Assuming that the liquidity premium theory is correct on Mar

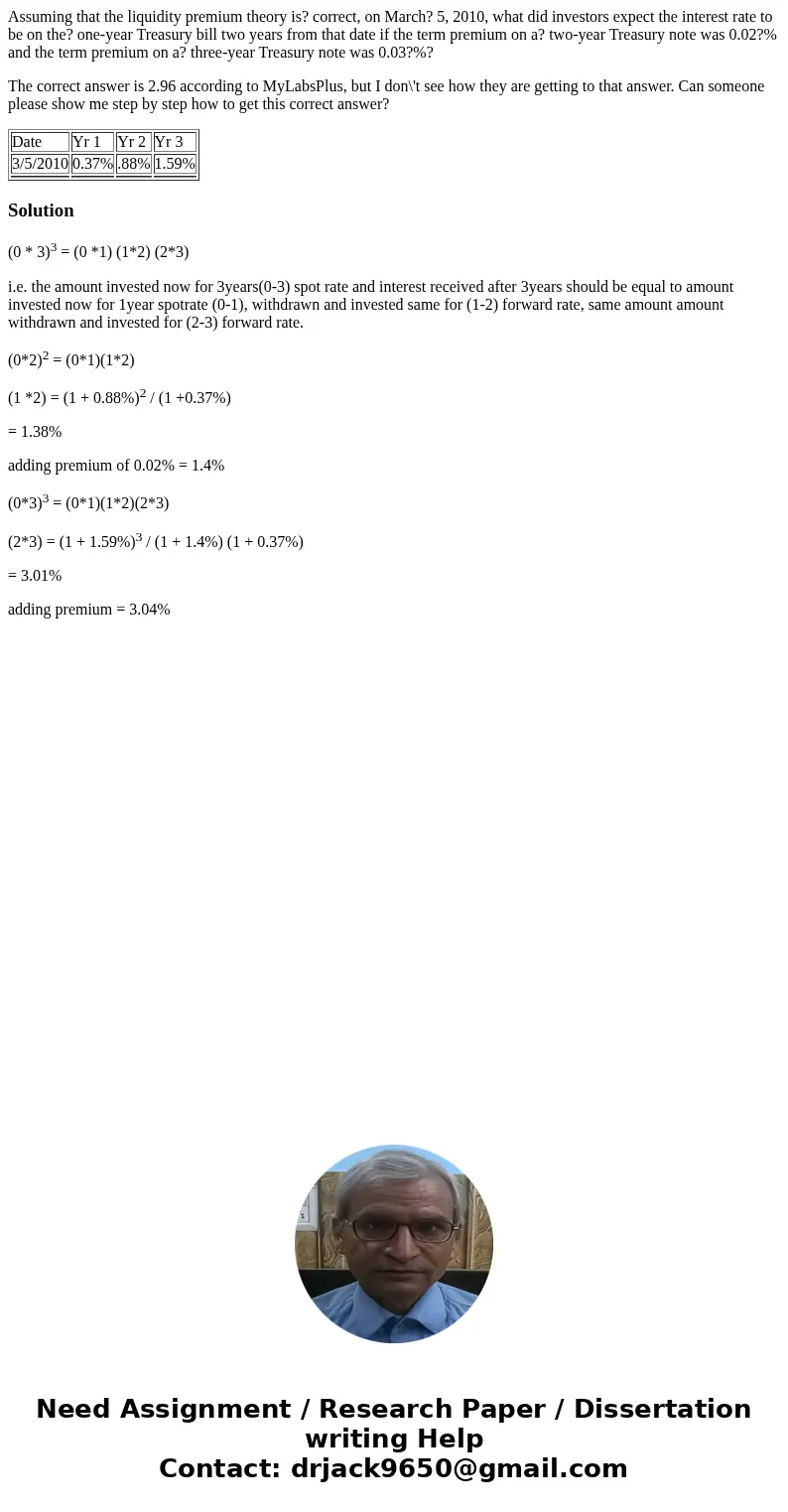

Assuming that the liquidity premium theory is? correct, on March? 5, 2010, what did investors expect the interest rate to be on the? one-year Treasury bill two years from that date if the term premium on a? two-year Treasury note was 0.02?% and the term premium on a? three-year Treasury note was 0.03?%?

The correct answer is 2.96 according to MyLabsPlus, but I don\'t see how they are getting to that answer. Can someone please show me step by step how to get this correct answer?

| Date | Yr 1 | Yr 2 | Yr 3 |

| 3/5/2010 | 0.37% | .88% | 1.59% |

Solution

(0 * 3)3 = (0 *1) (1*2) (2*3)

i.e. the amount invested now for 3years(0-3) spot rate and interest received after 3years should be equal to amount invested now for 1year spotrate (0-1), withdrawn and invested same for (1-2) forward rate, same amount amount withdrawn and invested for (2-3) forward rate.

(0*2)2 = (0*1)(1*2)

(1 *2) = (1 + 0.88%)2 / (1 +0.37%)

= 1.38%

adding premium of 0.02% = 1.4%

(0*3)3 = (0*1)(1*2)(2*3)

(2*3) = (1 + 1.59%)3 / (1 + 1.4%) (1 + 0.37%)

= 3.01%

adding premium = 3.04%

Homework Sourse

Homework Sourse