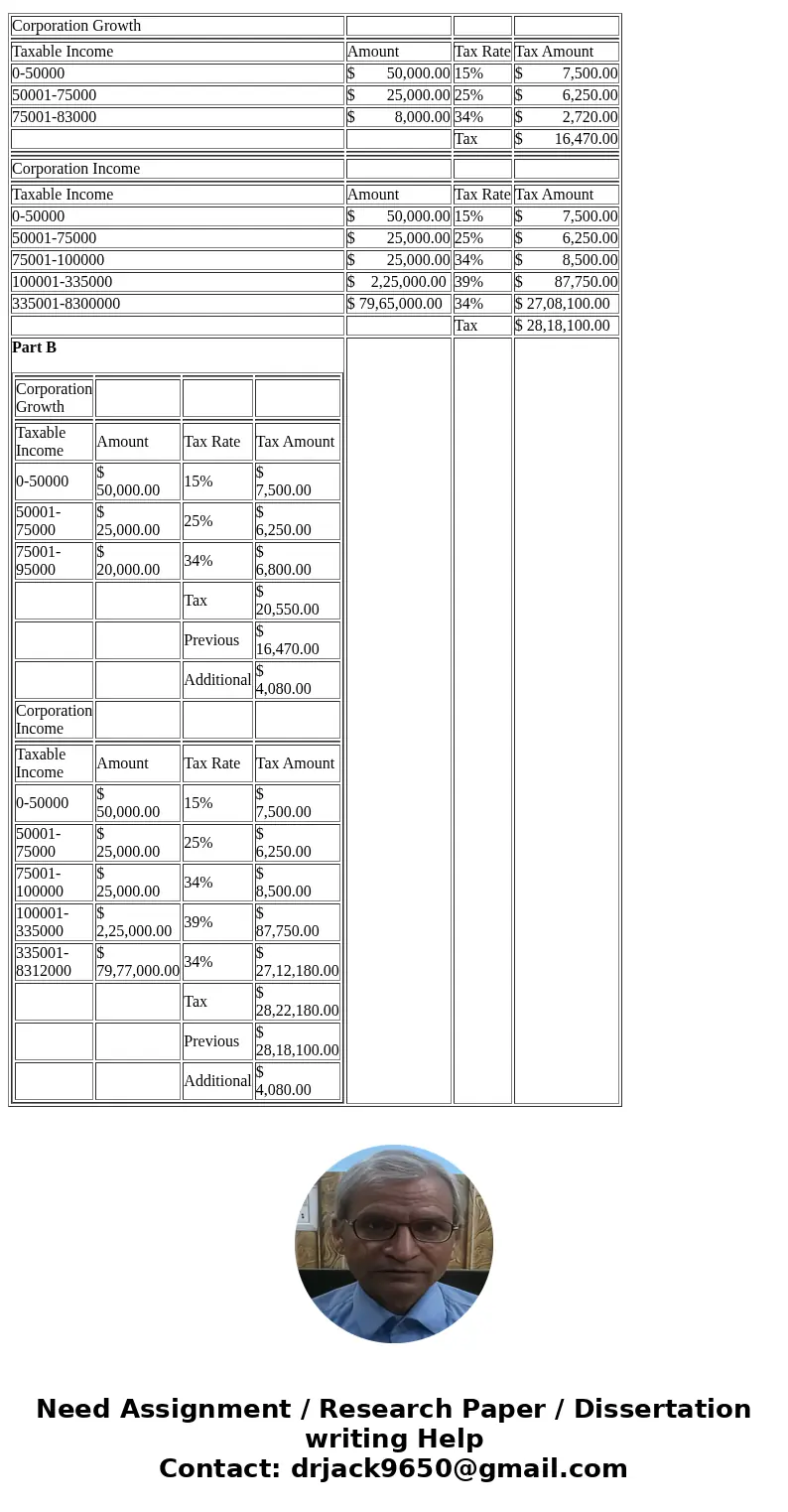

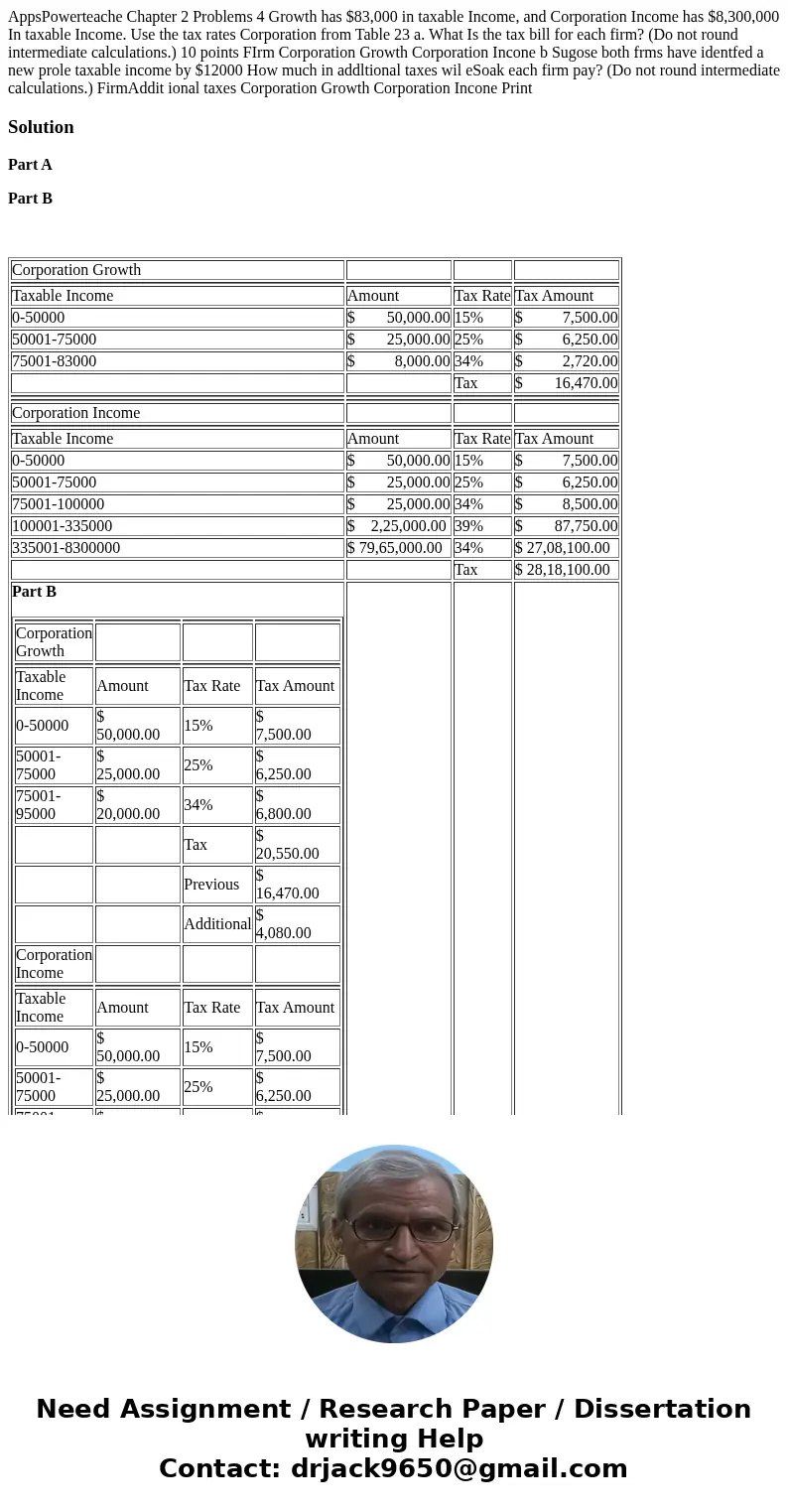

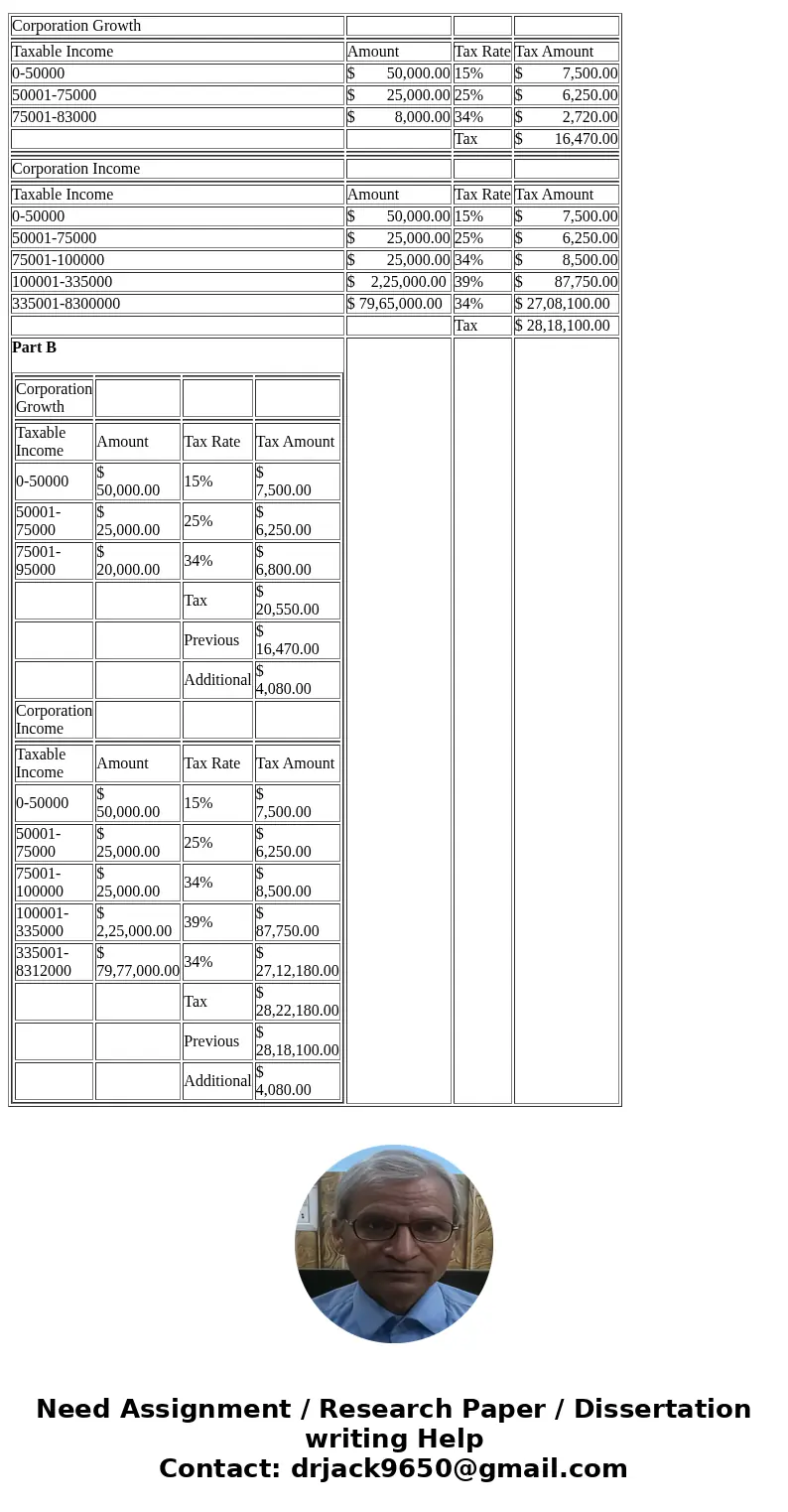

AppsPowerteache Chapter 2 Problems 4 Growth has $83,000 in taxable Income, and Corporation Income has $8,300,000 In taxable Income. Use the tax rates Corporation from Table 23 a. What Is the tax bill for each firm? (Do not round intermediate calculations.) 10 points FIrm Corporation Growth Corporation Incone b Sugose both frms have identfed a new prole taxable income by $12000 How much in addltional taxes wil eSoak each firm pay? (Do not round intermediate calculations.) FirmAddit ional taxes Corporation Growth Corporation Incone Print

Solution

Part A

Part B

| Corporation Growth | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxable Income | Amount | Tax Rate | Tax Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0-50000 | $ 50,000.00 | 15% | $ 7,500.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50001-75000 | $ 25,000.00 | 25% | $ 6,250.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 75001-83000 | $ 8,000.00 | 34% | $ 2,720.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax | $ 16,470.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporation Income | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxable Income | Amount | Tax Rate | Tax Amount | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 0-50000 | $ 50,000.00 | 15% | $ 7,500.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 50001-75000 | $ 25,000.00 | 25% | $ 6,250.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 75001-100000 | $ 25,000.00 | 34% | $ 8,500.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 100001-335000 | $ 2,25,000.00 | 39% | $ 87,750.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 335001-8300000 | $ 79,65,000.00 | 34% | $ 27,08,100.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax | $ 28,18,100.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Part B

| |

Homework Sourse

Homework Sourse