Ch 123 Exercises and Problems Distribution of Cash Upon Liqu

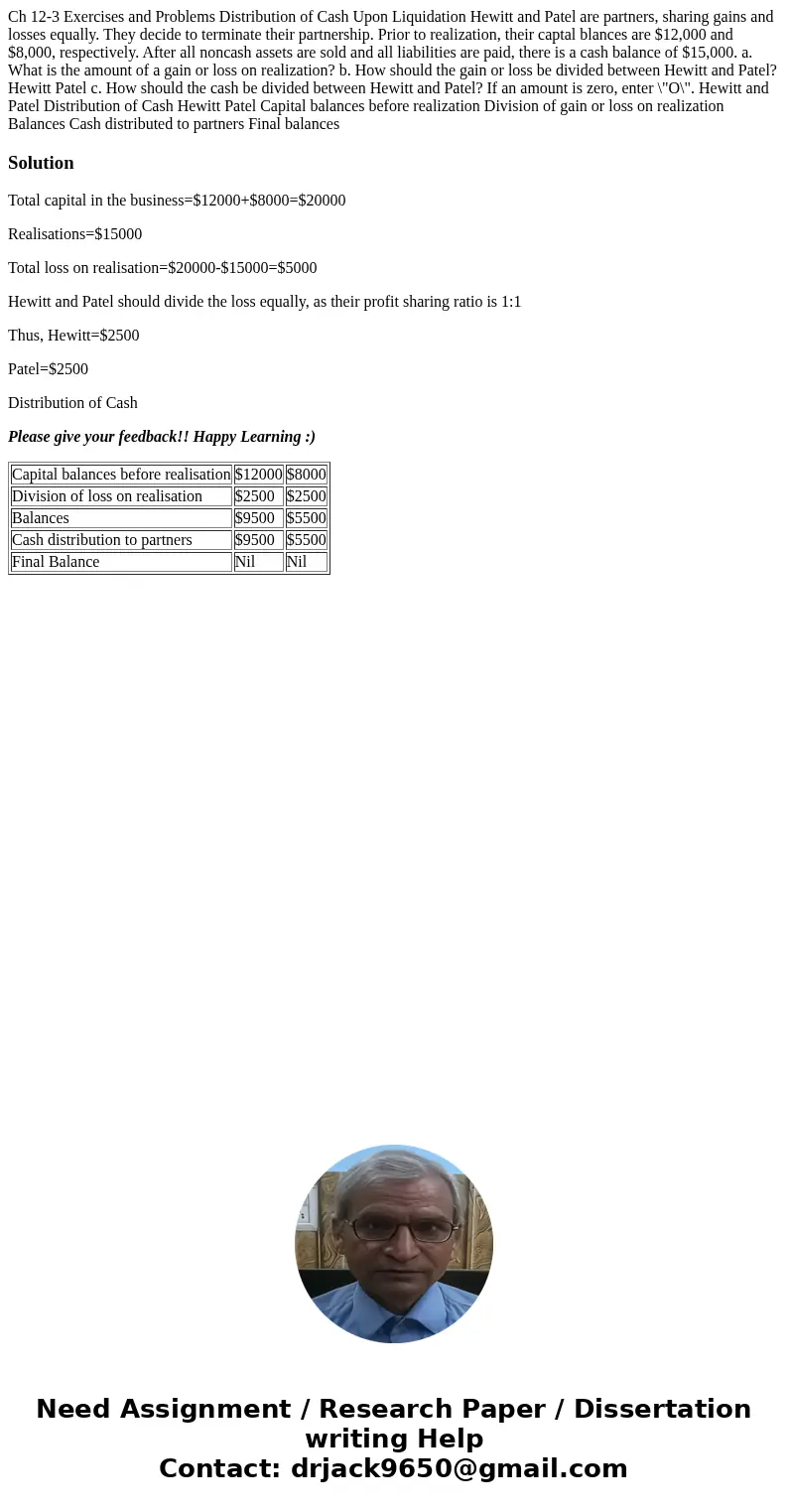

Ch 12-3 Exercises and Problems Distribution of Cash Upon Liquidation Hewitt and Patel are partners, sharing gains and losses equally. They decide to terminate their partnership. Prior to realization, their captal blances are $12,000 and $8,000, respectively. After all noncash assets are sold and all liabilities are paid, there is a cash balance of $15,000. a. What is the amount of a gain or loss on realization? b. How should the gain or loss be divided between Hewitt and Patel? Hewitt Patel c. How should the cash be divided between Hewitt and Patel? If an amount is zero, enter \"O\". Hewitt and Patel Distribution of Cash Hewitt Patel Capital balances before realization Division of gain or loss on realization Balances Cash distributed to partners Final balances

Solution

Total capital in the business=$12000+$8000=$20000

Realisations=$15000

Total loss on realisation=$20000-$15000=$5000

Hewitt and Patel should divide the loss equally, as their profit sharing ratio is 1:1

Thus, Hewitt=$2500

Patel=$2500

Distribution of Cash

Please give your feedback!! Happy Learning :)

| Capital balances before realisation | $12000 | $8000 |

| Division of loss on realisation | $2500 | $2500 |

| Balances | $9500 | $5500 |

| Cash distribution to partners | $9500 | $5500 |

| Final Balance | Nil | Nil |

Homework Sourse

Homework Sourse