RFR is 41 EMR 105 Year Stock A Stock B Market 2012 5 14 12 2

RFR is 4.1% EMR= 10.5

Year

Stock A

Stock B

Market

2012

5%

14%

12%

2013

7%

15%

10%

2014

-9%

-17%

-12%

2015

1.5%

3%

1%

2016

10%

18%

15%

2017

17.5%

24.5%

20%

RFR = Risk Free Rate, EMR = Expected Market Return, RRR = Required Rate of Return

Find Betas of Stock A & B

Find RRR of stock A & B

Find RRR for portfolio that consists of 40% of A and 60% of B?

| Year | Stock A | Stock B | Market |

| 2012 | 5% | 14% | 12% |

| 2013 | 7% | 15% | 10% |

| 2014 | -9% | -17% | -12% |

| 2015 | 1.5% | 3% | 1% |

| 2016 | 10% | 18% | 15% |

| 2017 | 17.5% | 24.5% | 20% |

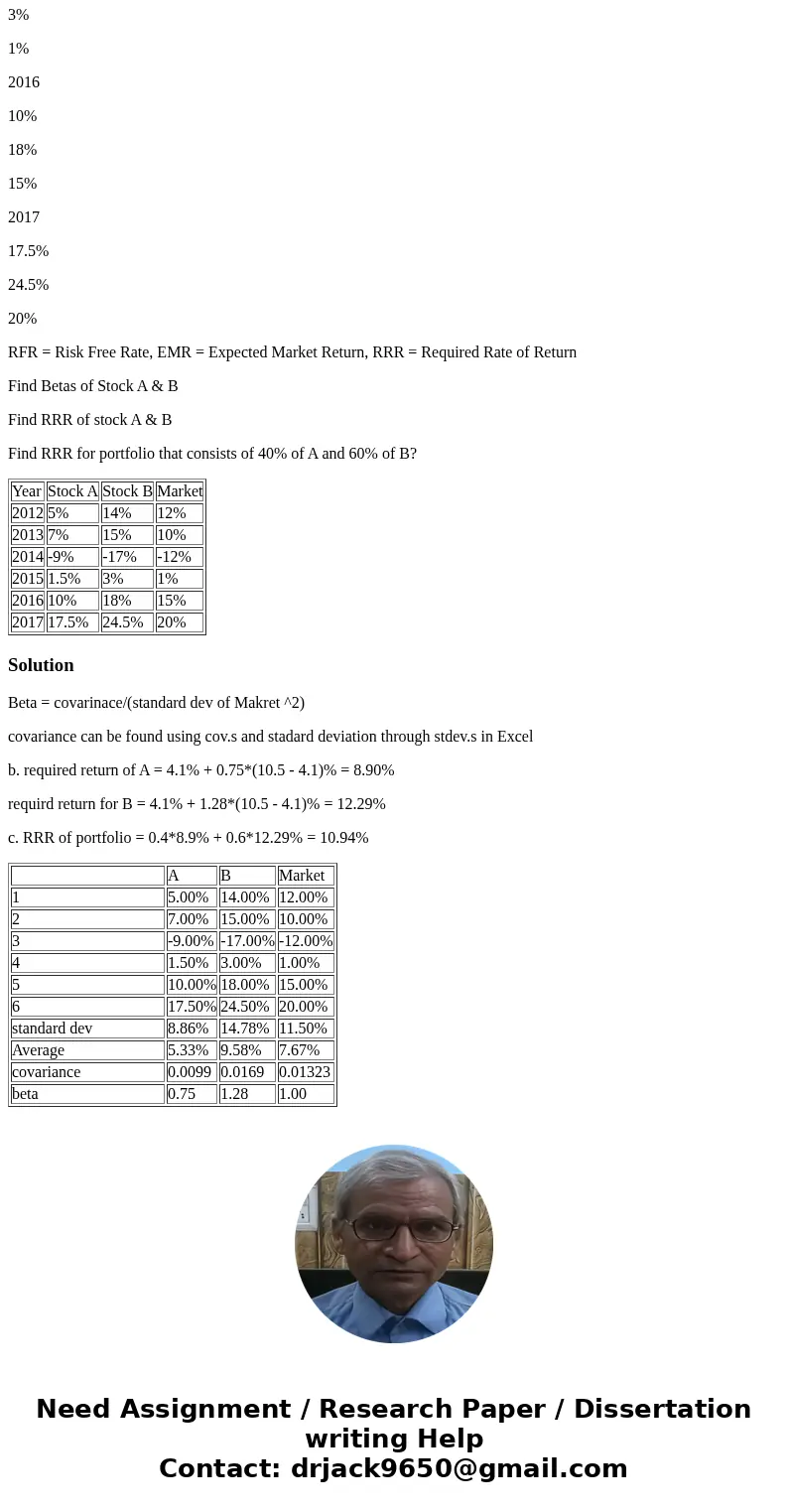

Solution

Beta = covarinace/(standard dev of Makret ^2)

covariance can be found using cov.s and stadard deviation through stdev.s in Excel

b. required return of A = 4.1% + 0.75*(10.5 - 4.1)% = 8.90%

requird return for B = 4.1% + 1.28*(10.5 - 4.1)% = 12.29%

c. RRR of portfolio = 0.4*8.9% + 0.6*12.29% = 10.94%

| A | B | Market | |

| 1 | 5.00% | 14.00% | 12.00% |

| 2 | 7.00% | 15.00% | 10.00% |

| 3 | -9.00% | -17.00% | -12.00% |

| 4 | 1.50% | 3.00% | 1.00% |

| 5 | 10.00% | 18.00% | 15.00% |

| 6 | 17.50% | 24.50% | 20.00% |

| standard dev | 8.86% | 14.78% | 11.50% |

| Average | 5.33% | 9.58% | 7.67% |

| covariance | 0.0099 | 0.0169 | 0.01323 |

| beta | 0.75 | 1.28 | 1.00 |

Homework Sourse

Homework Sourse