For each of the following plant assets 1 Calculate the amoun

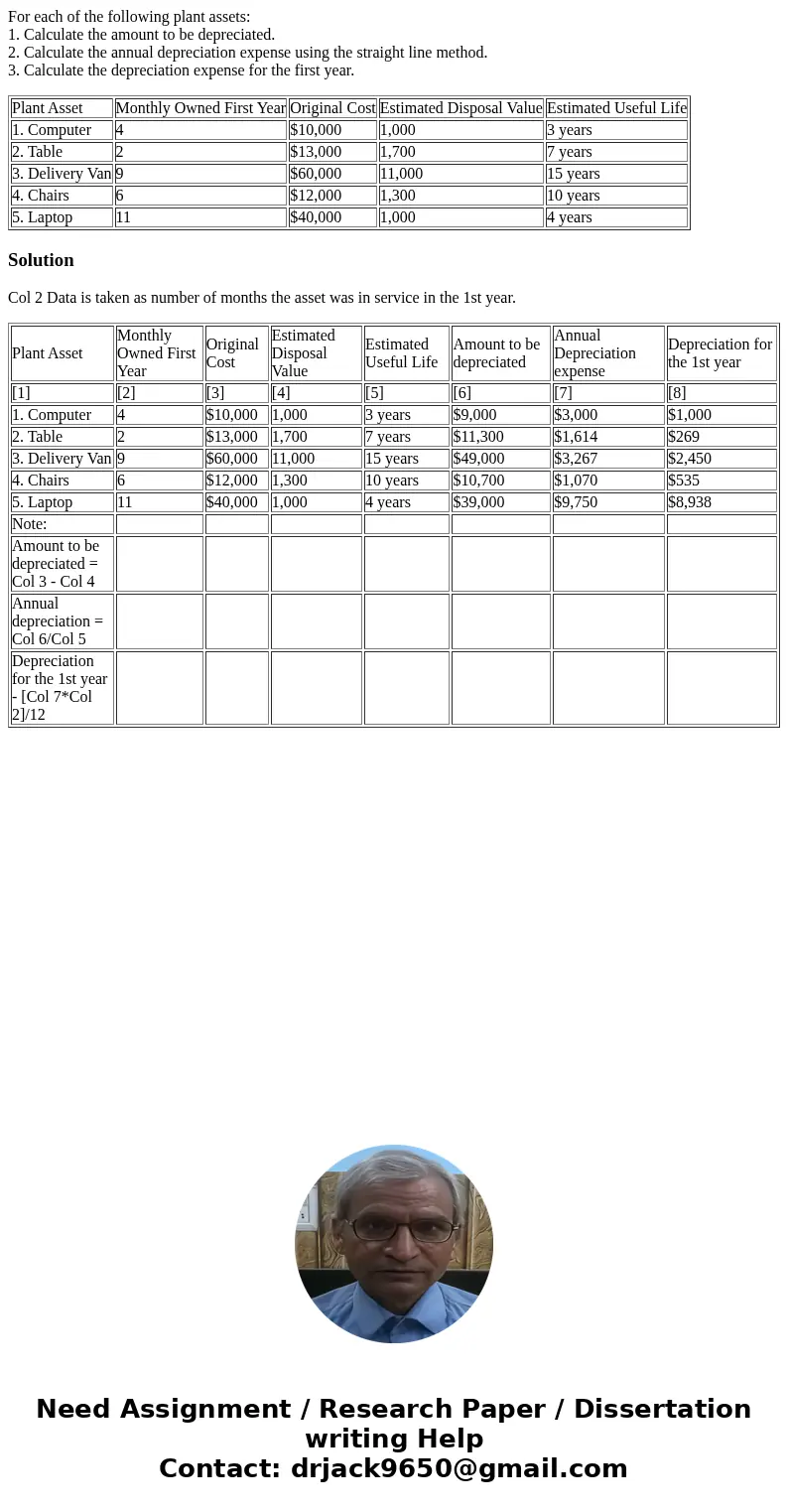

For each of the following plant assets:

1. Calculate the amount to be depreciated.

2. Calculate the annual depreciation expense using the straight line method.

3. Calculate the depreciation expense for the first year.

| Plant Asset | Monthly Owned First Year | Original Cost | Estimated Disposal Value | Estimated Useful Life |

| 1. Computer | 4 | $10,000 | 1,000 | 3 years |

| 2. Table | 2 | $13,000 | 1,700 | 7 years |

| 3. Delivery Van | 9 | $60,000 | 11,000 | 15 years |

| 4. Chairs | 6 | $12,000 | 1,300 | 10 years |

| 5. Laptop | 11 | $40,000 | 1,000 | 4 years |

Solution

Col 2 Data is taken as number of months the asset was in service in the 1st year.

| Plant Asset | Monthly Owned First Year | Original Cost | Estimated Disposal Value | Estimated Useful Life | Amount to be depreciated | Annual Depreciation expense | Depreciation for the 1st year |

| [1] | [2] | [3] | [4] | [5] | [6] | [7] | [8] |

| 1. Computer | 4 | $10,000 | 1,000 | 3 years | $9,000 | $3,000 | $1,000 |

| 2. Table | 2 | $13,000 | 1,700 | 7 years | $11,300 | $1,614 | $269 |

| 3. Delivery Van | 9 | $60,000 | 11,000 | 15 years | $49,000 | $3,267 | $2,450 |

| 4. Chairs | 6 | $12,000 | 1,300 | 10 years | $10,700 | $1,070 | $535 |

| 5. Laptop | 11 | $40,000 | 1,000 | 4 years | $39,000 | $9,750 | $8,938 |

| Note: | |||||||

| Amount to be depreciated = Col 3 - Col 4 | |||||||

| Annual depreciation = Col 6/Col 5 | |||||||

| Depreciation for the 1st year - [Col 7*Col 2]/12 |

Homework Sourse

Homework Sourse