h Prepare a consolidation worksheet as of December 31 20X9 C

h. Prepare a consolidation worksheet as of December 31, 20X9. Computation of Consolidated Totals Bunker Corporation owns 80 percent of Harrison Company\'s stock. At the end of P6-28 20X8, Bunker and Harrison reported the following partial operating results and inventory balances: Harrison Corporation Company $510,000 Bunker Total sales Sales to Harrison Company Sales to Bunker Corporation Net income Operating income (excluding investment income from Harrison) Inventory on hand, December 31, 20X8, purchased from: $660,000 140,000 240,000 20,000 70,000 Harrison Company Bunker Corporation 48,000 42,000 Bunker regularly prices its products at cost plus a 40 percent markup for profit. Harrison prices its sales at cost plus a 20 percent markup, The total sales reported by Bunker and Harrison include both intercompany sales and sales to nonaffiliates.

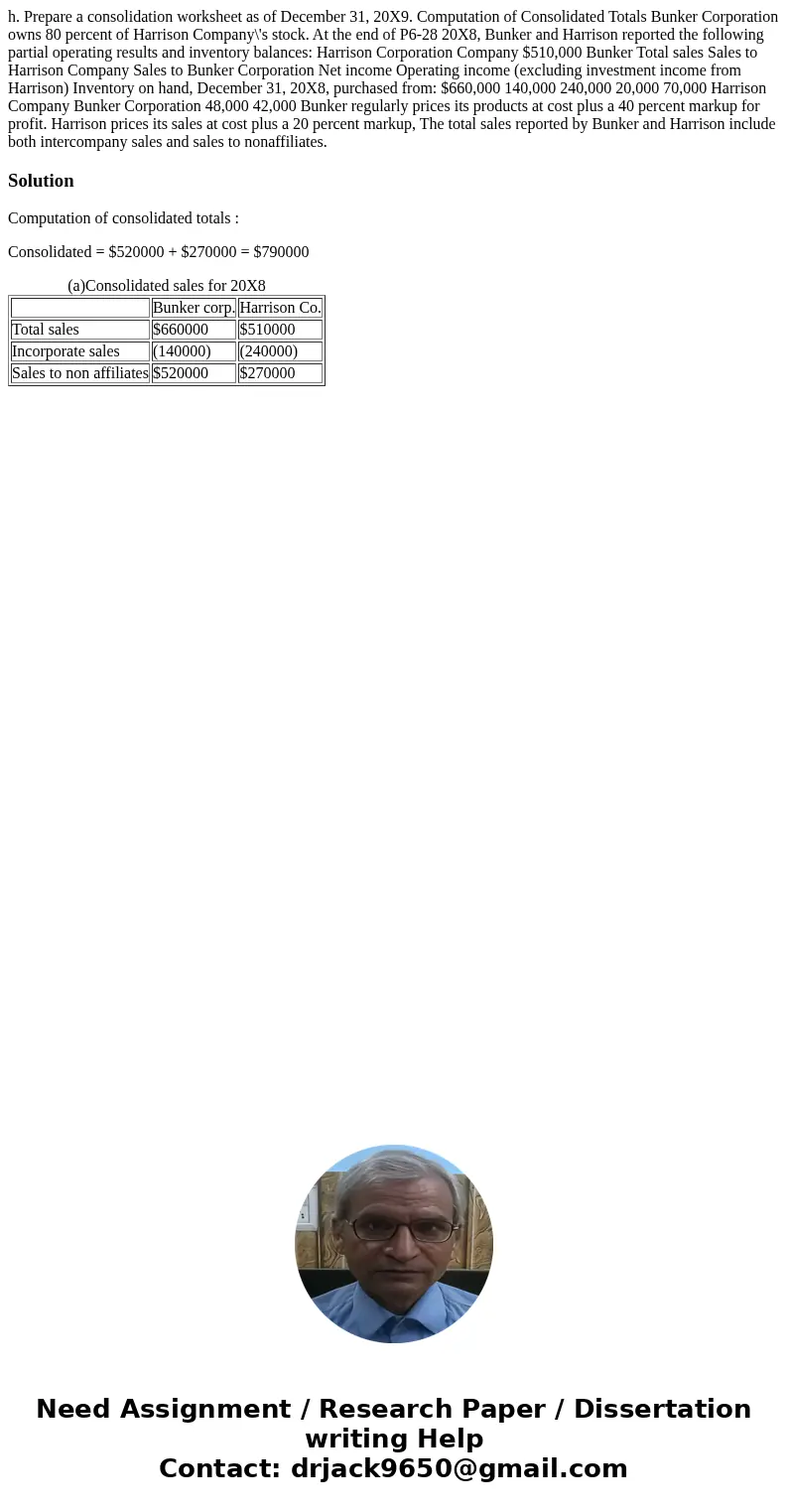

Solution

Computation of consolidated totals :

Consolidated = $520000 + $270000 = $790000

| Bunker corp. | Harrison Co. | |

| Total sales | $660000 | $510000 |

| Incorporate sales | (140000) | (240000) |

| Sales to non affiliates | $520000 | $270000 |

Homework Sourse

Homework Sourse