On January 1 Snipes Construction paid for earth moving equip

On January 1, Snipes Construction paid for earth moving equipment by issuing a 350,000, 2 year note that specified 4% interest to be paid on December 31 of each year. The equipments retail cash price was unknown, but it was determined that a reasonable interest rate was 7%

At what amount should Snipes record the equipment and the note?

what journal entry should it record for the transaction?

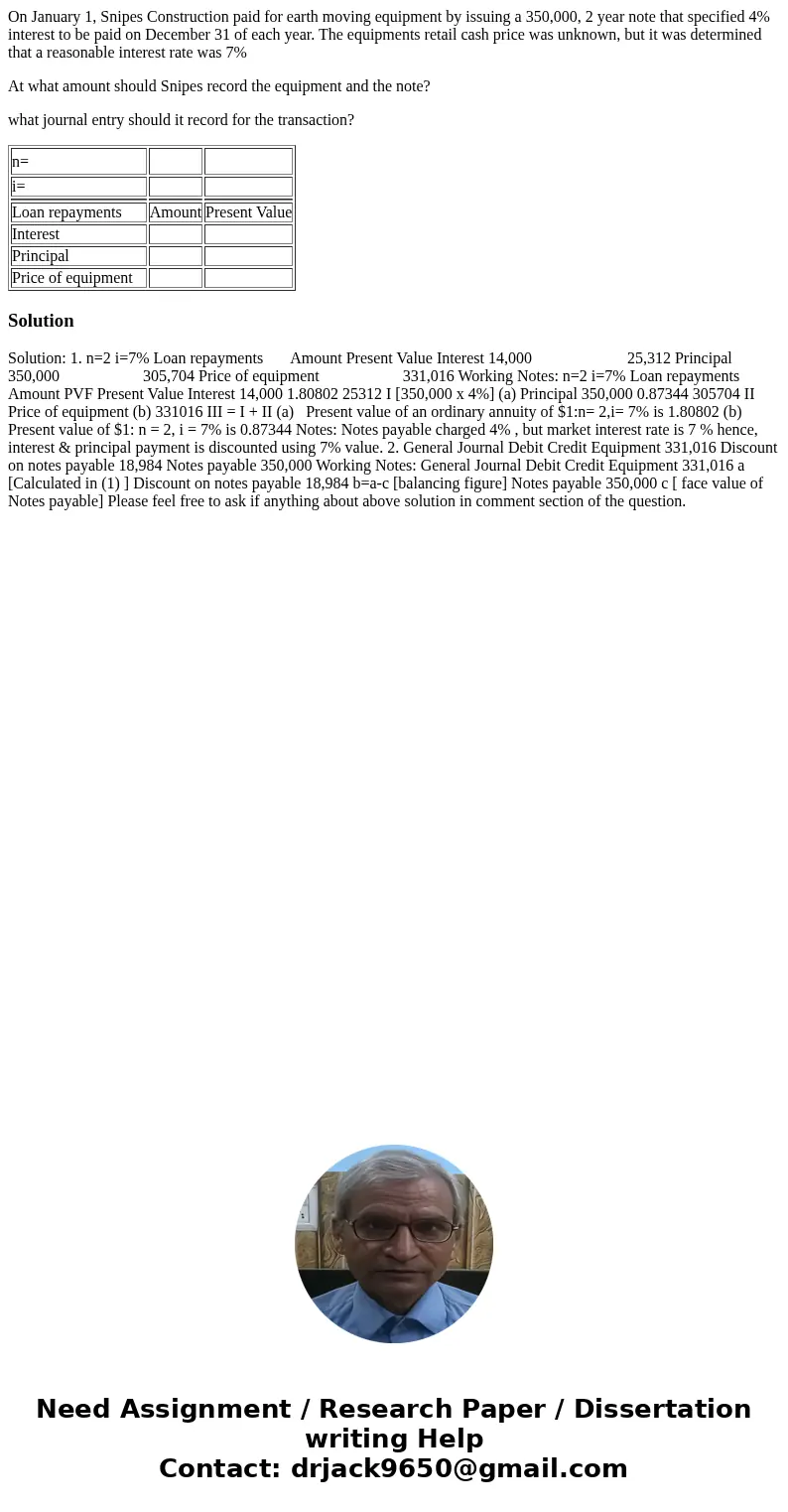

| n= | ||

| i= | ||

| Loan repayments | Amount | Present Value |

| Interest | ||

| Principal | ||

| Price of equipment |

Solution

Solution: 1. n=2 i=7% Loan repayments Amount Present Value Interest 14,000 25,312 Principal 350,000 305,704 Price of equipment 331,016 Working Notes: n=2 i=7% Loan repayments Amount PVF Present Value Interest 14,000 1.80802 25312 I [350,000 x 4%] (a) Principal 350,000 0.87344 305704 II Price of equipment (b) 331016 III = I + II (a) Present value of an ordinary annuity of $1:n= 2,i= 7% is 1.80802 (b) Present value of $1: n = 2, i = 7% is 0.87344 Notes: Notes payable charged 4% , but market interest rate is 7 % hence, interest & principal payment is discounted using 7% value. 2. General Journal Debit Credit Equipment 331,016 Discount on notes payable 18,984 Notes payable 350,000 Working Notes: General Journal Debit Credit Equipment 331,016 a [Calculated in (1) ] Discount on notes payable 18,984 b=a-c [balancing figure] Notes payable 350,000 c [ face value of Notes payable] Please feel free to ask if anything about above solution in comment section of the question.

Homework Sourse

Homework Sourse